Last Updated: March 26, 2025

Responding To The Demand Letter

DISCLAIMER: We are not lawyers and are not giving legal advice. We strongly recommend speaking to a professional attorney.

If you get a demand letter, you need to read it very carefully and respond within the time limit set out in the letter. Credit collectors can and do make mistakes. Make sure that the debt is yours or that you are responsible for it. Make sure that the debt amount is accurate. If it is older than three years, check your state (or that state where the debt was incurred) statute of limitations. Each state is different, and limitations range from three to ten years.

Speak to a debt expert and get your FREE Savings Estimate today.

Read the Demand Letter to:

- Make sure the debt is yours

- Make sure the debt amount is accurate

- Make sure the debt circumstances are correct

- Make sure your debt is within your state’s statute of limitations

The letter may threaten all sorts of actions, including the possibility that they will file a lawsuit against you. Some of this may be hyperbole, meant to scare you or take advantage of your lack of knowledge.

Below is a Letter of Demand Sample, which could be an initial demand or a cease and desist notice.

Below is a Letter of Demand Sample.

If you dispute any of the information in the letter, it's a good idea to address the issues in writing. Explain why the information is incorrect and if you have documentation to support your claims, send copies. DO NOT send the actual documents.

Once you have verified the information, respond in writing.

- Be polite

- Explain any misunderstandings

- Send copies of documents that support your argument – do not send the actual documents

- Send the letter with confirmation of delivery

In your response letter, if you are searching the net on how to answer a summons without an attorney. Do not make promises to pay if you do not plan to pay. That offer can reset the statute of limitations. Do not admit you are responsible but do not lie. Finally, don’t make threats or use profanity.

DO NOT

- Make promises to pay

- Admit that you are responsible

- Make threats

- Lie

How to Respond To A Summons Letter

Take a summons letter very seriously. If you don't respond to a received demand letter, the situation could escalate to civil litigation. Do not ignore the letter. If you ignore the letter, you may lose the case. The summons is a legal action. If you ignore it, the next step the court will take will be a warrant for your arrest.

Talk to our debt experts for free and find out all your options.

If you receive a summons, make sure that you are the correct person. The heading will read the Plaintiff (the creditor) vs Defendant (you). If this is not you or your debt, respond in writing immediately. There is be a section explaining how much the debt is and how and when it was incurred. Make certain these are correct. You will receive notice of where, when, and what date you are expected to appear in court. If you incurred the debt in another state, you may have to travel to that state, which could cost you additional time and money.

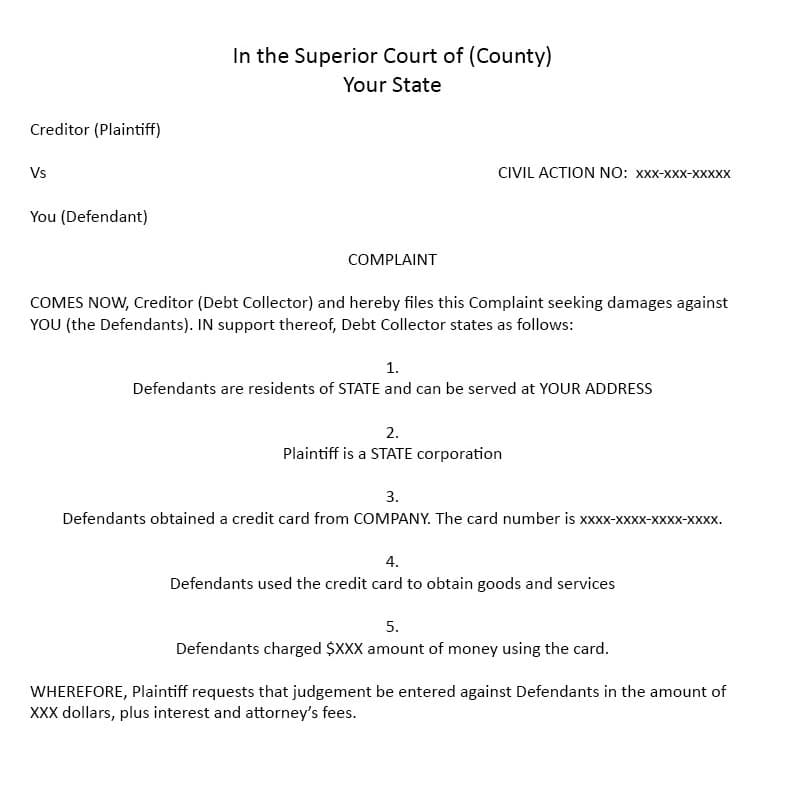

Below is a Summons Letter Sample.

If you receive a summons:

- Make sure the debt is yours

- Make sure the debt amount is accurate

- Make sure the debt circumstances are correct

- Make sure your debt is within your state’s statute of limitations

If you need to respond to a summons, include ALL the information on the letter so it can be filed correctly. This includes:

- Court’s name

- The case number

- Your name

- The creditor’s name

If you have a legitimate reason for not being able to attend the hearing, you may ask, in writing, for the date to be changed. The court may or may not grant the change.

Notice of Intention to Defend

If you plan to defend the suit, you must let the court know, generally within ten court days. The summons letter will contain a Notice of Intention to Defend. You will fill it out and make two copies. One copy must be taken to the court issuing the summons. It will be stamped and filed. Have the original stamped as well. The other goes to the plaintiff’s attorney or address on the summons. Have the original stamped by the plaintiff. Keep the original.

If you miss the 10-day limit, follow the above advice. Email or fax the notice to the attorneys and then deliver the copies as noted above. It may help you avoid the default judgment.

To defend a summons:

Fill out the Notice of Intention to Defend included in the summons

- Make two copies

- Take the copies to the court issuing the summons

- Have the original and the copies stamped

- Give one copy to the court to file

- Give one copy to the plaintiff or plaintiff’s attorney (address will be on summons)

- Have the original and the plaintiff copy stamped by the plaintiff

- Keep the original!

Consulting an Attorney

It is your right to contact an attorney. If the case is complicated or involves large amounts of money related to personal injury or family law matters, you may want to be represented in court. Consulting an attorney is often worth the time and money when facing serious legal situations.

We are NOT LAWYERS and ARE NOT GIVING LEGAL ADVICE.

Our Debt Specialists can help you explore your alternatives to bankruptcy, including

debt consolidation and debt settlement options.

✔ Accredited by Better Business Bureau with BBB A+ rating (4.93 rating and 1678 reviews)

✔ US News and World Reports and Bankrate ranked Pacific Debt Relief as one of “The Best Debt Relief Companies of 2024”

✔ 6.9 star rating by BestCompany.com (over 2379 client reviews)

✔ 4.8 star rating by TrustPilot based (over 1613 verified consumer reviews)

✔ ConsumerAffairs.com Accredited (over 544 verified reviews with an average rating of 5 stars)

✔ A Top 10 Rated Compan by TopTenReviews.com , ConsumersAdvocate.com and Top10debtconsolidation.com

✔ 4.6 star rating by Google (229 client reviews)

✔ 100% rating by SuperMoney (9 client reviews)

Reduce Your Credit Card Debt By Up to Half

BBB Reviews | 4.9/5.0 Rating

Do Not Sell My Personal Information

Do Not Sell My Personal Information