Wisconsin Debt Relief

Reduce Your Credit Card Debt By Up To Half

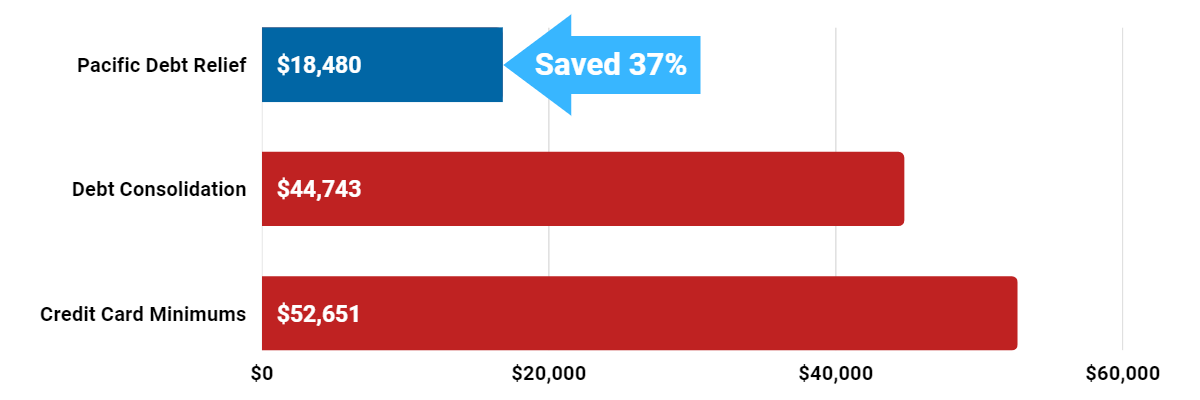

Pacific Debt Relief offers the only solution that significantly reduces your debt to less than you currently owe. That means you get debt-free in a fraction of the time it would take with other options.

Save thousands by lowering your debt balance and wiping away years of future interest and payments. Call today for a FREE consultation!

What is Wisconsin Debt Relief?

Relief involves paying off credit cards and other unsecured debt. Pacific Debt, Inc is one of the leading debt relief companies.

Contact us today for a FREE consultation with no obligation.

Our debt settlement program can help Wisconsin residents settle debt for substantially less than currently owed. This program takes between 2-4 years to complete. Pacific Debt deals directly with your creditors while guiding you throughout the entire process.

Call one of our certified specialists who can help you understand all your relief options and your best course of action. Our savings estimate will show you much money we can save you each month. Our free debt analysis will help you make an informed decision. Call to get your free quote for our services.

Pacific Debt has one of the best-rated settlement programs available for Wisconsin residents who are eligible for our relief program. Debt settlement is a great option when you face pressure from bill collectors and creditors. We understand what it is like to be unable to pay your creditor bills because of high interest rates or being unable to make the monthly payment for unsecured loans.

The secret to settlement is to stop paying your bills to make creditors negotiate. This action can come with late fees and collector phone calls. Debt settlement may cause some credit score damage as a settlement can stay on your credit report for up to seven years. Consider settlement for bills that are very delinquent or already in collections.

Most people considering debt programs do not have a high credit score. Most people who successfully complete our debt settlement services plan can see rapid improvements to their credit scores.

If you're a Wisconsin resident looking into debt relief programs, speak to one of our debt management experts -- you'll understand your options and how we can help you reduce unsecured debts.

Wisconsin Debt Relief Reviews

Does Debt Settlement Work?

Reputable debt settlement organizations, like Pacific Debt, can help you to live debt-free.

We do not require debt consolidation loans - we negotiate to reduce interest rates, offer helpful resources, and low total monthly payments with upfront fee disclosures. We can help you eliminate debt faster and improve your personal finances.

Pacific Debt Relief Accreditation

Pacific Debt Relief is proud to be accredited by the following organizations.

- The International Association of Professional Debt Arbitrators

- The Consumer Debt Relief Initiative

- Better Business Bureau

What Wisconsin Residents can expect from our Debt Settlement Services

- Affordable monthly payments based on your budget

- Resolve your situation in 2-4 years

- No fees upfront and low monthly fees- fees vary from 15-25% of the total enrolled amount and state of registration

- Personal attention from our Client Success team

- Develop a debt management plan or repayment plan and possibly lower interest rates.

- Excellent Customer Service & Support

- We negotiate decreased balances and lower interest rates

- We don't lend money and your financial data is safe with us!

