Minnesota Debt Relief

Reduce Your Credit Card Debt By Up To Half

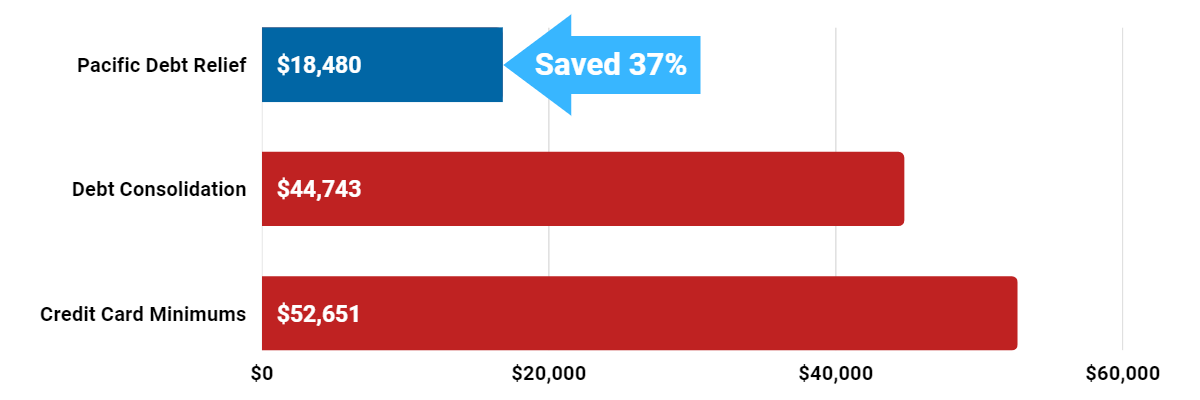

Pacific Debt Relief offers the only solution that significantly reduces your debt to less than you currently owe. That means you get debt-free in a fraction of the time it would take with other options.

Save thousands by lowering your debt balance and wiping away years of future interest and payments. Call today for a FREE consultation!

Minnesota Debt Relief Reviews

Minnesota Better Business Bureau

Pacific Debt Relief is an A+ rated business with the BBB. We have been accredited since 2010. We have received 4.87 out of five stars based on 40 customer reviews with the BBB.

Minnesota

Minnesota is known as the land of lakes and home to the Mall of the Americas. Minnesota has a diverse economy based on finished products and services. Thirty-three of the top 1,000 publicly traded companies are located in Minnesota. Minnesota is ranked #21 for population and #31 for population density.

As of 2018, over 5.3 million people called Minnesota home. Minneapolis is the largest city in Minnesota.

Income

The median state income is $70,218. As of 2018, the minimum wage is $7.87 per hour. Unfortunately, 12.3% of Minnesotan children under 18 live in poverty. For residents overall, 9.9% of all people in Minnesota live under the poverty level.

- Median state income: $70,218

- Minimum wage: $7.87/hour

- Children in poverty: 12.3%

- People in poverty: 9.9%

Is Minnesota a Community Property State?

Minnesota is not a community property state. Therefore your assets are not seen as equally owned by you and your spouse. Currently, there are only 10 states that are community property states. In the state of Minnesota, the judge will decide which assets are shared by you and your spouse, and what the equity is for each.

There are 10 community property states in which the state sees your assets as community property are Louisiana, Arizona, California, Texas, Washington, Idaho, Nevada,

New Mexico, and Wisconsin.

Homeowners

More than half (72.7%) of Minnesotans hold a mortgage. The median home price in Minnesota is $226,900 (2018). Of course, that median price depends on the location with some areas being much higher.

- Homeowner rate: 72.7%

- Median home price: $226,900

Employment

Minnesota has a current unemployment rate of 3.3%. However, the underemployment rate is 7.7%. Underemployment is the percentage of civilian workers who are unemployed, employed part-time, or are not seeking employment.

If this is you, we can help. Pacific Debt offers Minnesota debt relief solutions tailored to your unique situation and budget. Our certified counselors help you work up a budget and explain your options.

- Unemployment: 3.3% (2018)

- Underemployment: 7.7% (2017)

Minnesota Debt

Minnesotans carry a lot of debt. The average credit card debt is $6,761 (2018). The average student loan debt is $31,579. When you add all that debt on top of the cost of homes (rental or owned), versus the median income, it is very easy for Minnesotans to get into debt.

