Last Updated: March 06, 2025

If you have unpaid debt and are getting phone calls, eventually, you may get one of two letters. One is a demand letter and the other is a summons. both letters can require action because your financial well being may depend on it. If it is a summons, you may end up with a legal decision against you. Let's talk about each and how to handle them.

But first, a disclaimer: Pacific Debt is not a law firm and cannot provide legal advice. The information shared here is for informational purposes and if you have a legal situation, we recommend that you speak with an attorney in your state of residence.

In this section, we will look at each type of letter and what you need to do to take action or to protect yourself. Your first step is to NOT ignore the letter!

If you're ready to talk now, skip the article and click here for a

free consultation with our debt specialist.

What is a Demand Letter?

A demand letter is formal notice that your creditor is considering legal action. It may come from an attorney or from the creditor. There will be a demand for action, such as repaying your debt or a requested payment. A demand for payment letter will most likely include a threat of legal action.

You may receive a demand letter because you owe money or an obligation (such as a completed job), or you are at-fault for an action. You may become a party in a lawsuit. This letter may mean that the creditor is considering suing you for your unpaid debt. The creditor, or other party, is legally not allowed to send a demand letter as a threat. They must be seriously considering legal action. Because of this, do not ignore the demand letter!

Whether your letter is entitled a demand letter, a demand for payment letter or a demand letter for payment, they are in most cases all the same thing. Someone believes that you owe them money and they are considering taking you to court.

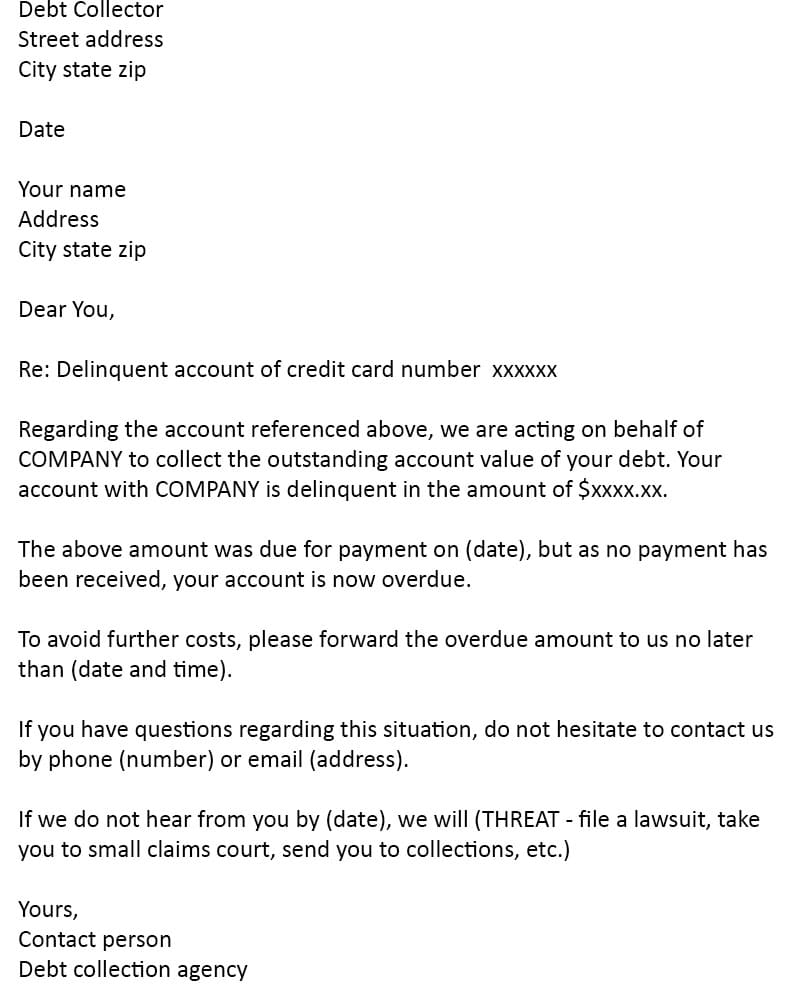

Demand for Payment Letter Sample

Below is a sample demand letter. It may be from a collector, creditor, or lawyer. While the form may vary, the information within the letter will be very similar to the demand for payment letter sample below.