Wisconsin Debt Relief Testimonials

Wisconsin Debt Relief Reviews

Wisconsin BBB - Better Business Bureau

Pacific Debt Relief is an A+ rated Business with the BBB for debt negotiation services to individuals and families struggling with unsecured debt. We have been accredited since 2010 and in business since 2002.

We have helped thousands of Wisconsin consumers as an accredited debt settlement company, just like Jody from Chilton Wisconsin. Call us today, we can help you too! We can help you understand all your financial options and create a debt management plan with our debt settlement specialists.

The State of Wisconsin

Wisconsin is known as the state that produces the best cheese. In reality, Wisconsin has a diverse economy based on manufacturing, agriculture, and health care. Wisconsin is ranked #20 for population and #23 for population density.

As of 2018, over 5.8 million people called Wisconsin home. Milwaukee is the largest city in Wisconsin.

Income

The median state income is $52,893. As of 2018, the minimum wage is $7.25 per hour. Unfortunately, 15.3% of Wisconsinite children under 18 live in poverty. For residents overall, 11.8% of all people in Wisconsin live under the poverty level.

- Median state income: $52,893

- Minimum wage: $7.25/hour

- Children in poverty: 15.3%

- People in poverty: 11.8%

Homeowners

More than half (68%) of Wisconsinites hold a mortgage. The median home price in Wisconsin is $179,600 (2018). Of course, that median price depends on the location with some areas being much higher.

- Homeowner rate: 68%

- Median home price: $179,600

Employment

Wisconsin has a current unemployment rate of 2.9%. However, the underemployment rate is 7.9%. Underemployment is the percentage of civilian workers who are unemployed, employed part-time, or are not seeking employment.

If this is you, we can help. Our certified counselors help you work up a budget and explain your options.

- Unemployment: 2.9% (2018)

- Underemployment: 7.9% (2017)

Wisconsin Debt Relief

Wisconsinites carry a lot of debt. The average credit card debt is $6,484 (2018). The average student loan debt is $28,810. When you add all that debt on top of the cost of homes (rental or owned), versus the median income, it is very easy for Wisconsinites to get into debt.

- Avg credit card debt: $6,484 (2018)

- Avg mortgage debt: $142,993 (2017)

- Avg student loan debt: $28,810 (2017)

Wisconsin Statute of Limitations

Wisconsin’s statute of limitations lays out maximum time periods that debt collectors can take action against a delinquent debt. These statutes of limitations begin on the date that your debt goes delinquent.

For debt in Wisconsin, the following are the statutes of limitations for different types of debt.

- Oral agreements: 6 years

- Written contracts: 6 years

- Promissory notes: 10 years

- Credit cards and other revolving loans: 6 years

Debt Relief & Debt Consolidation

If you have more debt than you can pay off and can not make minimum monthly payments, Pacific Debt can help you live without debt. Since 2002, we've settled over $200 million in debt for thousands of clients.

We will help you work through our proven debt management program that involves one monthly payment into a savings account. Your certified debt settlement counselor will review all your options. If debt settlement is right for you, we move forward with our debt settlement plan and work to save money on your enrolled debt-- unsecured debt like credit card debt, medical bills, and loans.

It is not an easy process and it won't happen overnight, but you can do it. Pacific Debt will be there every step of the way to help.

We are a nationally top-ranked company specializing in debt settlement and we have helped countless Wisconsin residents with our national debt management program. Contact us today so we can help you too!

Call us and ask our award winning debt specialists about our debt settlement program and how it can help you reduce debt faster.

Since we are a national debt relief company, we may be able to help your relatives as well. If we can not, we will refer you to other programs including debt consolidation programs that we trust.

Other Wisconsin Debt Relief Programs

We are a debt settlement company and have discussed debt settlement in detail. The quick version is: you (or a company) negotiates with creditors to lower the debt amount of unsecured loans, like credit card debt and helps you to save money. Debt settlement is not for secured debt like a car loan.

Click here to learn more about debt settlement.

We want you to understand your options. These include debt consolidation, credit counseling, and bankruptcy.

Debt Consolidation

This option will consolidate debt by rolling all debt into a debt consolidation loan is tis then paid off by a single payment each month. You apply with a loan company for a low interest rate debt consolidation loan to pay off the debt or work with a debt consolidation program.

Click here to learn more about debt consolidation and finding a debt consolidation loan.

Credit Counseling

Credit counseling helps you learn money management including developing a budget, helping you understand your credit score, and set up a debt management plan.

Click here to learn more about Credit Counseling.