- Avg credit card debt: $6,761 (2018)

- Avg mortgage debt: $175,993 (2017)

- Avg student loan debt: $31,579 (2017)

Minnesota Statute of Limitations

Minnesota’s statute of limitations lays out maximum time periods that debt collectors can take action against a delinquent debt. These statutes of limitations begin on the date that your debt goes delinquent.

For debts taken out in Minnesota, the following are the statutes of limitations for different types of debt.

- Oral agreements: 4-6 years

- Written contracts: 4-6 years

- Promissory notes: 6 years

- Credit cards and other revolving loans: 6 years

Minnesota Debt Relief & Debt Consolidation

If you have more debt than you can pay off, Pacific Debt can help you consolidate your debt and learn to live debt free. Since 2002, we’ve settled over $200 million in debt for thousands of clients. We are a nationally top ranked debt relief company located in San Diego.

We will help you work through our proven and comprehensive debt relief program. Your certified debt relief counselor will review all your options. If debt settlement is right for you, we move forward with our debt consolidation program and work to save you money. Pacific Debt can help with most unsecured debt like credit cards, personal loans, medical bills, and repossessions.

It is not an easy process and it won’t happen overnight, but you can do it. Pacific Debt will be there every step of the way to help.

Debt Collection Laws

Minnesotans are protected against unscrupulous debt collectors. The federal Fair Debt Collection Practices Act (FDCPA) prohibits debt collectors from using abusive or harassing bill collection practices. In addition, the Minnesota Fair Debt Collection Practices Act (MFDCPA) adds protections against more types of collectors and actions. If you are a victim of any of these actions, you may take legal action against them.

Overall, debt collectors can NOT:

- Charges more than 10% interest

- Garnish more than 25% of wages

- U se/threaten physical force or criminal tactics to harm you, your property, or your reputation

- Accusing you of committing a crime for not paying the debt

- Make/threaten to make defamatory statements to someone else

- Threaten arrest, to seize assets, or garnish wages unless actually planning to take such action

- Use obscene or profane language

- Cause you to spend money you wouldn’t otherwise have spent (ie long-distance telephone calls)

- Call you repeatedly or let your phone ring repeatedly

- Call frequently

- Contact your employer, except to verify employment or health insurance status, garnish wages or locate you

- Reveal information about debt to anyone except your spouse or your parents if a minor.

- Publicly publish your name for failing to pay

- Send a postcard or letter with revealing information on the envelope

- Claim to be someone other than a debt collector, including a governmental official

- Use stationery that appears to be from a law firm

- Charge you collection or attorney’s fees unless legally allowable

- Threaten to report you to a credit reporting agency if they have no intention of doing so

- Send a letter claiming to come from a claim, credit, audit, or legal department unless it actually is

Debt collectors must:

- Disclose caller identification

- May contact your family to locate you

- Must serve you with notice of a lawsuit if suing you

Bankruptcy Court Information

Bankruptcy is a legal action that can erase most of your debt as well as your credit history. It is not an action to take lightly. If you do, you must follow the following steps in Alaska.

Persons filing for bankruptcy must:

- Complete credit counseling within six months before filing for bankruptcy.

- Complete a financial management instructional course after filing bankruptcy.

- Complete a Bankruptcy Act Means Test to determine if you are eligible for a Chapter 7 or 13 bankruptcy

- Itemize current income sources; major financial transactions; monthly living expenses; debts (secured and unsecured); and property (all assets and possessions, not just real estate).

- Collect last 2 years of tax returns, deeds to real estate you own, car titles, and loan documents

- File for bankruptcy

- Chapter 7 bankruptcy fee is $306

- Chapter 13 bankruptcy fee is $281

- Meet with court assigned bankruptcy trustee

- Attend a Meeting of Creditors

- Confirm plan if filing for Chapter 13 bankruptcy

Disclaimer: In some states, PDR may not be able to offer our services directly due to state regulations related to debt settlement. In those instances, PDR will refer you to a reputable debt relief provider or attorney firm for assistance with your debt. We are not lawyers and are not giving legal advice. Before filing bankruptcy, talk to a lawyer in your state. The information included on this site is for educational purposes only.

Do Not Sell My Personal Information

Do Not Sell My Personal Information