What To Do If You Receive a Demand Letter

- If you receive a demand letter, verify the following:

- the debt is yours

- the debt amount is accurate

- the debt circumstances are correct

- your debt is within your state's statute of limitations

Once you have verified the information, respond in a timely manner in writing. If you dispute any of the information in the letter, respond in writing to explain why the information is incorrect and if you have documentation to support your claims, send copies. DO NOT send the actual documents.

Your polite answer should contain the following:

- Explain any misunderstandings

- Send copies of documents that support your argument – do not send the actual documents

- Send the letter with confirmation of delivery and a return receipt requested

In your response letter, DO NOT make the following statements:

- A promise to pay

- Admit that you are responsible

- Make threats or use profanity

- Lie

Keep copies of everything you send and everything you receive, including a phone log of who, when, and why they called.

If your debt is older and approaching your state's statutes of limitation, a promise to pay may reset the statute clock. Lying, threats, profanity, and admission of responsibility will be used against you if you end up in a court case.

The Settlement Negotiation Process

In many cases, receiving a demand letter can lead to a settlement negotiation process with the creditor before the situation escalates to court. During settlement negotiations, a debt resolution company like Pacific Debt can sometimes help mediate between you and your creditors. These negotiations may help you avoid court altogether and potentially settle your debt for less than what you owe.

The negotiation process typically involves:

- Reviewing the demand letter and assessing your financial situation

- Developing a settlement proposal based on what you can realistically afford

- Engaging in settlement negotiations with the creditor or their representative

- Documenting any agreement reached during the negotiation process

- Following through with the agreed-upon payment plan

Successful settlement negotiations can help prevent further action and avoid potential lost income from wage garnishments that might result from a court judgment.

What is a Summons Letter?

A

summons letter is a legal notice that you may be getting sued, usually, small claims court and you must appear in court in front of a judge on a specific date. Some people call this a complaint summons or a summons and complaint. You are now a party to a lawsuit and must answer the summons. It will contain the name of the court, the case number, the parties involved, and what you are legally required to do. The summons letter can be delivered by a law officer or registered mail.

You may receive a summons letter when a creditor has filed a lawsuit against you in court for unpaid debt. DO NOT ignore this letter. It will not go away and you may lose all rights to dispute the matter! You may end up with a garnishment of your wages or having your bank account levied, potentially causing significant lost income over time.

Whether your letter is entitled a summons letter, a summons or a court summons letter, they are the same thing. Other parties believe that you owe them money and they have filed a lawsuit against you in court and you will have to defend the court case.

If you are getting threatening legal documents from collectors, check out this article

How to deal with debt collectors when you can't pay.