File Bankruptcy

Filing bankruptcy is a last resort option – this legal action wipes out most of your total debt, severely damages your credit for up to ten years, and is expensive and time-consuming.

Click here to learn more about bankruptcy.

Debt Collection Laws

Wisconsinites are protected against unscrupulous debt collectors. The federal Fair Debt Collection Practices Act (FDCPA) prohibits debt collectors from using abusive or harassing bill collection practices.If you are a victim of any of these actions, you may take legal action against them.

Overall, debt collectors can NOT:

- Charges more than 10% interest

- Garnish more than 25% of wages

- U se/threaten physical force or criminal tactics to harm you, your property, or your reputation

- Accusing you of committing a crime for not paying the debt

- Make/threaten to make defamatory statements to someone else

- Threaten arrest, to seize assets, or garnish wages unless actually planning to take such action

- Use obscene or profane language

- Cause you to spend money you wouldn’t otherwise have spent (ie long-distance telephone calls)

- Call you repeatedly or let your phone ring repeatedly

- Call frequently

- Contact your employer, except to verify employment or health insurance status, garnish wages or locate you

- Reveal information about debt to anyone except your spouse or your parents if a minor.

- Publicly publish your name for failing to pay

- Send a postcard or letter with revealing information on the envelope

- Claim to be someone other than a debt collector, including a governmental official

- Use stationery that appears to be from a law firm

- Charge you collection or attorney’s fees unless legally allowable

- Threaten to report you to a credit reporting agency if they have no intention of doing so

- Send a letter claiming to come from a claim, credit, audit, or legal department unless it actually is

Debt collectors must:

- Disclose caller identification

- May contact your family to locate you

- Must serve you with notice of a lawsuit if suing you

Bankruptcy Court Information

Bankruptcy is a legal action that can erase most of your debt as well as your credit history. It is not an action to take lightly. If you do, you must follow the following steps in Wisconsin.

Persons filing for bankruptcy must:

- Complete credit counseling within six months before filing for bankruptcy.

- Complete a financial management instructional course after filing bankruptcy.

- Complete a Bankruptcy Act Means Test to determine if you are eligible for a Chapter 7 or 13 bankruptcy

- Itemize current income sources; major financial transactions; monthly living expenses; debts (secured and unsecured); and property (all assets and possessions, not just real estate).

- Collect last 2 years of tax returns, deeds to real estate you own, car titles, and loan documents

