Last Updated: March 25, 2024

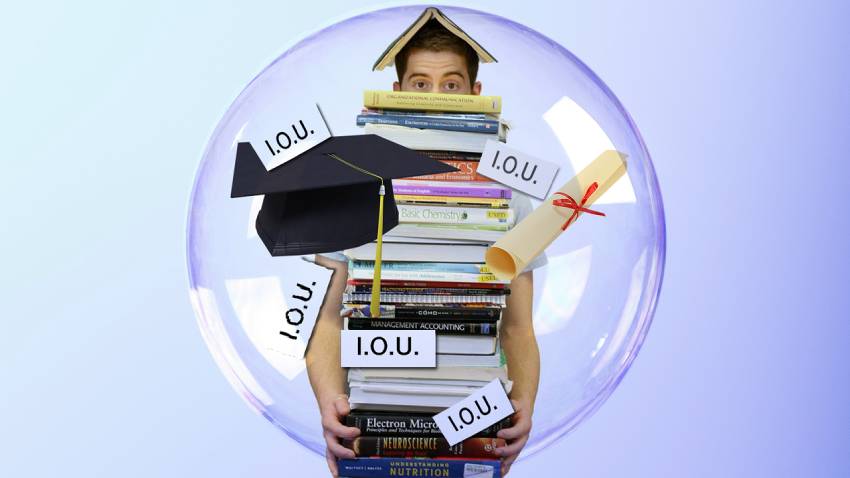

Putting Your House on the Line for a Degree

Disclaimer: We are not qualified legal or tax professionals and are not giving advice. Always speak with a qualified professional before making any legal or financial decisions.

Exploring the potential of your home's equity to manage or eliminate student loan debt? While tapping into home equity through a loan or HELOC offers an appealing route to reducing your educational debt burden, it's crucial to navigate this decision with a full understanding of the benefits and risks.

Lower interest rates and potential fixed-rate conversions offer enticing advantages, but the implications for your financial stability and tax considerations cannot be overlooked.

Let's dive into whether leveraging your home equity to clear student loan debt aligns with your financial goals.

No time for the article? Click here for a free consultation.

Types of Student Loans

Federal student loans are made available through the federal government but managed by a private company. There are four types of federal student loans:

- Direct Subsidized Loans - for eligible undergraduate students who demonstrate financial need

- Direct Unsubsidized Loans - for eligible undergraduate, graduate, and professional students, not based on financial need.

- Direct PLUS Loans - made to parents of dependent undergraduate students, graduate or professional students to help pay for education expenses not covered by other financial aid. Not based on financial need, but must have a credit check.

- Direct Consolidation Loans - combine all eligible federal student loans into a single loan with a single loan servicer

Private Student Loans are available through financial institutions and lenders.The benefit of a private student loan is that, unlike federal student loans, students can borrow 100% of the cost of their education. There are two types:

- School channel loans - money goes directly to your school

- Direct-to-consumer loans - paid to the student

Interest Rates

In general, student loan interest rates are lower than other types of loan interest rates and come with some unique protections. Within student loans, federal loans generally have the lowest interest rates while direct-to-consumer loans have the highest interest rates.

Direct PLUS Loans or parent PLUS loans have higher interest rates than direct federal loans.

Problems with Student Loans

The biggest issue with student loans of any variety seems to be how they are managed by service companies. For insights on managing student loan payments effectively, consider exploring Pacific Debt Inc.'s guide on how to pay off student loans early.

Student loans come with protections, but services appear to make it very difficult for borrowers to enroll in the protections and many people end up defaulting on their loans.

For more information on the consequences of not paying student loans, Pacific Debt Inc. provides a detailed explanation of what happens if you don't pay your student loans.

Benefits of Keeping a Student Loan

Some of the benefits of keeping a student loan include the possibility of having student loan interest deductions on your federal income tax. If you are below the income threshold, you should be claiming this!

Another plus with federal student loans is that you can ask for forbearance or deferment on payments, and indeed, the pandemic-inspired deferral has been extended to September 2021.

If you qualify for the somewhat limited and difficult to enroll Public Service Loan Forgiveness Program, you can have your federal loans forgiven in total or in part.

Direct Plus programs are income-contingent, so monthly bills are capped at 20% of disposable income with balance forgiveness after 25 years.

Using Home Equity to Pay Off Student Loans

There are three different ways to use the equity in your home to pay off student loans. These include a cash-out refinance loan, a home equity loan, and a home equity line of credit. Let’s look at each one separately.

A cash-out refinance means that you take out a new mortgage for more than you currently owe. You pay off the old mortgage and use the remainder to pay off student loans.

- These make sense for people

- Getting a new mortgage interest rate far lower than the student loan interest rate

- Having stable income and job is very important

- Are high income earners who can’t claim student loan interest deduction may be able to use mortgage interest deduction instead

- Downsides

- Puts your home at risk of foreclosure if unable to pay off new mortgage

- Could end up owing more than the home is worth making it difficult to sell

- Lose out on accessing student loan protections

A home equity loan allows you to access the equity (what your house is worth minus the current mortgage balance). You can usually borrow up to 80% of your equity.

