How Long Does Debt Settlement Stay on Your Credit Report?

Last Updated: March 12 , 2024

How Long It Affects Your Credit Score

Disclaimer: We are not qualified legal or tax professionals and are not giving advice. Always speak with a qualified professional before making any legal or financial decisions.

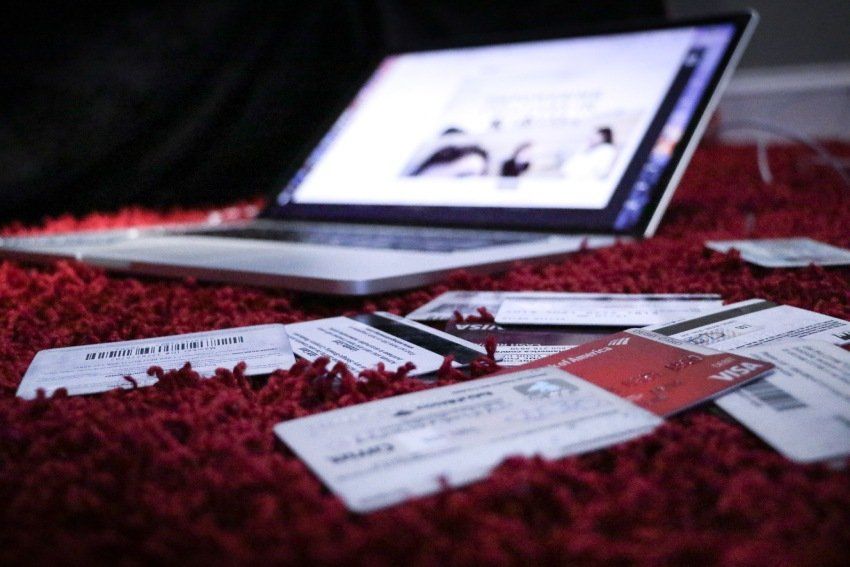

Learning the complexities of debt settlement can often feel like charting a course through uncharted financial waters. It's a path many consider when faced with the daunting reality of overwhelming debt, offering a beacon of hope to reduce what's owed and start anew.

However, this financial relief doesn't come without its caveats, particularly when it comes to your credit report, a critical barometer of your financial health.

Debt settlement, while a viable strategy to escape the clutches of debt, casts a long shadow on your credit score, a key indicator of your trustworthiness to lenders. This impact raises important questions: How does debt settlement work, and more importantly, how long does its effect linger on your credit report? Understanding the nuances of this impact is essential for anyone considering debt settlement as a way out of financial distress.

In this comprehensive guide, we'll dive into the heart of debt settlement, exploring its implications for your credit score and providing insights into navigating its consequences. Whether you're contemplating debt settlement or simply seeking to understand its effects, this article aims to shed light on the critical aspects of debt settlement and its long-term impact on your financial journey.

Want to skip the article and speak directly to a debt specialist? Click here for a free consultation.

Your Credit Score

When you borrow money, your repayment history is reported to one or all three credit bureaus including TransUnion, Equifax, and Experian. They use formulas developed by either FICO or VantageScore to determine your credit score. More than half your credit score is based on paying your bills on-time and how much of your available credit you are using. The less of your available credit you use, the better. The rest of your score is based on how long you have had credit, what kinds of credit you have, and how many “hard pulls” you have authorized on your credit report.

Negative actions like not paying bills on time drive your credit score down very quickly. This is why debt settlement affects your credit score.

Debt Settlement Impact on Your Credit Report

When you ask a company to settle debt, you are asking them to take less than you owe because you have overused your credit and are not able to repay it in full. Debt settlement companies will tell you to stop making payments on your debts in order to convince the creditor that you are serious. Your debts become delinquent and are reported to credit bureaus, immediately negatively affecting your credit score.

However, if you are considering debt settlement, you are probably already delinquent on your payments.

How Debt Settlement Affects Other Aspects of Your Finances

While debt settlement can negatively impact your credit score, it's important to consider how it might affect other areas of your financial life as well.