- File for bankruptcy

- Chapter 7 bankruptcy fee is $306

- Chapter 13 bankruptcy fee is $281

- Meet with court assigned bankruptcy trustee

- Attend a Meeting of Creditors

- Confirm plan if filing for Chapter 13 bankruptcy

We Provide Debt Relief to Wisconsin Cities

Abbotsford

Algoma

Almena village

Amherst village

Appleton

Arlington village

Athens village

Bagley village

Baraboo

Bayfield

Belgium village

Belmont village

Big Bend village

Biron village

Blair

Blue Mounds village

Bonduel village

Boyd village

Brodhead

Brown Deer village

Bruce village

Butternut village

Cameron village

Cascade village

Catawba village

Cedar Grove village

Chenequa village

Chippewa Falls

Clinton village

Cochrane village

Coloma village

Conrath village

Couderay village

Cuba City

Dallas village

Deerfield village

Delavan

De Soto village

Dousman village

Durand

Eastman village

Edgar village

Elderon village

Elk Mound village

Elmwood Park village

Ephraim village

Exeland village

Fall River village

Fitchburg

Forestville village

Fox Point village

Frederic village

Friendship village

Genoa village

Gilman village

Glenwood City

Gratiot village

Green Lake

Hammond village

Hatley village

Hazel Green village

Highland village

Hollandale village

Howard village

Hustisford village

Iola village

Jackson village

Junction City village

Kellnersville village

Keshena

Kimberly village

Lac du Flambeau

La Farge village

Lake Lac La Belle

Lake Shangrila

Lancaster

Lena village

Little Round Lake

Lohrville village

Loyal

Lyndon Station village

Maiden Rock village

Marathon City village

Markesan

Mason village

Mazomanie village

Melvina village

Mequon

Merton village

Milltown village

Minong village

Monroe

Montreal

Mount Horeb village

Muskego

Neillsville

Neopit

New Berlin

New Lisbon

Niagara

North Freedom village

Oak Creek

Oconomowoc Lake village

Ogdensburg village

Onalaska

Oregon village

Osseo

Palmyra village

Patch Grove village

Pewaukee

Pittsville

Pleasant Prairie village

Poplar village

Potosi village

Powers Lake

Prairie Farm village

Pulaski village

Random Lake village

Reedsville village

Rhinelander

Richland Center

Ripon

Rochester village

Rome

Rudolph village

St. Nazianz village

Schofield

Shawano

Shell Lake

Shorewood Hills village

Sister Bay village

Somerset village

Spencer village

Stanley

Stevens Point

Stoughton

Sturtevant village

Superior village

Taylor village

Thorp

Tony village

Two Rivers

Valders village

Viroqua

Warrens village

Waterloo

Waupaca

Wautoma

West Allis

Westfield village

Weyauwega

Whitehall

Whiting village

Wilton village

Winneconne village

Withee village

Woodville village

Yuba village

Adams

Allouez village

Almond village

Amherst Junction village

Arcadia

Arpin village

Auburndale village

Baldwin village

Barneveld village

Bayside village

Bell Center village

Beloit

Big Falls village

Black Creek village

Blanchardville village

Blue River village

Boscobel

Brandon village

Brokaw village

Browns Lake

Buffalo City

Cadott village

Campbellsport village

Casco village

Cazenovia village

Centuria village

Chetek

Clayton village

Clintonville

Colby

Columbus

Coon Valley village

Crandon

Cudahy

Dane village

Deer Park village

Delavan Lake

Dickeyville village

Downing village

Eagle village

East Troy village

Edgerton

Eleva village

Ellsworth village

Elroy

Ettrick village

Fairchild village

Fennimore

Fond du Lac

Fort Atkinson

Francis Creek village

Fredonia village

Friesland village

Genoa City village

Glenbeulah village

Grafton village

Green Bay

Greenwood

Hancock village

Haugen village

Hebron

Hilbert village

Holmen village

Howards Grove village

Hustler village

Iron Ridge village

Janesville

Juneau

Kendall village

Kewaskum village

Kingston village

Lac La Belle village

Lake Delton village

Lake Mills

Lake Wazeecha

Lannon village

Lime Ridge village

Livingston village

Lomira village

Lublin village

Lynxville village

Manawa

Maribel village

Marquette village

Mattoon village

Medford

Menasha

Merrill

Middleton

Milton

Mishicot village

Montello

Mosinee

Mount Sterling village

Nashotah village

Nekoosa

Neosho village

Newburg village

New London

Nichols village

North Hudson village

Oakdale village

Oconto

Okauchee Lake

Oneida

Orfordville village

Owen

Pardeeville village

Pell Lake

Pewaukee village

Plain village

Plover village

Portage

Potter village

Poynette village

Prentice village

Racine

Readstown village

Reeseville village

Rib Lake village

Ridgeland village

River Falls

Rockdale village

Rosendale village

St. Cloud village

Sauk City village

Seymour

Sheboygan

Sherwood village

Shullsburg

Slinger village

South Milwaukee

Spooner

Star Prairie village

Stockbridge village

Stratford village

Sullivan village

Suring village

Tennyson village

Tigerton village

Trempealeau village

Union Center village

Verona

Waldo village

Washburn

Watertown

Waupun

Wauwatosa

West Baraboo village

West Milwaukee village

Weyerhaeuser village

White Lake village

Wild Rose village

Wind Lake

Winter village

Wittenberg village

Wrightstown village

Zoar

Adell village

Alma

Altoona

Aniwa village

Arena village

Ashland

Augusta

Balsam Lake village

Barron