- You may

- Be eligible for a lower interest rate that your current student loan

- Have more time to pay off student loans (30 years versus 5 to 15)

- Have fewer monthly bills to keep track of

- Downsides

- Not tax deductible as is student loan debt (based on income)

- Puts your home at risk of foreclosure if unable to pay off

- Could end up owing more than the home is worth making it difficult to sell

- Lose out on accessing student loan protections

A home equity line of credit is a revolving loan based on your equity. It works similarly to a credit card. You use some of the available amount, pay it back, and can reuse the line of credit again. Like a home equity loan, these are usually limited to 80% of your equity.

- You may

- Be eligible for a lower interest rate that your current student loan

- Have more time to pay off student loans (30 years versus 5 to 15)

- Have fewer monthly bills to keep track of

- Downsides

- Not tax deductible as is student loan debt (based on income)

- Puts your home at risk of foreclosure if unable to pay off

- Could end up owing more than the home is worth making it difficult to sell

- Lose out on accessing student loan protections

Now that you have seen both sides for keeping a student loan and for taking out a new loan, should you?

Possibly. Here are a few questions to ask yourself.

- Will you pay less in interest over the life of the new loan versus the life of the old loans (mortgage and student loan combined)?

- Have you taken advantage of all the student loan protections available?

- Can you refinance the loan through the federal government or a private loan option without putting your home at risk of foreclosure? Will you save money if you do so?

- Do you have other debt that is causing problems for you?

If you answered yes to the last question, it may be worth your time to pay off that outstanding non-student loan debt first. You’ll have the protections that having a student loan offers without risking your home.

If you have more than $10,000 in credit card and other unsecured debt, Pacific Debt, Inc may be able to help.

Other Options to Pay for College

Before taking out a home equity loan, be sure to fully explore other avenues to fund college costs. These alternatives may help limit or eliminate the need for borrowing against your home.

Scholarships and grants should be your first step. Have your child study for and excel on the SAT/ACTs, write stellar admissions essays, and meet application deadlines for merit-based and need-based aid.

Also, complete the FAFSA form to qualify for federal grants and loans. Federal loans typically have lower interest rates and more flexible repayment options than private bank loans. Income-based plans cap monthly payments based on disposable income.

If federal loans won't cover everything, compare private student loans from banks, credit unions, and online lenders. Read all terms carefully and shop around for the best rates. Consider having a co-signer with strong credit to potentially qualify for lower rates.

Don't forget payment plans offered directly through the college's financial aid office. These can spread tuition costs over the semester or year. Interest rates are usually reasonable.

Finally, look seriously at lower-cost college alternatives. In-state public schools charge much less tuition for residents. Completing general education credits at a community college and then transferring to a university can also drastically cut costs. Some online programs are affordable as well.

Risks of Home Equity Loans

While home equity loans boast lower interest rates than other financing options, they carry considerable risks:

- If you fall behind on payments, your lender can foreclose on your home. This means you could lose your house.

- Struggling with a home equity loan hurts your credit score, making other borrowing more expensive.

- If housing prices drop, you may end up "underwater" and owe more than your home’s market value. This makes selling difficult.

Carefully consider these severe downsides before moving forward with tapping home equity to pay college costs.

Advice for Parents and Adult Students

For parents of high school students:

- Open and regularly contribute to a dedicated 529 college savings account

- Research in-state public school options that charge much lower in-state tuition

- Consider community college for general courses then transferring credits to a university

For parents of current college students:

- Speak to the financial aid office about payment plans to spread costs over the year

- Compare Federal Parent PLUS loans to private bank loans and determine best option

- Discuss private student loan possibilities with your child, carefully weighing all terms

For adult students returning to college:

- Make sure to submit the FAFSA form to get Federal grant and loan aid

- Enroll in an income-driven repayment plan if you qualify for Federal loans

- Compare the total costs of online programs, community colleges, and state public schools

FAQs

Conclusion

Paying for college is a major financial undertaking, so exploring creative financing options makes sense. However, turning to a home equity loan to fund education costs requires careful thought and analysis. While interest rates may beat alternatives, the risks of falling behind, damaging your credit, and even losing your foreclosure home are severe.

Before pursuing home equity financing, be sure to exhaust more affordable college options as well as all possible federal loan aid, grants, scholarships, and payment plans. Work through other reasonable alternatives like private bank loans or spreading payments out over time. View tapping your home equity as an absolute last resort after other avenues have been depleted. And make sure you can realistically manage the required monthly payments over the loan's full term.

With skyrocketing education expenses, using home equity may seem necessary for some families. But dot every “i” and cross every “t” before committing to such an impactful financial obligation. Your home and long-term stability hang in the balance. Carefully explore all college funding options before settling on borrowing against your most valuable asset.

Pacific Debt, Inc

Pacific Debt, Inc. is an award-winning debt settlement company. If you’d like more information on how to get out of debt, we are happy to help. We will explain all your options and help you decide which is the best option for you. We can even refer you to trusted partners who can better meet your needs.

If you have more questions, contact one of our debt specialists today. The initial consultation is free, and our debt experts will explain your options to you.

*Disclaimer: Pacific Debt Relief explicitly states that it is not a credit repair organization, and its program does not aim to improve individuals' credit scores. The information provided here is intended solely for educational purposes, aiding consumers in making informed decisions regarding credit and debt matters. The content does not constitute legal or financial advice. Pacific Debt Relief strongly advises individuals to seek the counsel of qualified professionals before undertaking any legal or financial actions.

Reduce Your Credit Card Debt By Up to Half

BBB Reviews | 4.9/5.0 Rating

Do Not Sell My Personal Information

Do Not Sell My Personal Information