Consider these things:

- Taxes - If you have debt forgiven through settlement, you may owe taxes on the amount forgiven. Be sure to discuss the tax implications with your debt specialist.

- Bank Account Levys - Creditors may attempt to levy funds from your bank account to collect on debts. This can disrupt your finances, so be prepared.

- Lawsuits - Creditors can sue you in an attempt to collect on the debt. Ensure you understand this risk before pursuing debt settlement.

- Fees - Debt settlement companies charge fees, often a percentage of enrolled debt. Confirm the total costs so you know the full expense.

How Long Does Debt Settlement Stay on Your Credit Report?

The answer to this has two parts. First, in order to convince creditors that you are serious about debt settlement, your debts must be unpaid. These delinquencies are reported to credit bureaus after 30, 60, 90 and 180 days of non-payment. If you do not bring the debt payments up to date, each delinquency will stay on your credit report for up to seven years from the date the debt became delinquent, regardless of if it was settled later.

If your debt has been sent to collections, it also remains on your credit report for seven years from the date it was sent to collections. Keep in mind that your state may have a statute of limitations that is less than seven years. Debt older than the statute of limitations does not need to be paid, but it may continue to affect your credit score.

Debt settlement can drop your credit score by 60 to 100 points. However, if you pay any future debts on time and use credit wisely, your credit score will improve as these are the two largest factors in your credit score.

Can I Remove Settled Accounts from My Credit Report?

Yes, there are three ways to remove settled accounts from your credit report. It is possible to pay the remainder of the settled debt and have the report removed from your credit report. This is generally an option for collections accounts. Since these are in your public records section of your credit report, it immediately improves your score.

Re-aging is another option. This means that the creditor agrees that if you bring your account current and make payments, they will remove the delinquency report. This obviously negates the debt settlement. For most people, debt settlement is a second to last option before bankruptcy and they would have paid the debt in full in the first place had they not been in financial straits.

The final option is to avoid having “settled” placed on your credit report. Debt settlement companies will work with creditors to include a “paid as agreed” report once you have paid the settled debt. This means that the settled debt will not affect your credit score at all. Always ask the debt settlement company if this is one of the negotiation points.

Repairing Your Credit Score

You will see ads on TV offering to “repair your credit” for a certain fee. The truth is that there are two actions you can take to immediately improve your credit score and both of them are free! The first is to pay your debts on time. The second is to pay your debt down.

If you are considering debt settlement as a way out of debt, your credit score will take a hit. However, you can bring your score back up without paying for credit repair. Debt settlement offers you a chance to clear your financial slate and start again. A good debt settlement company will help you learn how to better manage money in the future and to improve your credit score.

There are other cons to debt settlement including a potential tax liability. If you are considering debt settlement, speak with a professional financial advisor and then give one of our debt specialists a call. They can explain the pros and cons and help you decide whether debt settlement is right for you.

FAQs

-

Will debt settlement hurt my credit score?

Yes, debt settlement will likely have a negative impact on your credit score, at least in the short term. Missed payments and settled accounts will be reported and can significantly drop your score. Over time, as settled accounts age and you rebuild credit, your score can recover.

-

Should I avoid debt settlement because of credit damage?

Not necessarily. For some in severe debt, a credit score drop may be worthwhile to resolve unmanageable debt. Evaluate your situation holistically. Will settling provide overall financial relief? Can you commit to rebuilding credit? Understand the tradeoffs.

-

How much will my credit score drop with debt settlement?

It depends on your current score and debts, but expect a drop of 60 to over 100 points initially. Those with very good credit see the largest drops. The damage lessens over the 7 years settled accounts remain on your report.

-

Are there ways to reduce credit damage from settlement?

Yes. "Pay for delete" can sometimes remove collections. Ask creditors to report accounts as "paid" rather than "settled." Get re-aging agreements to bring accounts current. And commit to on-time future payments.

-

Should I hire a debt settlement company?

