Last Updated: March 26, 2024

How Much Does it Cost?

Disclaimer: We are not qualified legal or tax professionals and are not giving advice. Always speak with a qualified professional before making any legal or financial decisions.

Paying just the minimum amount on your credit card might seem like an easy way to keep your finances in check. However, this strategy does more to maintain your debt than reduce it.

By making only the minimum payment, you're essentially on a treadmill of debt, where your balance hardly decreases, and the interest continues to build.

This article dives into the true cost of sticking to minimum payments and provides practical advice for breaking free from this cycle. Understand the real implications of minimum payments and learn strategies to manage and overcome credit card debt more effectively.

Don't delay your debt resolution. Speak with our debt specialist immediately for a free consultation.

What is the Minimum Payment?

The minimum payment is usually a percentage of your credit card balance plus any penalties you’ve earned. Each card calculates the minimum payment amount differently, but the percentage is roughly anywhere from 1 to 3%.

Most of the minimum payment goes to penalties and interest with whatever is leftover applied to the balance. If you miss a payment, that penalty is added to the minimum payment and must be paid off before any money can go to the balances. As you can see, paying just the minimum payment means that it will take forever to pay off your credit card and you will be hit with huge interest charges.

Sure the minimum payment will keep your account in good standing, but you won’t make any headway in becoming debt-free.

How Much of a Difference Does Paying More Make?

What is the true cost of paying the minimum payment? Let’s look at a couple of different minimum payment scenarios below.

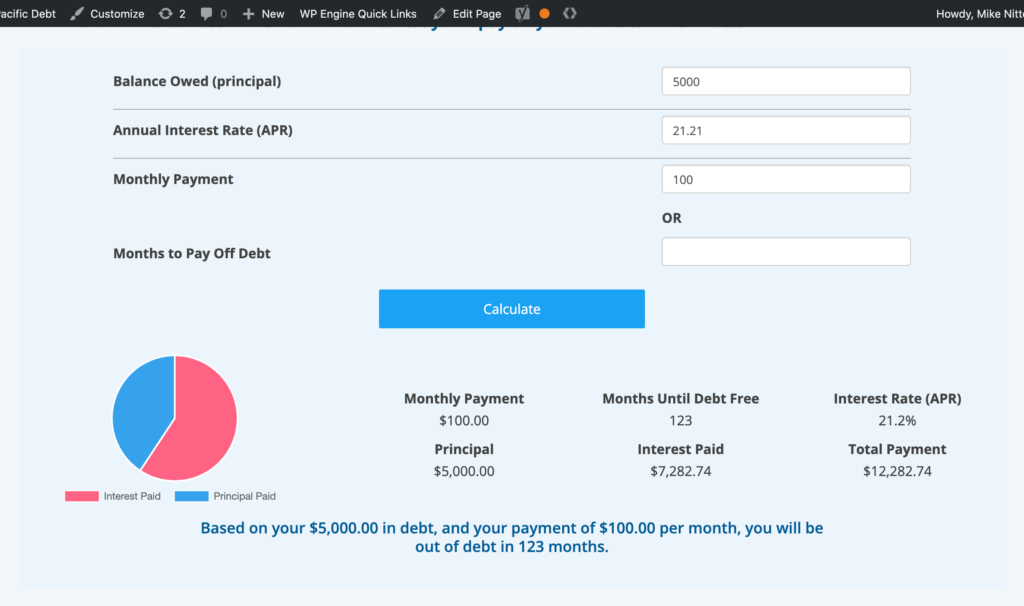

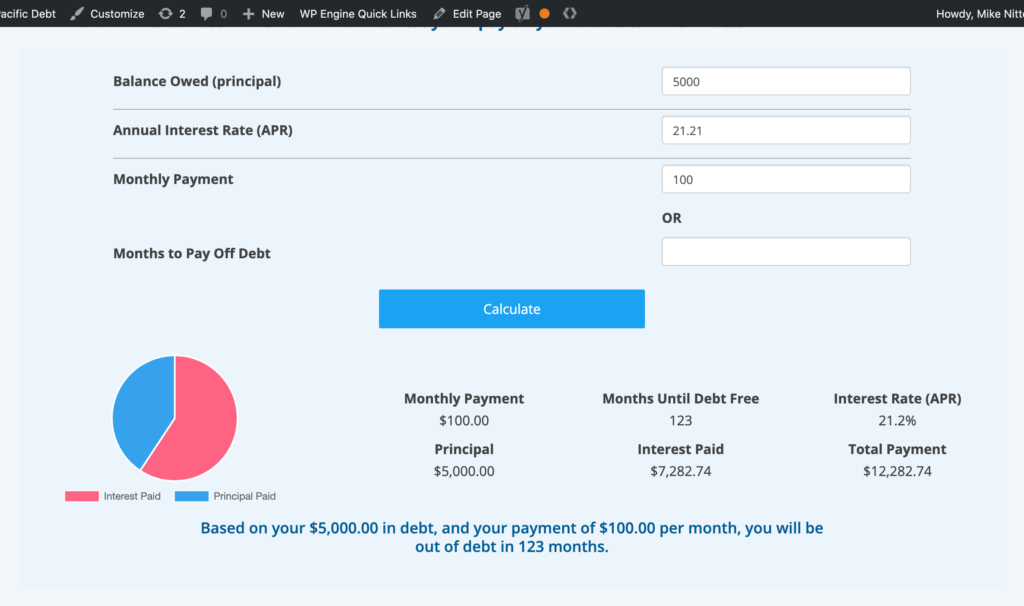

Minimum Payment Scenario #1

Credit card balance: $5,000

APR: 21.21%

Minimum payment: $100

Time to pay off: 10 years

Finance charges: $7,282.74

Total paid: $12,282.74

That is a lot of money that you could use for something far more important than finance charges.

