West Virginia Debt Relief

Reduce Your Credit Card Debt By Up To Half

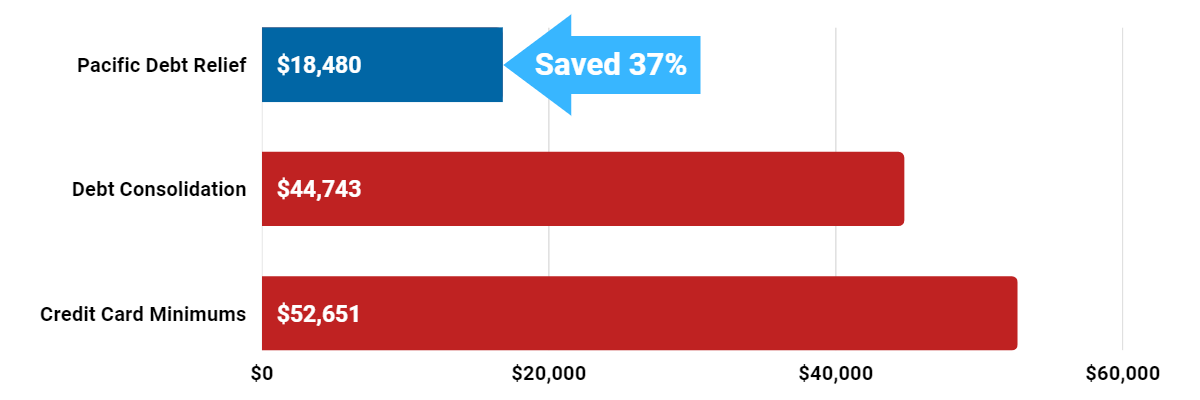

Pacific Debt Relief offers the only solution that significantly reduces your debt to less than you currently owe. That means you get debt-free in a fraction of the time it would take with other options.

Save thousands by lowering your debt balance and wiping away years of future interest and payments. Call today for a FREE consultation!

For over 20 years our debt relief program has helped clients change the trajectory of their financial lives. Our work has impacted families and future generations. We are a debt relief company that provides exceptional customer service and works diligently to maintain your trust throughout our entire process.

Don't just take our word for it, read our video testimonial reviews. We're rated A+ and fully accredited by the Better Business Bureau (BBB). We have thousands of reviews and testimonials highlighting we are trustworthy, we keep our word, we have a friendly dedicated customer care team, we offer tailored programs to suit your unique needs, and offer ongoing encouragement throughout the process of becoming debt free.

During your free debt relief consultation we will listen closely to your financial situation and create a tailored program to get you debt-free faster than you thought possible. We have helped hundreds of thousands of clients resolve millions in consumer debt. We are ready to help you get out of debt!

West Virginia Debt Relief Reviews & Ratings

What is West Virginia Debt Relief?

Pacific Debt Relief is a top-rated debt settlement company with an excellent track record and reputation. We work directly with your creditors to negotiate your credit card debt, lowering the amount you owe.

If you're struggling under the burden of high-interest debt in West Virginia, you're not alone. As a top-rated debt settlement company, we understand the stress of mounting bills and aggressive creditors. As a trusted debt relief company, we have years of experience helping West Virginians achieve financial freedom.

Our certified debt specialists will analyze your situation and explain all your debt relief options, including our customized debt settlement program. With no upfront fees, we won’t charge you until we’ve successfully negotiated your debt balances and set you up on an affordable payment plan.

Get a FREE consultation today with no obligation! We will explain all your options and help find the best one for you.

Debt Relief Options in West Virginia

Pacific Debt has one of the best-rated debt relief programs available for West Virginia residents who qualify for our West Virginia debt relief program. Best of all, our program doesn't require any upfront fees!

The debt settlement process may impact your credit score in the short term, but once completed, most of our clients see significant credit score improvements. We help you weigh the pros and cons to determine if our West Virginia debt relief solution is your best path to financial freedom.

On average, West Virginia residents carry around $8,500 in credit card debt and over $49,000 in total debt from credit cards, personal loans, medical bills, and student loans. With rising costs of living and stagnant wages, this debt burden can make financial relief an urgent necessity.

Don't struggle with high-interest debt any longer. Call Pacific Debt today for a free consultation and take the first step toward financial freedom!

Does Debt Settlement Work?

Yes! Reputable debt settlement companies, like Pacific Debt Relief, can help you achieve financial stability.

We have great debt relief reviews—check them out! Always research thoroughly and compare different debt settlement companies before making a decision.

Instead of balance transfer credit cards, debt consolidation loans, or personal loans, our debt settlement program focuses on negotiating with your creditors to reduce your total debt amount while setting up an affordable monthly payment plan.

We are one of the leading debt relief companies in the U.S., and since 2002, we've helped settle over $300 million in debt for our clients. We can explain everything in a

free consultation.

Pacific Debt Relief Accreditation

Pacific Debt Relief is accredited by:

- Consumer Debt Relief Initiative

- International Association of Professional Debt Arbitrators

- BetterBusiness Bureau

The Federal Trade Commission, a government program, also oversees debt relief companies. Always check the accreditation of debt relief companies as there are debt relief scams.