When considering whether to hire a debt settlement company, it's important to understand the benefits they can offer. Professional debt settlement companies provide expert guidance and handle negotiations on your behalf, potentially securing better settlements and saving you considerable effort. However, choosing a reputable and transparent company is crucial. To ensure you make an informed decision, it's advisable to do thorough research. For more insights, consider reading our article about why using a debt relief program could be beneficial.

Pacific Debt, Inc

Pacific Debt, Inc is an award winning debt settlement company. If you’d like more information on how to get out of debt, we are happy to help. We will explain all your options and help you decide which is the best option for you. We can even refer you to trusted partners who can better meet your needs.

If you have more questions, contact one of our debt specialists today. The initial consultation is free, and our debt experts will explain your options to you.

*Disclaimer: Pacific Debt Relief explicitly states that it is not a credit repair organization, and its program does not aim to improve individuals' credit scores. The information provided here is intended solely for educational purposes, aiding consumers in making informed decisions regarding credit and debt matters. The content does not constitute legal or financial advice. Pacific Debt Relief strongly advises individuals to seek the counsel of qualified professionals before undertaking any legal or financial actions.

Are you ready for debt relief help now?

Get Free Consultation- Accredited by Better Business Bureau with BBB A+ rating(4.93 rating and 1678 reviews)

- US News and World Reports and Bankrate ranked Pacific Debt Relief as one of “The Best Debt Relief Companies of 2024”

- 6.9 star rating by BestCompany.com (over 2379 client reviews)

- 4.8 star rating by TrustPilot based (over 1613 verified consumer reviews)

- ConsumerAffairs.com Accredited (over 544 verified reviews with an average rating of 5 stars)

- A Top 10 Rated Company by TopTenReviews.com , ConsumersAdvocate.com and Top10debtconsolidation.com

- 4.6 star rating by Google (229 client reviews)

- 100% rating by SuperMoney (9 client reviews)

Reduce Your Credit Card Debt By Up to Half

BBB Reviews | 4.9/5.0 Rating

Head Office

750 B Street Suite 1700 San Diego, CA 92101

Hours of Operation

Mon-Thurs: 6am - 7pm PST

Friday: 6am - 4:30pm PST

Saturday: 7:30am - 4:30pm PST

Clients

Phone: (877) 722-3328

Fax: (619) 238-6709

cs@pacificdebt.com

Non-Clients

Phone: (833) 865-2028

Fax: (619) 238-6709

inquiries@pacificdebt.com

Creditors

Phone: (833) 865-2028

Fax: (619) 238-6709

creditorinquiries@pacificdebt.com

"To eliminate debt one household at a time, while placing people first."

California Privacy Policy |  Do Not Sell My Personal Information

Do Not Sell My Personal Information

GLBA Privacy Notice | CDRI Accredited Member

*Please note that all calls with the company may be recorded or monitored for quality assurance and training purposes.

*Your visit to our website may be monitored and recorded from essential 3rd party scripts.

*Clients who make all their monthly program deposits pay approximately 50% of their enrolled balance before fees, or 65% to 85% including fees, over 24 to 48 months (some programs lengths can go higher). Not all clients are able to complete our program for various reasons, including their ability to save sufficient funds. Our estimates are based on prior results, which will vary depending on your specific circumstances. We do not guarantee that your debts will be resolved for a specific amount or percentage or within a specific period of time. We do not assume your debts, make monthly payments to creditors or provide tax, bankruptcy, accounting or legal advice or credit repair services. We are not a credit repair firm nor do we offer credit repair services. Our service is not available in all states and our fees may vary from state to state. Please contact a tax professional to discuss potential tax consequences of less than full balance debt resolution. Read and understand all program materials prior to enrollment. We are licensed where we engage in business. NMLS # 1250953. The use of our services will likely adversely affect your creditworthiness, may result in you being subject to collections or being sued by creditors or collectors and may increase the outstanding balances of your enrolled accounts due to the accrual of fees and interest. However, negotiated settlements we obtain on your behalf resolve the entire account, including all accrued fees and interest. C.P.D. Reg. No. T.S. 12-03825. Pacific Debt, Inc. is registered with the California DFPI under the CCFPL registration number 01-CCFPL-1250953-3419036.