Hawaii Debt Relief

Reduce Your Credit Card Debt By Up To Half

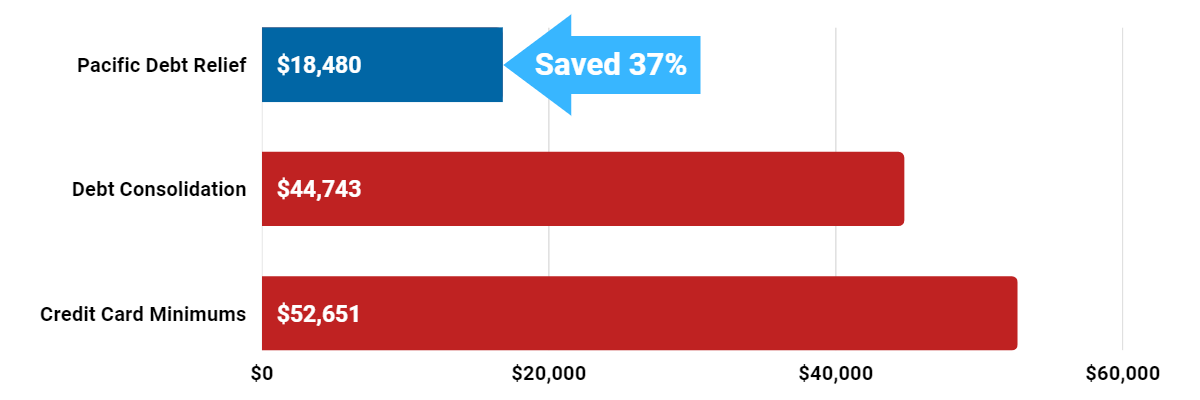

Pacific Debt Relief offers the only solution that significantly reduces your debt to less than you currently owe. That means you get debt-free in a fraction of the time it would take with other options.

Save thousands by lowering your debt balance and wiping away years of future interest and payments. Call today for a FREE consultation!

Hawaii Debt Relief Reviews

Hawaii Debt Relief Testimonials

Hawaii Better Business Bureau

Pacific Debt Relief is an A+ rated business with the BBB. We have been accredited since 2010. We have received 4.87 out of five stars based on 40 customer reviews with the BBB.

State of Hawaii Statistics

Hawaii is an island paradise.As of 2018, over 1.4 million people called Hawaii home. Honolulu is the largest city and about ½ the state’s population live there. Hawaii is ranked #40 for population and #13 for population density.

Hawaii generates most of its economy through tourism. However, agriculture’s leading crops of sugarcane and pineapple are also the leading ingredients in the manufacturing sector. Hawaii has a rich cultural life and a long and fascinating history.

Income in the State of Hawaii

The median state income in Hawaii is $74,923. As of 2018, the minimum wage is $10.10 per hour. Unfortunately, 11% of Hawaiian children under 18 live in poverty. For residents overall, 9.5% of all people in Hawaii live under the poverty level.

- Median state income: $74,923

- Minimum wage: $10.10/hour

- Children in poverty: 11%

- People in poverty: 9.5%

Homeowners in Hawaii

More than half (58.1%) of Hawaiians hold a mortgage. The median home price in Hawaii is $617,900 (2019). Of course, that median price depends on the location with some areas being much higher.

- Homeowner rate: 58.1%

- Median home price: $617,900

Hawaii Employment Rate

Hawaii has a current unemployment rate of 2.1%. However, the underemployment rate is 6.0%. Underemployment is the percentage of civilian workers who are unemployed, employed part-time, or are not seeking employment.

If this is you, we can help. Pacific Debt offers Hawaii debt relief solutions tailored to your unique situation and budget. Our certified counselors help you work up a budget and explain your options.

- Unemployment: 2.1% (2018)

- Underemployment: 6.0% (2018)

Hawaii Debt Statistics

Hawaiians carry a lot of debt. The average credit card debt is $8,315 (2018). The average student loan debt is $35,125. When you add all that debt on top of the cost of homes (rental or owned), versus the median income, it is very easy for Hawaiians to get into debt.

- Avg credit card debt: $8,315 (2018)

- Avg mortgage debt: $342,613 (2017) (Third highest in the US)

- Avg student loan debt: $35,125 (2018)

Hawaii Statute of Limitations

Hawaii’s statute of limitations lays out maximum time periods that debt collectors can take action against a delinquent debt. These statutes of limitations begin on the date that your debt goes delinquent.

For debts taken out in Hawaii, the following are the statutes of limitations for different types of debt.

- Oral agreements: 6 years

- Written contracts: 6 years

- Promissory notes: 6 years

- Credit cards and other revolving loans: 6 years

Debt Consolidation Hawaii

If you have more debt than you can pay off, Pacific Debt can help you consolidate your debt and learn to live debt-free. Since 2002, we’ve settled over $200 million in debt for residents of Hawaii. We are a nationally top-ranked debt relief company that helps Hawaii Residents reduce their unsecured debt substantially.

We will help you work through our proven and comprehensive debt relief program. Your certified debt relief counselor will review all your options. If debt settlement is right for you, we move forward with our debt consolidation program and work to save you money. Pacific Debt can help with most unsecured debt like credit cards, personal loans, medical bills, and repossessions.

It is not an easy process and it won’t happen overnight, but you can do it. Pacific Debt will be there every step of the way to help.

Debt Collection Laws in Hawaii

Hawaiians are protected against unscrupulous debt collectors. The federal Fair Debt Collection Practices Act (FDCPA) prohibits debt collectors from using abusive or harassing bill collection practices.In addition, the Hawaii Fair Debt Collection Practices Act (HFDCPA) adds protections against more types of collectors and actions. If you are a victim of any of these actions, you may take legal action against them.

Overall, debt collectors can NOT:

- Charges more than 10% interest

- Garnish more than 25% of wages

- U se/threaten physical force or criminal tactics to harm you, your property, or your reputation

- Accusing you of committing a crime for not paying the debt

- Make/threaten to make defamatory statements to someone else

- Threaten arrest, to seize assets, or garnish wages unless actually planning to take such action

- Use obscene or profane language

- Cause you to spend money you wouldn’t otherwise have spent (ie long-distance telephone calls)

- Call you repeatedly or let your phone ring repeatedly

- Call frequently

- Contact your employer, except to verify employment or health insurance status, garnish wages or locate you

- Reveal information about debt to anyone except your spouse or your parents if a minor.

- Publicly publish your name for failing to pay

- Send a postcard or letter with revealing information on the envelope

- Claim to be someone other than a debt collector, including a governmental official

- Use stationery that appears to be from a law firm

- Charge you collection or attorney’s fees unless legally allowable

- Threaten to report you to a credit reporting agency if they have no intention of doing so

- Send a letter claiming to come from a claim, credit, audit, or legal department unless it actually is

Debt collectors in Hawaii must:

- Disclose caller identification

- May contact your family to locate you

- Must serve you with notice of a lawsuit if suing you

Hawaii Bankruptcy Court Information

Bankruptcy is a legal action that can erase most of your debt and your credit history. It is not an action to take lightly. If you do, you must follow the following steps in Hawaii.

Persons filing for bankruptcy must:

- Complete credit counseling within six months before filing for bankruptcy.

- Complete a financial management instructional course after filing bankruptcy.

- Complete a Bankruptcy Act Means Test to determine if you are eligible for a Chapter 7 or 13 bankruptcy

- Itemize current income sources; major financial transactions; monthly living expenses; debts (secured and unsecured); and property (all assets and possessions, not just real estate).

- Collect last 2 years of tax returns, deeds to real estate you own, car titles, and loan documents

- File for bankruptcy

- Chapter 7 bankruptcy fee is $306

- Chapter 13 bankruptcy fee is $281

- Meet with court assigned bankruptcy trustee

- Attend a Meeting of Creditors

- Confirm plan if filing for Chapter 13 bankruptcy

Pacific Debt Provides Relief to Hawaii Cities

Ahuimanu

Barbers Point Housing

Ewa Beach

Fern Forest

Haleiwa

Hanamaulu

Hawaiian Beaches

Heeia

Honalo

Honomu

Kahaluu

Kailua CDP (Hawaii County)

Kalihiwai

Kapaau

Kawela Bay

Kihei

Kukuihaele

Lanai City

Lihue

Makaha Valley

Maunawili

Naalehu

Omao

Pahoa

Paukaa

Princeville

Punaluu

Volcano

Waihee-Waiehu

Wailea-Makena

Waimalu

Waimea CDP (Kauai County)

Waipio Acres

Aiea

Captain Cook

Ewa Gentry

Haiku-Pauwela

Haliimaile

Hanapepe

Hawaiian Ocean View

Hickam Housing

Honaunau-Napoopoo

Iroquois Point

Kahaluu-Keauhou

Kailua CDP (Honolulu County)

Kaneohe

Kapalua

Keaau

Kilauea

Kurtistown

Laupahoehoe

Maalaea

Makakilo City

Mililani Town

Nanakuli

Orchidlands Estates

Paia

Pearl City

Puako

Pupukea

Wahiawa

Waikane

Wailua

Waimanalo

Wainaku

Wheeler AFB

Ainaloa

Eden Roc

Ewa Villages

Halaula

Hana

Hauula

Hawaiian Paradise Park

Hilo

Honokaa

Kaaawa

Kahuku

Kalaheo

Kaneohe Station

Kaumakani

Kealakekua

Koloa

Lahaina

Lawai

Maili

Makawao

Mokuleia

Nanawale Estates

Paauilo

Pakala Village

Pepeekeo

Puhi

Schofield Barracks

Waialua

Waikapu

Wailua Homesteads

Waimanalo Beach

Waipahu

Whitmore Village

Anahola

Eleele

Fern Acres

Halawa

Hanalei

Hawaiian Acres

Hawi

Holualoa

Honolulu

Kaanapali

Kahului

Kalaoa

Kapaa

Kaunakakai

Kekaha

Kualapuu

Laie

Leilani Estates

Makaha

Maunaloa

Mountain View

Napili-Honokowai

Pahala

Papaikou

Poipu

Pukalani

Village Park

Waianae

Waikoloa Village

Wailuku

Waimea CDP (Hawaii County)

Waipio

Disclaimer: In some states, PDR may not be able to offer our services directly due to state regulations related to debt settlement. In those instances, PDR will refer you to a reputable debt relief provider or attorney firm for assistance with your debt. We are not lawyers and are not giving legal advice. Before filing bankruptcy, talk to a lawyer in your state. The information included on this site is for educational purposes only.

Do Not Sell My Personal Information

Do Not Sell My Personal Information