Now, let’s look at a slightly more than minimum payment of $125.

Minimum Payment Scenario #2)

Credit card balance: $5,000

APR: 21.21%

Minimum payment: $125

Time to pay off: 6 years

Finance charges: $3,758.13

Total paid: $8,758.13

That $25 a month makes a huge difference!

Of course, both these examples assume you are not using your credit card and don’t make a late payment.

If you’d like to see what happens with your balance and payments, check out this credit card payment calculator from Pacific Debt, Inc.

Minimum Payments vs. Fixed Payments

Paying more than the minimum payment can drastically reduce the time it takes to pay off credit card balances. For example, let's compare a $100 minimum payment to a $200 fixed monthly payment on a credit card with a $5,000 balance and 21% APR:

Minimum Payment

- Payment: $100

- Interest paid: $7,282

- Months to payoff: 10 years

Fixed Payment

- Payment: $200

- Interest paid: $2,271

- Months to payoff: 3 years

By paying just $100 more per month, you can save $5,011 in interest and pay off the balance 7 years faster!

Use our minimum payment calculator to compare your own minimum payments to fixed monthly payments. See how much time and money you can save by paying above the minimum.

How Can I Pay Off My Credit Card Faster?

One of the fastest ways to pay off a card is to make a minimum payment and then several more small payments during the month. The first pays off your finance charges and the subsequent payments pay down the balance. If you are stretching your paycheck six ways to Sunday, it may be easier to make smaller payments from each paycheck than one lump sum.

The Avalanche

If you have several credit cards with balances, there are several options to the avalanche payoff. The first is to list all your cards and the balances and APRs. Either choose the smallest balance or the highest APR and focus on paying that one off while making minimum payments on the others. Once you have card one paid off, put all that payment plus the minimum payment on card two while making a minimum payment on the next card.

The benefit of paying off the highest APR is that you eliminate finance charges faster. The benefit of paying off the lowest balance card first is the feeling of accomplishment.

The Balance Transfer

Another way is to look for a balance transfer card with a 0% APR. Transfer as much of your credit card debt onto that card and pay off as much as you can each month. Just read the fine print because the APR on balance transfers can be quite high after the introductory period ends.

If eligible for a new credit card, balance transfer offers allow you to move existing credit card balances to a new card, typically with a 0% introductory APR for 12-18 months. This can help save on interest costs in the short term. However, these cards eventually revert to higher variable APRs after the intro period. They also come with balance transfer fees, usually 3-5% of the amount transferred.

Do the math to calculate possible interest savings against fees paid. And beware of racking up additional balances on old cards or overspending on the new card. Discipline is required to truly benefit. Cards like Chase Slate and Citi Diamond Preferred offer lengthy intro 0% APR periods with no balance transfer fees.

The Personal Loan

Another option is to find a personal loan and pay off your credit cards. You can then pay off the personal loan. To get the best interest, you need to have a good credit score, so this may not be in your favor. Check at credit unions for better rates on a loan.

Other Options

If there is no money to make more than minimum payments, you may need to look at your finances more closely. One of the first options is to find another job. The problem is that many people either can not find jobs thanks to the pandemic or are already working two or more jobs. So instead of recommending that, let’s see what else you may be able to do.

Budget

No matter what your financial situation is, you need to make a budget and stick to it. We have written several previous articles about budgeting apps and types of budgets that might fit your needs and personality.

The biggest secret to budget is to know where you spend your money, what you can cut out, and sticking to it. You may also need a financial reset such as the one we detail 30 Days without Spending Money.

In addition to manual budgeting, apps like Mint, YNAB, Personal Capital can help you easily track spending categories and net worth over time. These tools make it simple to stick to a budget by connecting to bank accounts and credit cards to automatically import and categorize transactions. Many are free to use or have paid upgrades with additional features. Setting budgeting alerts and monitoring your spending habits over time can keep your finances on track.

Credit Counseling

If budgeting leaves you cold, you may want to speak with a credit counselor. Choose a reputable non-profit company. Credit counselors will help you to set up a budget and stick with it. You’ll get extra training and information about finances that can help you become debt-free.

Debt Settlement

If you have more than $10,000 in credit card debt and can’t make even the minimum payment, you may be a candidate for debt settlement. Debt settlement is negotiating with your creditors to lower the amount that you owe while you build up a savings account to pay the decreased debt.

Debt Consolidation Loans

Debt consolidation loans allow you to roll multiple credit card balances into one personal loan. This can make managing payments easier with a single monthly bill. However, consolidation loans have pros and cons to consider.

Pros

- Lower interest rate

- Single payment

- Fixed payoff timeline

Cons

- Loan origination fees

- Credit score requirements

- