Kentucky Debt Relief

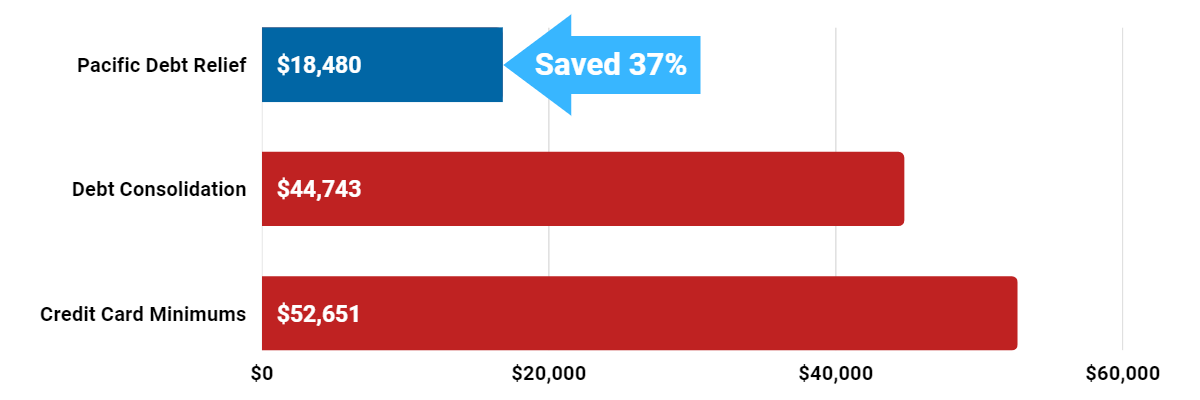

Reduce Your Credit Card Debt By Up To Half

Pacific Debt Relief offers the only solution that significantly reduces your debt to less than you currently owe. That means you get debt-free in a fraction of the time it would take with other options.

Save thousands by lowering your debt balance and wiping away years of future interest and payments. Call today for a FREE consultation!

Kentucky Debt Relief Reviews

What is Kentucky Debt Relief?

Kentucky Debt relief is reduction of debt through settlement or consolidation.

Pacific Debt specializes in debt settlement. We take an active approach to reduce your debt for less than you owe. Most types of unsecured debt qualify for our relief program.

Contact us today and get a FREE consultation. We will help find the best option for your financial situation

When you enter into settlement, you stop paying bills in order to make creditors negotiate. This action can come with late fees. Debt settlement causes some credit score damage as a settlement stays on your credit report for up to seven years. Consider settlement for bills that are very delinquent or already in collections.

Pacific Debt deals directly with your creditors while guiding you throughout the entire process.

We have one of the best-rated settlement programs available for Kentucky residents.

Call our certified specialists who can help you understand all your relief options and your best course of action.

Our FREE analysis will help you make an informed decision. Call to get your free analysis and about our services.

How Do Kentucky Debt Relief Programs Work?

Debt relief reduces the amount you owe your creditors. This usually results in financial relief. Our debt settlement program is one option and Pacific Debt is a Kentucky debt settlement company.

The first step in the Kentucky debt relief process is a FREE phone call with one of our specialists who lay out your options. You will you understand your position and what steps need to be taken to reduce your debt.

Is Kentucky Debt Relief Legit?

Pacific Debt has helped countless Kentucky residents reduce their debt. Since 2002, we've settled over $300 million in credit card debt. Contact us today to see how we can help.

If you are looking for information on debt consolidation or a debt management plan in Kentucky, a free conversation with our specialists will help you see if we can help lower monthly payments and help you become debt-free. If you are looking for loans but have bad credit, our Kentucky debt settlement company program might be perfect for you!

We are experts at negotiation. Call us to work out a relief plan for your financial situation.

We do not require loans. Instead, we negotiate reduced interest rates, offer helpful resources, and upfront fee disclosures. We can help you eliminate debt faster and improve your personal finances.

What Kentucky Residents can expect from our Settlement Services

- Affordable monthly payments based on your budget

- Resolve your situation in 2-4 years

- No upfront fees with low monthly fees- fees vary from 15-25% of the total enrolled amount and state of registration.

- Personal attention from your assigned Account Manager

- Develop a repayment plan and possibly lower interest rates.

- Excellent Customer Service & Support

- We negotiate decreased balances and lower interest rates

- We don't lend money and your financial data is safe with us!

Who qualifies for debt settlement?

You must meet the following:

- Outstanding debts of at least $10,000 in unsecured debts (credit card debt, payday loans, personal loans, doctor bills, collections and repossessions, business debts, and some student loans).

- Difficulties making minimum payments or making on time payments.

* Since not all states are included, not all clients can enroll in our company. People in other states can be connected to one of our trusted partners.

We are not a full balance debt resolution option. As a result, there are some tax consequences. Before pursuing debt settlement, discuss potential tax consequences with a tax professional.

We are also not a law firm and are not giving legal advice.

Pacific Debt Accreditation

Pacific Debt Relief is proud to be accredited by the following organizations.

- The International Association of Professional Debt Arbitrators

- The Consumer Debt Relief Initiative

- Better Business Bureauau

Kentucky Debt Relief Testimonials

Kentucky Better Business Bureau

Pacific Debtis an A+ rated business with the BBB. We have been accredited since 2010. We have received 4.87 out of five stars based on 40 customer reviews with the BBB.

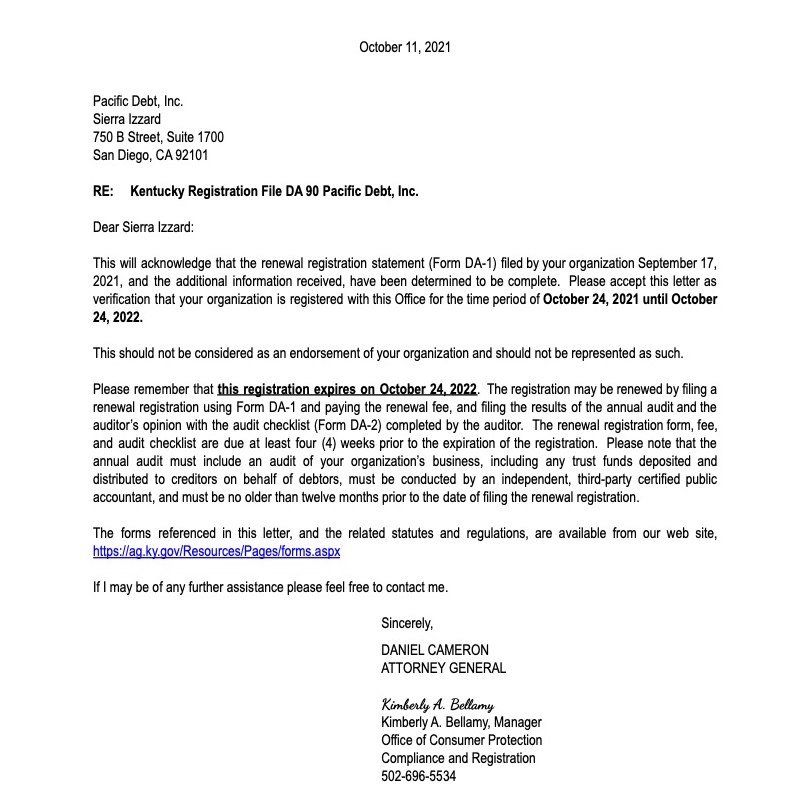

State of Kentucky License Registered Debt Adjusters

Click here to get your FREE Consultation & Savings Estimate , or call us at 800-909-9893

We can help you and your family with relief in the state of Kentucky.

View our Office of the Attorney General of Kentucky 2020 Registration

The State of Kentucky

Kentucky is a state known worldwide for the racehorses that populated the gentle hills near Lexington and the spectacular of the Kentucky Derby. It is highly ranked in agriculture and auto manufacturing. Kentucky is ranked #26 for population and #24 for population density.

As of 2017, almost 4.5 million people called Kentucky home. Louisville is the largest city in Kentucky.

Income

The median state income is $59,023. As of 2018, the minimum wage is $7.25 per hour. Unfortunately, 24.5% of Kentuckian children under 18 live in poverty. For residents overall, 18.5% of all people in Kentucky live under the poverty level.

- Median state income: $59,023

- Minimum wage: $7.25/hour

- Children in poverty: 24.5%

- People in poverty: 18.5%

Is Kentucky a Community Property State?

Kentucky is not a community property state. Therefore your assets are not seen as equally owned by you and your spouse. Currently, there are only 10 states that are community property states. In the state of Kentucky, the judge will decide which assets are shared by you and your spouse, and what the equity is for each.

There are 10 community property states in which the state sees your assets as community property are Louisiana, Arizona, California, Texas, Washington, Idaho, Nevada, New Mexico, and Wisconsin.

Homeowners

More than half (70.1%) of Kentuckians hold a mortgage. The median home price in Kentucky is $139,200 (2018). Of course, that median price depends on the location with some areas being much higher.

- Homeowner rate: 70.1%

- Median home price: $139,200

Employment

Kentucky has a the current unemployment rate of 4%. However, the underemployment rate is 9.7%. Underemployment is the percentage of civilian workers who are unemployed, employed part-time or are not seeking employment.

If this is you, we can help. Pacific Debt offers Kentucky debt relief solutions tailored to your unique situation and budget. Our certified counselors help you work up a budget and explain your options.

- Unemployment: 4% (2018)

- Underemployment: 9.7% (2017)

Kentucky Debt

Kentuckians carry a lot of debt. The average credit card debt is $7,190 (2018). The average student loan is $27,536. When you add that debt on top of the cost of homes (rental or owned), versus the median income, it is very easy for Kentuckians to get into debt.

- Average credit card debt: $7,190 (2018)

- Average mortgage debt: $126,446 (2017)

- Average student loan debt: $27,536 (2017)

Kentucky Statute of Limitations

Kentucky’s statute of limitations lays out maximum time periods that debt collectors can take action against a delinquent debt. These statutes of limitations begin on the date that your debt goes delinquent.

For debts taken out in Kentucky, the following are the statutes of limitations.

- Oral agreements: 4-5 years

- Written contracts: 15 years

- Promissory notes: 5 years

- Credit cards and other revolving loans: 4-15 years

Kentucky Debt Relief & Debt Consolidation

If you have more debt than you can pay off, Pacific Debt can help you consolidate your debts and learn to live debt free. Since 2002, we've settled over $300 million for thousands of clients. We are a national top-ranked debt relief company located in San Diego.

We will help you work through our proven and comprehensive debt settlement programs. Your certified debt relief counselor will review all your options.

If debt settlement is right for you, we move forward with our debt consolidation program and work to save you money.

Pacific Debt can help with most accounts like credit card debt, unsecured loans, medical bills, and repossessions.

It is not an easy process and it won't happen overnight, but you can do it. Pacific Debt will be there every step of the way to help.

Debt Collection Laws

Kentuckians are protected against unscrupulous debt collectors. The federal Fair Debt Collection Practices Act (FDCPA) prohibits debt collectors from using abusive or harassing bill collection practices. If you are a victim of any of these actions, you may take legal action against them.

Overall, debt collectors can NOT:

- Charges more than 10% interest

- Garnish more than 25% of wages

- U se/threaten physical force or criminal tactics to harm you, your property, or your reputation

- Accusing you of committing a crime for not paying the debt

- Make/threaten to make defamatory statements to someone else

- Threaten arrest, to seize assets, or garnish wages unless actually planning to take such action

- Use obscene or profane language

- Cause you to spend money you wouldn’t otherwise have spent (ie long-distance telephone calls)

- Call you repeatedly or let your phone ring repeatedly

- Call frequently

- Contact your employer, except to verify employment or health insurance status, garnish wages or locate you

- Reveal information about debt to anyone except your spouse or your parents if a minor.

- Publicly publish your name for failing to pay

- Send a postcard or letter with revealing information on the envelope

- Claim to be someone other than a debt collector, including a governmental official

- Use stationery that appears to be from a law firm

- Charge you collection or attorney’s fees unless legally allowable

- Threaten to report you to a credit reporting agency if they have no intention of doing so

- Send a letter claiming to come from a claim, credit, audit, or legal department unless it actually is

Debt collectors must:

- Disclose caller identification

- May contact your family to locate you

- Must serve you with notice of a lawsuit if suing you

Bankruptcy Court Information

Bankruptcy is a legal action that can erase most of your debt as well as your credit history. It is not an action to take lightly.

Persons filing for bankruptcy must:

- Complete credit counseling within six months before filing for bankruptcy.

- Complete a financial management instructional course after filing bankruptcy.

- Complete a Bankruptcy Act Means Test to determine if you are eligible for a Chapter 7 or 13 bankruptcy

- Itemize current income sources; major financial transactions; monthly living expenses; debts (secured and unsecured); and property (all assets and possessions, not just real estate).

- Collect last 2 years of tax returns, deeds to real estate you own, car titles, and loan documents

- File for bankruptcy

- Chapter 7 bankruptcy fee is $306

- Chapter 13 bankruptcy fee is $281

- Meet with court assigned bankruptcy trustee

- Attend a Meeting of Creditors

- Confirm plan if filing for Chapter 13 bankruptcy

DISCLAIMER: We are not lawyers and are not giving legal advice. Before filing bankruptcy, talk to a lawyer in your state.

Pacific Debt

We are a nationally top-ranked debt settlement company and we have helped countless Kentucky residents with our national program.

Pacific debt relief program works by having you deposit an agreed amount in your escrow bank account. As you build up sufficient funds through a single monthly payment, we pay off your settled accounts.

The program usually takes anywhere from 2-4 years to complete because everyone's financial situation is different.

Take time to understand how debt settlement companies work and all your Kentucky relief options.

Since we are a national debt relief company, we may be able to help your relatives as well. If we cannot, we will refer you to other programs including debt consolidation programs that we trust.

Your credit score might take a hit but in most cases it's better to take the hit sooner than later, then once your debt is settled, you can work on fixing your credit score after that.

Debt Relief Solution

We are a debt settlement company and have discussed debt settlement in detail. Click here to learn more about debt settlement.

We want you to understand your options. These include debt consolidation, credit counseling, and bankruptcy.

Read all program materials prior to enrolling with any program.

Debt Consolidation program

Debt consolidation rolls debt into personal loans. You apply with a loan company for a consolidation loan or work with a debt consolidation company to set up a consolidation plan. This is paid off by a single payment each month.

Click here to learn more about debt consolidation and finding Kentucky debt consolidation loans.

Credit Counseling

Credit counseling helps you learn money management including developing a budget, helping you understand your credit score, and set up a debt management program. Look for a not for profit credit counseling organization.

Click here to learn more about Credit Counseling.

File Bankruptcy

Filing bankruptcy is a last resort option – this legal action wipes out most of your total debt, severely damages your credit for up to ten years, and is expensive and time-consuming.

Click here to learn more about bankruptcy.

Contact Pacific Debt today so we can help you with your creditors.

Pacific Debt Offers Debt Relief To Kentucky Cities

Adair

Barren

Bourbon

Breathitt

Caldwell

Carroll

Clark

Cumberland

Estill

Franklin

Grant

Greenup

Harrison

Hickman

Jessamine

Knox

Lee

Lincoln

McCracken

Magoffin

Mason

Metcalfe

Muhlenberg

Oldham

Perry

Robertson

Scott

Taylor

Union

Webster

Allen

Bath

Boyd

Breckinridge

Calloway

Carter

Clay

Daviess

Fayette

Fulton

Graves

Hancock

Hart

Hopkins

Johnson

Larue

Leslie

Livingston

McCreary

Marion

Meade

Monroe

Nelson

Owen

Pike

Rockcastle

Shelby

Todd

Warren

Whitley

Anderson

Bell

Boyle

Bullitt

Campbell

Casey

Clinton

Edmonson

Fleming

Gallatin

Grayson

Hardin

Henderson

Jackson

Kenton

Laurel

Letcher

Logan

McLean

Marshall

Menifee

Montgomery

Nicholas

Owsley

Powell

Rowan

Simpson

Trigg

Washington

Wolfe

Ballard

Boone

Bracken

Butler

Carlisle

Christian

Crittenden

Elliott

Floyd

Garrard

Green

Harlan

Henry

Jefferson

Knott

Lawrence

Lewis

Lyon

Madison

Martin

Mercer

Morgan

Ohio

Pendleton

Pulaski

Russell

Spencer

Trimble

Wayne

Woodford

Disclaimer: In some states, PDR may not be able to offer our services directly due to state regulations related to debt settlement. In those instances, PDR will refer you to a reputable debt relief provider or attorney firm for assistance with your debt. We are not lawyers and are not giving legal advice. Before filing bankruptcy, talk to a lawyer in your state. The information included on this site is for educational purposes only.

Do Not Sell My Personal Information

Do Not Sell My Personal Information