Montana Debt Relief

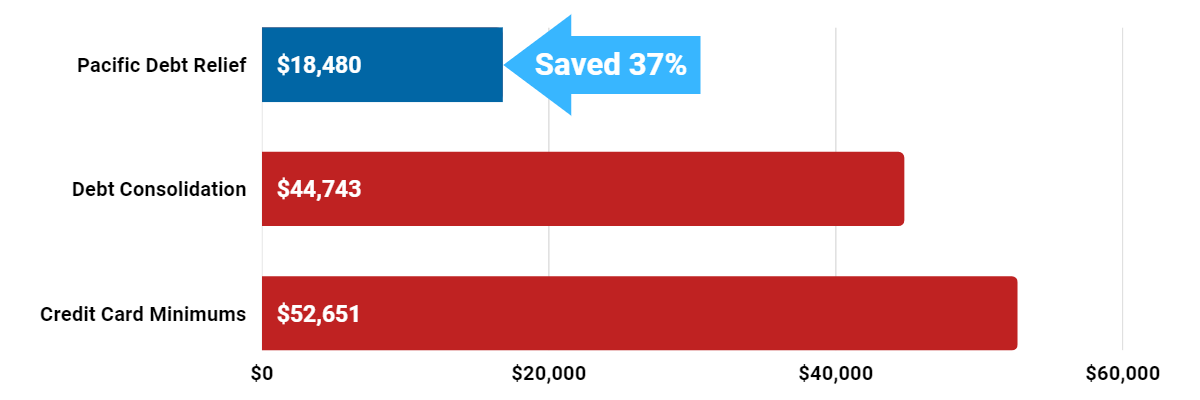

Reduce Your Credit Card Debt By Up To Half

Pacific Debt Relief offers the only solution that significantly reduces your debt to less than you currently owe. That means you get debt-free in a fraction of the time it would take with other options.

Save thousands by lowering your debt balance and wiping away years of future interest and payments. Call today for a FREE consultation!

Montana Debt Relief Reviews

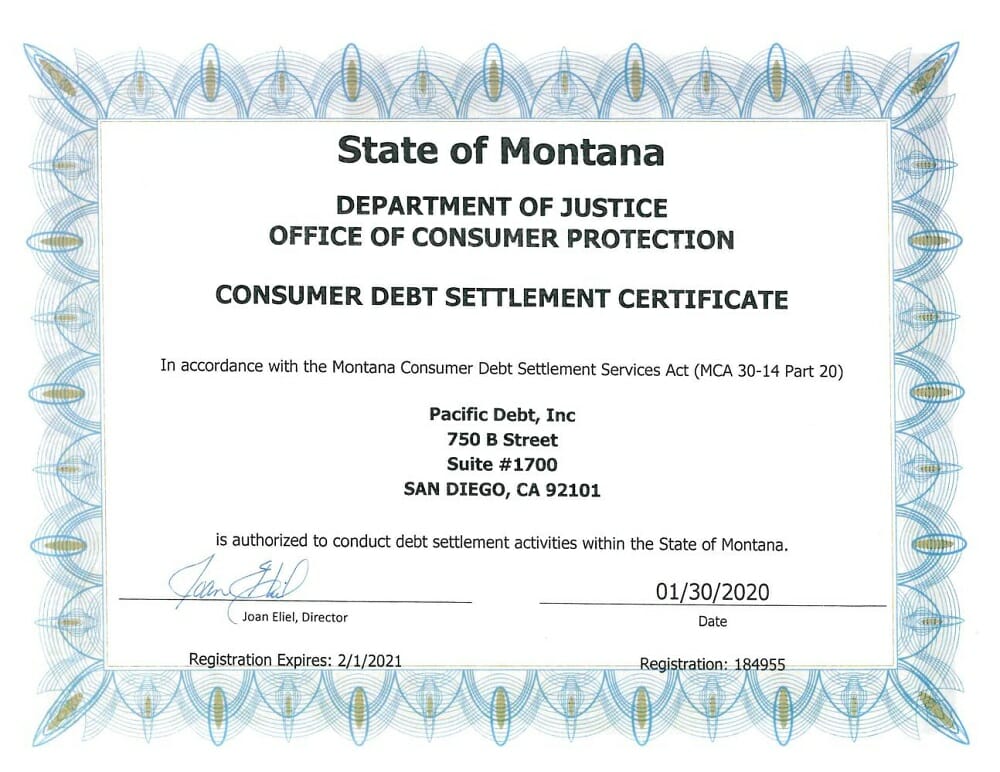

State of Montana Department of Justice Office of Consumer Protection 2020 Certificate

Montana Better Business Bureau

Pacific Debt Relief is an A+ rated business with the BBB. We have been accredited since 2010. We have received 4.87 out of five stars based on 40 customer reviews with the BBB.