What West Virginia Consumers Can Expect from Our Debt Settlement Services

- Monthly payments based on your budget

- Resolve your debt in 2-4 years, based on the national average

- No upfront fees – program fees vary from 15-25% of the total enrolled debt

- Personal attention from our Client Success team

- A custom-tailored debt management plan with negotiated rates

- Excellent customer service and ongoing support

- We negotiate directly with your creditors to lower balances and interest rates

- No unsecured personal loans required

State of West Virginia

West Virginia is home to stunning Appalachian landscapes and rich coal mining history. The state is ranked #38 for population and #29 for population density.

As of 2023, over 1.8 million people call West Virginia home. Charleston is the largest city in West Virginia.

West Virginia Debt Statistics

West Virginia's state and local government debt has fluctuated over the years. In the 2019 fiscal year, the state's total outstanding debt reached approximately $8.68 billion, while local government debt stood at around$3.71 billion. These figures highlight the financial obligations carried by both state and municipal governments in managing public services and infrastructure.

West Virginia Statute of Limitations

West Virginia's statute of limitations limits the time debt collectors can take action against delinquent debt. The statutes start on the date your debt becomes delinquent.

- Oral agreements: 5 years

- Written contracts: 10 years

- Promissory notes: 6 years

- Credit cards and revolving loans: 5 years

Other common unsecured debts that can be negotiated through West Virginia debt settlement include:

- Credit cards

- Medical bills

- Personal loans

- Utility bills

- Payday loans

Debt settlement provides a way to significantly reduce balances owed and become debt-free faster than options like debt management plans and debt consolidation loans.

However, debt settlement is not right for everyone. It can temporarily impact your credit score and is best suited for those facing serious financial hardship.

Debt Settlement

Debt settlement is an agreement between a creditor and debtor to settle a debt for less than the amount owed. This can be a great debt relief option for anyone looking to reduce their debt substantially.

If you have more debt than you can pay off, Pacific Debt Relief can help you with West Virginia debt settlement and teach you how to live debt-free. Since 2002, we've settled over $300 million in debt for thousands of clients.

We are a nationally top-ranked company specializing in debt settlement, and we have helped countless West Virginia residents with our national debt relief program. Contact us today so we can help you too! We also offer free debt analysis and can recommend a trusted credit counseling agency.

We will guide you through our proven and comprehensive debt relief program, which involves making one monthly payment into a savings account. As you build up sufficient funds, we pay off your settled accounts.

Debt Management Plan

You may have heard of a Debt Management Plan (DMP) to help pay off your debt on time. A DMP is a voluntary agreement between a debtor and creditors to repay a portion of the outstanding debt. Under this agreement, the debtor agrees to make monthly payments to a credit counseling agency, which then distributes the money among creditors.

A debt management program can be helpful for consumers struggling to manage their debts. However, not all creditors will agree to participate in a DMP.

Your certified debt settlement counselor will review all your debt options. If West Virginia debt settlement is right for you, we will move forward with our debt settlement program and work to save money on your enrolled debt.

Other Debt Relief Options

We are a West Virginia debt settlement company, and we have covered debt settlement in detail. The quick version: we negotiate with creditors to lower the amount of unsecured loans owed, including credit cards, to help you save money and settle debts faster.

However, we also want you to understand your other debt relief options, including:

- Debt consolidation

- Credit counseling

- Bankruptcy

West Virginia Debt Collection Laws

West Virginians are protected against unscrupulous debt collectors. The federal Fair Debt Collection Practices Act (FDCPA) prohibits debt collectors from using abusive or harassing bill collection practices. Additionally, West Virginia state laws provide further protections against certain debt collection tactics.

If you believe you are being harassed or subjected to illegal practices by a debt collector, contact our team at Pacific Debt Relief for assistance.

Call us at (833) 865-2028 to discuss your situation and learn about your consumer rights and protections. Our knowledgeable debt specialists can provide guidance and advice.

West Virginia Debt Collection Laws

Debt collectors in West Virginia CANNOT:

- Charge more than 6% interest on unpaid debts (unless a contract specifies otherwise)

- Garnish more than 25% of wages

- Use or threaten physical force or criminal tactics to harm you, your property, or your reputation

- Accuse you of committing a crime for not paying the debt

- Make or threaten to make defamatory statements about you to others

- Threaten arrest, asset seizure, or wage garnishment unless they legally intend to take such action

- Use obscene or profane language

- Call repeatedly or let your phone ring excessively to annoy or harass you

- Contact your employer, except to verify employment or health insurance status, garnish wages, or locate you

- Reveal information about your debt to anyone except your spouse or your parents (if you are a minor)

- Publicly publish your name for failing to pay

- Send misleading or deceptive letters that claim to be from a legal department or government agency

- Claim to be someone other than a debt collector, including a government official

- Use law firm stationery or falsely claim to be a law firm if they are not attorneys

- Charge collection or attorney’s fees unless legally allowable

- Threaten to report you to a credit reporting agency if they have no intention of doing so

Debt collectors CAN:

- Disclose their identity and caller information when contacting you

- May contact your family members only to locate you—not to discuss your debt

- Must provide written notice of a lawsuit if they intend to sue you

DISCLAIMER: In some states, PDR may not be able to offer our services directly due to state regulations related to debt settlement. In those instances, PDR will refer you to a reputable debt relief provider or attorney firm for assistance with your debt. We are not lawyers and are not giving legal advice. Before filing bankruptcy, talk to a lawyer in your state. The information included on this site is for educational purposes only. Your state may not qualify for the Pacific Debt, Inc debt relief program. If it does not qualify, we can refer you to a Trusted Partner or assist in connecting you with a provider who offers servicing in your state of residence.

Do Not Sell My Personal Information

Do Not Sell My Personal Information