Last Updated: April 3, 2024

Everything You Need To Know Before Pursuing Debt Settlement

Disclaimer: We are not qualified tax professionals and are not giving advice. Always speak with a qualified professional before making any legal or financial decisions.

Navigating the complexities of debt cancellation and its tax implications can be daunting. If you've recently had debt forgiven, you might be facing the confusing task of dealing with IRS Form 1099-C, which reports canceled debt as taxable income. Understanding how to properly use IRS Form 982 alongside Form 1099-C is crucial to potentially reducing or eliminating your tax liability from debt cancellation.

This guide aims to help demystify these forms to help you navigate the process. Whether you're dealing with credit card debt settlement, a mortgage loan, or student loan forgiveness, we'll try to walk you through the essential steps.

If you'd like to skip the article and speak to a debt specialist, click here for a free consultation.

What is a Form 1099-C?

As stated above, a 1099 C form may be sent if you have received any payment including forgiven debt or actual discharge of debt. The Internal Revenue Service (IRS) may consider debt cancellation to be a form of income and so if you have had cancelled debt, you may see a 1099-C.

If you are not certain why you received a 1099 C form, look at Box 6 to identify a cancellation code. You'll find eight different identifiable event codes. These may include:

- Bankruptcy discharge

- Other judicial debt relief

- Statute of limitations or expiration of deficiency period

- Foreclosure election

- Debt relief from probate or similar proceeding

- By agreement

- Decision or policy to discontinue collection

- Other actual discharge before identifiable event

Once you understand the event code and identifiable event, you can determine if the debt forgiveness is yours and what you may be able to do about it including pay taxes. A 1099 C can affect your expected tax refund.

If I get a 1099-C, do I still owe the debt?

Generally, when you receive a 1099-C form, it may indicate that the lender has canceled or forgiven the debt. However, there are exceptions where you might may still owe the debt. It's important to seek professional tax advice from a legal expert in these complex situations.

Internal Revenue Service (IRS) Exceptions and Exclusions

Next, look at the IRS.gov website to find exceptions and exclusions to the cancellation of debt income.

Exception may include:

- Amounts canceled as gifts, bequests, devises, or inheritances

- Certain qualified student loans

- Certain other education loan repayment or loan forgiveness programs

- Amounts of canceled debt that would be deductible if you, as a cash basis taxpayer, paid it

- A qualified purchase price reduction given by the seller of property to the buyer

- Any Pay-for-Performance Success Payments under the Home Affordable Modification Program

- Amounts from student loans discharged on the account of death or total and permanent disability of the student.

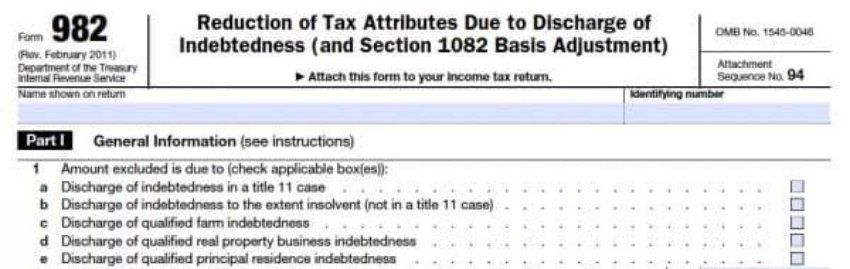

Exclusion may include:

- Debt canceled in a Title 11 bankruptcy case

- Debt canceled due to receivership, foreclosure or other that renders the debt unenforceable

- Cancellation of qualified farm indebtedness

- Cancellation of qualified real property business indebtedness

- Cancellation of qualified principal residence indebtedness that is discharged subject to an arrangement that is entered into and evidenced in writing before January 1, 2021

If the debt was cancelled as part of an identity theft, you may not have to file a 1099 C. You should seek professional tax advice from a tax specialist to understand if you have exclusions or exceptions and what to do about each situation!

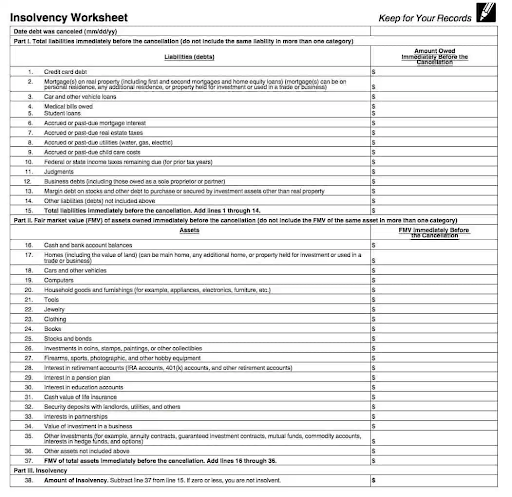

How to Claim Insolvency

Insolvency means that you are unable to pay your debts. Now, you have to prove to the IRS that you were insolvent. Fill out the insolvency worksheet (and keep it in your important paperwork!). Keep in mind that the IRS can require you to prove all the values, so keep good notes and documentation for each amount or fair market value claimed.

Again, since you are dealing with the IRS, getting professional tax help from an expert is important. You may be able to avoid auditing and even more expensive penalties by getting professional advice.

1099-C Arrived After I filed Taxes

If you were very organized and filed your taxes long before the due date and an unexpected 1099-C arrived from a creditor, what should you do? Very simply, you may need to file an amended tax form. You can usually amend your income tax return by e-filing it.

You may need to fill out 1040-X. Most of it is transferred directly from your 1040 but you will have to explain why you are amending it in Part lll. Don't put it off until next year and claim it on next year's tax return. Failing to report other income and result in audits.

Understanding Debt Settlement

Debt settlement can be an effective way to resolve unmanageable debt, but many people have questions about how the process works.

The Debt Settlement Process

- Consultation: The first step is to speak with a debt relief specialist to discuss your financial situation. They will review your debts, income, expenses, and goals to determine if you are a good candidate for debt settlement.

- Set Up Accounts: If you enroll, you will open a dedicated account that you will make monthly payments into to save for settlements. We negotiate with your creditors on your behalf when the account has sufficient funds.

- Stop Payments: You may need to stop payments to creditors so you can focus on saving for settlements.

- Negotiation: Once the dedicated account builds up enough savings to make an offer, we will start negotiating with your creditors. Offers are typically for 30-50% of the total owed. Creditors may accept or counter before accepting.

- Settlement: This continues until all your debts have been settled. Very motivated creditors may settle quickly, but others can take longer. Our debt experts handle all settlements on your behalf until the program is complete.

- Debt-Free: When your program finishes and all your accounts are settled, you can start to enjoy a debt-free lifestyle! We provide support during this transition period.

What Debts Can Be Settled?

Debt settlement works for most types of unsecured debt like credit cards, medical bills, personal loans, and more. Even old debts that have gone into collections may be candidates for settlement. Your debt specialist can advise if a specific debt can or cannot be negotiated under a settlement program.

If you have too much debt, contact us for a free consultation today!

*Disclaimer:

Pacific Debt Relief explicitly states that it is not a credit repair organization, and its program does not aim to improve individuals' credit scores. The information provided here is intended solely for educational purposes, aiding consumers in making informed decisions regarding credit and debt matters. The content does not constitute legal or financial advice. Pacific Debt Relief strongly advises individuals to seek the counsel of qualified professionals before undertaking any legal or financial actions.

Reduce Your Credit Card Debt By Up to Half

BBB Reviews | 4.9/5.0 Rating

Do Not Sell My Personal Information

Do Not Sell My Personal Information