Montana

Montana is truly the Big Sky country. Home to Glacier National Park and Custer Battlefield, Montana ranges from wheat on the eastern plains to the rugged Rocky Mountains on the west. Montana has a diverse economy based on agriculture, tourism, timber, and mining. Montana is ranked #43 for population and #48 for population density.

As of 2018, over 1 million people called Montana home. Billings is the largest city in the Montana.

Income

- Median state income: $50,027

- Minimum wage: $8.30/hour

- Children in poverty: 14.8%

- People in poverty: 13.3%

Homeowners

More than half (67.6%) of Montanans hold a mortgage. The median home price in Montana is $224,400 (2018). Of course, that median price depends on the location with some areas being much higher.

- Homeowner rate: 67.6%

- Median home price: $224,400

Employment

Montana has a current unemployment rate of 4.1%. However, the underemployment rate is 8.5%. Underemployment is the percentage of civilian workers who are unemployed, employed part-time, or are not seeking employment.

If this is you, we can help. Pacific Debt Relief offers Montana debt relief solutions tailored to your unique situation and budget. Our certified counselors help you work up a budget and explain your options.

- Unemployment: 4.1% (2018)

- Underemployment: 8.5% (2017)

Montana Debt

Montanans carry a lot of debt. The average credit card debt is $9,759 (2018). The average student loan debt is $26,280. When you add all that debt on top of the cost of homes (rental or owned), versus the median income, it is very easy for Montanans to get into debt.

- Avg credit card debt: $9,759 (2018)

- Avg mortgage debt: $175,730 (2017)

- Avg student loan debt: $26,280 (2017)

Montana Statute of Limitations

Montana’s statute of limitations lays out maximum time periods that debt collectors can take action against a delinquent debt. These statutes of limitations begin on the date that your debt goes delinquent.

For debts taken out in Montana, the following are the statutes of limitations for different types of debt.

- Oral agreements: 5 years

- Written contracts: 8 years

- Promissory notes: 5 years

- Credit cards and other revolving loans: 8 years

Montana Debt Relief & Debt Consolidation

If you have more debt than you can pay off, Pacific Debt can help you consolidate your debt and learn to live debt free. Since 2002, we’ve settled over $200 million in debt for thousands of clients. We are a nationally top ranked debt relief company located in San Diego.

We will help you work through our proven and comprehensive debt relief program. Your certified debt relief counselor will review all your options. If debt settlement is right for you, we move forward with our debt consolidation program and work to save you money. Pacific Debt can help with most unsecured debt like credit cards, personal loans, medical bills, and repossessions.

It is not an easy process and it won’t happen overnight, but you can do it. Pacific Debt will be there every step of the way to help.

Debt Collection Laws

Montanans are protected against unscrupulous debt collectors. The federal Fair Debt Collection Practices Act (FDCPA) prohibits debt collectors from using abusive or harassing bill collection practices. n addition, the Montana Fair Debt Collection Practices Act (MFDCPA) adds protections against more types of collectors and actions. If you are a victim of any of these actions, you may take legal action against them.

Overall, debt collectors can NOT:

- Charges more than 10% interest

- Garnish more than 25% of wages

- U se/threaten physical force or criminal tactics to harm you, your property, or your reputation

- Accusing you of committing a crime for not paying the debt

- Make/threaten to make defamatory statements to someone else

- Threaten arrest, to seize assets, or garnish wages unless actually planning to take such action

- Use obscene or profane language

- Cause you to spend money you wouldn’t otherwise have spent (ie long-distance telephone calls)

- Call you repeatedly or let your phone ring repeatedly

- Call frequently

- Contact your employer, except to verify employment or health insurance status, garnish wages or locate you

- Reveal information about debt to anyone except your spouse or your parents if a minor.

- Publicly publish your name for failing to pay

- Send a postcard or letter with revealing information on the envelope

- Claim to be someone other than a debt collector, including a governmental official

- Use stationery that appears to be from a law firm

- Charge you collection or attorney’s fees unless legally allowable

- Threaten to report you to a credit reporting agency if they have no intention of doing so

- Send a letter claiming to come from a claim, credit, audit, or legal department unless it actually is

Debt collectors must:

- Disclose caller identification

- May contact your family to locate you

- Must serve you with notice of a lawsuit if suing you

Bankruptcy Court Information

Bankruptcy is a legal action that can erase most of your debt as well as your credit history. It is not an action to take lightly. If you do, you must follow the following steps in Montana.

Persons filing for bankruptcy must:

- Complete credit counseling within six months before filing for bankruptcy.

- Complete a financial management instructional course after filing bankruptcy.

- Complete a Bankruptcy Act Means Test to determine if you are eligible for a Chapter 7 or 13 bankruptcy

- Itemize current income sources; major financial transactions; monthly living expenses; debts (secured and unsecured); and property (all assets and possessions, not just real estate).