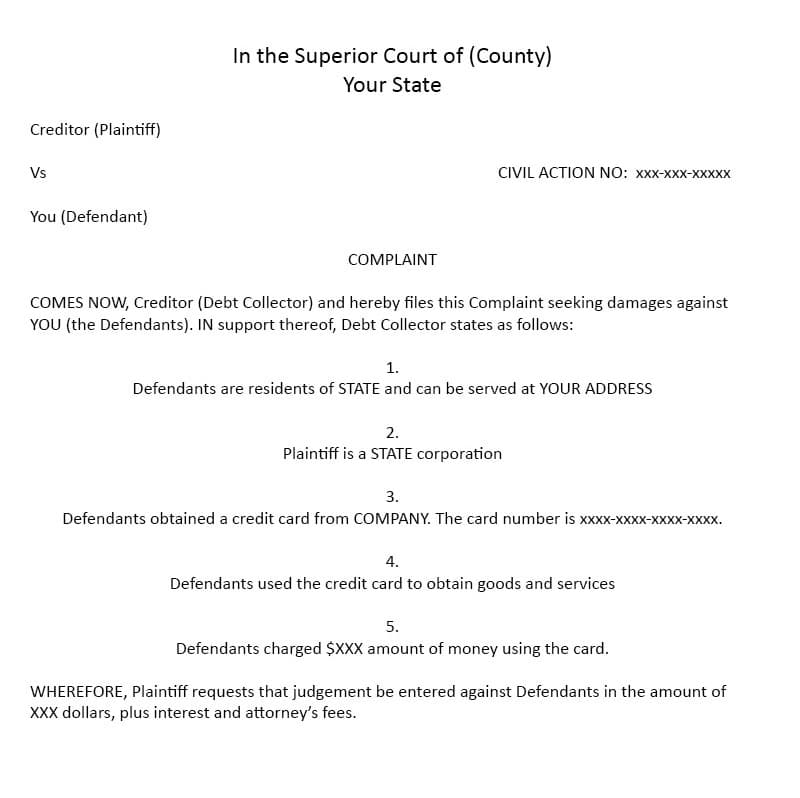

Summon Letter Sample

If you receive a letter delivered by either a deputy sheriff or as a registered letter from a court, it is a summons letter. It will be very formal and contain the name of the court and the complaints against you. While yours may not look exactly like the summon letter sample, it will contain the same general information.

What To Do If You Receive a Summons Letter

If you receive a court summons, you may want to contact an attorney for representation. However, if you would prefer to answer the summons on your own in small claims court, make sure that :

- the debt is yours

- the specific amount of the debt is accurate

- the debt circumstances are correct

- your debt is within your state's statute of limitations

If you decide to respond to a summons, include ALL the information on the summons so it can be filed correctly. Keep in mind that courts do not appreciate rudeness, threats, or other bas behavior. Your answer should include:

- name of the court

- the case number

- your name

- the creditor's name

- the date the letter was sent and received

If you have a legitimate reason for not being able to appear in court, you may ask, in writing, for the date to be changed. The court may or may not grant the change.

Keep in mind that you are the defendant. You will need to prove that the debt is not yours. The debt collector is the plaintiff.

Defending the Lawsuit

If you plan to defend the suit, you must let the court know, generally within ten court days. The summons letter will contain a Notice of Intention to Defend form. This is the official form you will file with the court. Fill it out and make two copies.

One copy of the form must be taken to the court issuing the summons to file. The form will be stamped and filed. Have the original stamped as well. The other goes to the plaintiff's attorney or address on the summons. Have the original stamped by the plaintiff. Keep the original.

If you miss the 10-day limit, follow the above advice. Email or fax the notice to the attorneys and then deliver the copies as noted above. It may help you avoid the default judgment.

To defend a summons:

- Fill out the Notice of Intention to Defend included in the summons

- Make two copies

- Take the copies to the court issuing the summons

- Have the original and the copies stamped

- Give one copy to the court to file with the summons

- Give one copy to the plaintiff or plaintiff's attorney (address will be on summons)

- Have the original and the plaintiff copy stamped by the plaintiff

- Keep the original!

Because this can be a complex issue, you may want to consult or hire a lawyer for your court date. We are not lawyers and are not giving specific advice.

Summons vs. Demand Letter - What You Need to Know

The differences between a summons and a demand are:

- A summons and complaint comes from a court system

- A summons means a lawsuit has been filed against you

- A demand letter means the creditor is considering legal action

- A complaint summons will be very formal and delivered by either registered mail or a deputy sheriff

Your response to either should be:

- Immediate

- DO NOT ignore either letter

- Verify the debt is your and all details are correct

- Respond in writing as recommended above

- Consider hiring legal assistance

Complaint about Aggressive Debt Collector

If you are dealing with a threatening debt collector, you have some protection against then through the

Fair Debt Collection Practices Act.

A debt collector can not make threats. If you have one threatening to take you to court but you have not yet received a demand letter or a summons complaint, you may have a case of harassment and can file a summons and complaint against them.

We will detail that act in great detail in the next section.

Fair Debt Collection Practices Act

You are protected from harassment by the

Federal Fair Debt Collection Practices Act (FDCPA). Your state may also have a Fair Collections Practices Act that adds additional protections. Your demand letter, whether it comes from a lawyer or debt collection agency, must respect the

FDCPA. The federal law includes the following provisions.