Bear Creek village

Belleville village

Benton village

Birchwood village

Black Earth village

Bloomer

Boaz village

Bowler village

Brice Prairie

Brookfield

Brownsville village

Burlington

Cambria village

Camp Douglas village

Cashton village

Cecil village

Chain O' Lakes-King

Chief Lake

Clear Lake village

Clyman village

Coleman village

Combined Locks village

Cornell

Crivitz village

Cumberland

Darien village

DeForest village

Denmark village

Dodgeville

Doylestown village

Eagle Lake

Eau Claire

Egg Harbor village

Elkhart Lake village

Elm Grove village

Embarrass village

Evansville

Fairwater village

Fenwood village

Fontana-on-Geneva Lake village

Fountain City

Franklin

Fremont village

Galesville

Germantown village

Glendale

Granton village

Greendale village

Gresham village

Hartford

Hawkins village

Helenville

Hillsboro

Horicon

Hudson

Independence

Ironton village

Jefferson

Kaukauna

Kennan village

Kewaunee

Knapp village

La Crosse

Lake Geneva

Lake Nebagamon village

Lake Wisconsin

La Valle village

Linden village

Lodi

Lone Rock village

Luck village

McFarland village

Manitowoc

Marinette

Marshall village

Mauston

Mellen

Menomonee Falls village

Merrillan village

Middle Village

Milwaukee

Mondovi

Montfort village

Mount Calvary village

Mukwonago village

Necedah village

Nelson village

Neshkoro village

New Glarus village

New Post

North Bay village

North Prairie village

Oakfield village

Oconto Falls

Oliver village

Ontario village

Osceola village

Oxford village

Park Falls

Pepin village

Phillips

Plainfield village

Plum City village

Port Edwards village

Potter Lake

Prairie du Chien

Prescott

Radisson village

Redgranite village

Reserve

Rib Mountain

Ridgeway village

River Hills village

Rockland village

Rosholt village

St. Croix Falls

Saukville village

Seymour

Sheboygan Falls

Shiocton village

Silver Lake village

Soldiers Grove village

South Wayne village

Spring Green village

Stetsonville village

Stockholm village

Strum village

Sun Prairie

Sussex village

Theresa village

Tomah

Turtle Lake village

Union Grove village

Vesper village

Wales village

Waterford village

Waukesha

Wausau

Wauzeka village

West Bend

Weston village

Wheeler village

Whitelaw village

Williams Bay village

Wind Point village

Wisconsin Dells

Wonewoc village

Wyeville village

Albany village

Alma Center village

Amery

Antigo

Argyle village

Ashwaubenon village

Avoca village

Bangor village

Bay City village

Beaver Dam

Bellevue Town

Berlin

Birnamwood village

Black River Falls

Bloomington village

Bohners Lake

Boyceville village

Brillion

Brooklyn village

Browntown village

Butler village

Cambridge village

Camp Lake

Cassville village

Cedarburg

Chaseburg village

Chilton

Cleveland village

Cobb village

Colfax village

Como

Cottage Grove village

Cross Plains village

Curtiss village

Darlington

Delafield

De Pere

Dorchester village

Dresser village

Eagle River

Eden village

Eland village

Elkhorn

Elmwood village

Endeavor village

Evergreen

Fall Creek village

Ferryville village

Footville village

Fox Lake

Franksville

French Island

Gays Mills village

Gillett

Glen Flora village

Grantsburg village

Greenfield

Hales Corners village

Hartland village

Hayward

Hewitt village

Hixton village

Hortonville village

Hurley

Ingram village

Ixonia

Johnson Creek village

Kekoskee village

Kenosha

Kiel

Kohler village

Ladysmith

Lake Koshkonong

Lake Ripley

Lake Wissota

Legend Lake

Little Chute village

Loganville village

Lowell village

Luxemburg village

Madison

Maple Bluff village

Marion

Marshfield

Mayville

Melrose village

Menomonie

Merrimac village

Milladore village

Mineral Point

Monona

Monticello village

Mount Hope village

Muscoda village

Neenah

Nelsonville village

New Auburn village

New Holstein

New Richmond

North Fond du Lac village

Norwalk village

Oconomowoc

Odanah

Omro

Oostburg village

Oshkosh

Paddock Lake village

Park Ridge village

Peshtigo

Pigeon Falls village

Platteville

Plymouth

Port Washington

Pound village

Prairie du Sac village

Princeton

Randolph village

Reedsburg

Rewey village

Rice Lake

Rio village

Roberts village

Rock Springs village

Rothschild village

St. Francis

Scandinavia village

Sharon village

Sheldon village

Shorewood village

Siren village

Solon Springs village

Sparta

Spring Valley village

Steuben village

Stoddard village

Sturgeon Bay

Superior

Tainter Lake

Thiensville village

Tomahawk

Twin Lakes village

Unity village

Viola village

Walworth village

Waterford North

Waunakee village

Wausaukee village

Webster village

Westby

West Salem village

Whitefish Bay village

Whitewater

Wilson village

Windsor

Wisconsin Rapids

Woodman village

Wyocena village

Disclaimer: In some states, PDR may not be able to offer our services directly due to state regulations related to debt settlement. In those instances, PDR will refer you to a reputable debt relief provider or attorney firm for assistance with your debt. We are not lawyers and are not giving legal advice. Before filing bankruptcy, talk to a lawyer in your state. The information included on this site is for educational purposes only.

Do Not Sell My Personal Information

Do Not Sell My Personal Information