- Collect last 2 years of tax returns, deeds to real estate you own, car titles, and loan documents

- File for bankruptcy

- Chapter 7 bankruptcy fee is $306

- Chapter 13 bankruptcy fee is $281

- Meet with court assigned bankruptcy trustee

- Attend a Meeting of Creditors

- Confirm plan if filing for Chapter 13 bankruptcy

Providing Debt Relief for Montana Cities

Absarokee

Amsterdam-Churchill

Ashland

Bainville

Bearcreek

Belt

Big Sky

Black Eagle

Box Elder

Broadview

Butte-Silver Bow (balance)

Cascade

Choteau

Clyde Park

Conrad

Crow Agency

Darby

Denton

Drummond

East Missoula

Ennis

Fairfield

Flaxville

Fort Benton

Fort Smith

Frenchtown

Garrison

Glendive

Hamilton

Harrison

Heart Butte

Helena Valley Southeast

Herron

Hot Springs

Inverness

Joliet

Kalispell

Kings Point

Lakeside

Lewistown

Lincoln

Lodge Pole

Malmstrom AFB

Medicine Lake

Montana City

Nashua

Noxon

Outlook

Park City

Plains

Poplar

Ravalli

Rexford

Rollins

Ryegate

St. Marie

Sangrey

Shepherd

Somers

Stevensville

Superior

Toston

Turtle Lake

Vaughn

Westby

Whitefish

Willow Creek

Winston

Worden

Agency

Anaconda-Deer Lodge County

Augusta

Baker

Beaver Creek

Big Arm

Big Timber

Boneau

Bozeman

Brockton

Camp Three

Charlo

Circle

Colstrip

Cooke City-Silver Gate

Culbertson

Dayton

Dillon

Dutton

Ekalaka

Eureka

Fairview

Florence

Fortine

Four Corners

Froid

Geraldine

Grass Range

Hardin

Havre

Helena

Helena Valley West Central

Highwood

Hungry Horse

Ismay

Joplin

Kerr

Klein

Lame Deer

Lewistown Heights

Livingston

Lolo

Malta

Melstone

Moore

Neihart

Old Agency

Ovando

Parker School

Plentywood

Power

Red Lodge

Richey

Ronan

Saco

St. Pierre

Scobey

Sheridan

South Browning

Sunburst

Terry

Townsend

Twin Bridges

Victor

West Glendive

Whitehall

Wilsall

Wisdom

Wye

Alberton

Antelope

Avon

Ballantine

Belfry

Bigfork

Billings

Bonner-West Riverside

Bridger

Browning

Cardwell

Chester

Clancy

Columbia Falls

Coram

Custer

De Borgia

Dixon

East Glacier Park Village

Elliston

Evaro

Fallon

Forsyth

Fort Peck

Fox Lake

Fromberg

Gildford

Great Falls

Harlem

Havre North

Helena Valley Northeast

Helena West Side

Hingham

Huntley

Jefferson City

Jordan

Kevin

Knife River

Laurel

Libby

Lockwood

Loma

Manhattan

Miles City

Muddy

Niarada

Opheim

Pablo

Philipsburg

Plevna

Pryor

Reed Point

Riverbend

Roundup

Saddle Butte

St. Regis

Seeley Lake

Sidney

Stanford

Sun Prairie

Thompson Falls

Trout Creek

Ulm

Virginia City

West Havre

White Sulphur Springs

Winifred

Wolf Point

Wyola

Alder

Arlee

Azure

Basin

Belgrade

Big Sandy

Birney

Boulder

Broadus

Busby

Carter

Chinook

Clinton

Columbus

Corvallis

Cut Bank

Deer Lodge

Dodson

East Helena

Elmo

Evergreen

Finley Point

Fort Belknap Agency

Fort Shaw

Frazer

Gardiner

Glasgow

Greycliff

Harlowton

Hays

Helena Valley Northwest

Heron

Hobson

Hysham

Jette

Judith Gap

Kicking Horse

Kremlin

Lavina

Lima

Lodge Grass

Lonepine

Martin City

Missoula

Musselshell

North Browning

Orchard Homes

Paradise

Pinesdale

Polson

Radersburg

Reserve

Rocky Point

Rudyard

St. Ignatius

St. Xavier

Shelby

Simms

Starr School

Sun River

Three Forks

Troy

Valier

Walkerville

West Yellowstone

Wibaux

Winnett

Woods Bay

Disclaimer: In some states, PDR may not be able to offer our services directly due to state regulations related to debt settlement. In those instances, PDR will refer you to a reputable debt relief provider or attorney firm for assistance with your debt. We are not lawyers and are not giving legal advice. Before filing bankruptcy, talk to a lawyer in your state. The information included on this site is for educational purposes only.

Do Not Sell My Personal Information

Do Not Sell My Personal Information