Debt collectors can NOT:

- Garnish more than 25% of wages, which could cause significant lost income

- Use/threaten physical force or criminal tactics to harm you, your property, or your reputation

- Use/threaten physical force or criminal tactics to harm you, your property, or your reputation

- Accusing you of committing a crime for not paying the debt

- Make/threaten to make defamatory statements to someone else

- Threaten arrest, to seize assets, or garnish wages, unless actually planning to take such action

- Use obscene or profane language

- Cause you to spend money you wouldn't otherwise have spent (ie long-distance telephone calls)

- Call you repeatedly or let your phone ring repeatedly

- Call frequently

- Contact your employer, except to verify employment or health insurance status, garnish wages or locate you

- Reveal information about debt to anyone except your spouse or your parents if a minor.

- Publicly publish your name for failing to pay

- Send a postcard or letter with revealing information on the envelope

- Claim to be someone other than a debt collector, including a governmental official

- Use stationary that appears to be from a law firm (unless they are)

- Charge you collection or attorney's fees unless legally allowable

- Threaten to report you to a credit reporting agency if they have no intention of doing so

- Send a letter claiming to come from a claim, credit, audit, or legal department unless it is

Debt collectors must:

- Disclose caller identification

- May contact your family to locate you

- Must serve you with notice of a lawsuit if suing you

If you receive a letter that violates any of these, you may have a case to sue the collection agency. Make sure you keep a written record of all letters, emails, or phone calls. You may have to speak to an attorney in order to stop harassing behavior. Use certified mail when dealing with debt collectors.

Frequently Asked Question

Our Final Take

If you are in debt, you may receive a demand letter to pay. If you decide not to answer it, you may receive a summons and complaint from the courts. Whatever you do, do not ignore them. The courts do not look favorably on people who fail to show up and this could even become a criminal case. Engaging in the settlement negotiation process early, whether on your own or with the help of a debt resolution company like Pacific Debt, can often lead to more favorable outcomes. Successful settlement negotiations can help you avoid court proceedings altogether and prevent potential lost income from judgments and wage garnishments.

DISCLAIMER: We are not lawyers and are not giving legal advice. We strongly recommend speaking to a professional attorney

References

https://www.thelegalseagull.com/write-great-demand-letter/

https://litigation.findlaw.com/filing-a-lawsuit/how-to-demand-payment-in-a-letter.html

https://www.thebalancesmb.com/what-to-do-if-you-receive-a-summons-or-a-subpoena-398483

https://www.nolo.com/legal-encyclopedia/what-to-do-when-you-receive-a-demand-letter.html

http://articledge.com/summons-response-template.html

https://www.sample-resignation-letters.com/writing-a-demand-letter-for-money-owed-with-sample.html

http://protectingconsumerrights.com/debt-collection-problems/debt-collection-lawsuits/

https://www.michaelmatthewssa.com/what-to-do-when-you-receive-a-summons-and-what-not-to-do/

Our Debt Specialists can help you explore your alternatives to bankruptcy, including

debt consolidation and debt settlement options.

✔ Accredited by Better Business Bureau with BBB A+ rating (4.93 rating and 1678 reviews)

✔ US News and World Reports and Bankrate ranked Pacific Debt Relief as one of “The Best Debt Relief Companies of 2024”

✔ 6.9 star rating by BestCompany.com (over 2379 client reviews)

✔ 4.8 star rating by TrustPilot based (over 1613 verified consumer reviews)

✔ ConsumerAffairs.com Accredited (over 544 verified reviews with an average rating of 5 stars)

✔ A Top 10 Rated Compan by TopTenReviews.com , ConsumersAdvocate.com and Top10debtconsolidation.com

✔ 4.6 star rating by Google (229 client reviews)

✔ 100% rating by SuperMoney (9 client reviews)

Reduce Your Credit Card Debt By Up to Half

BBB Reviews | 4.9/5.0 Rating

Do Not Sell My Personal Information

Do Not Sell My Personal Information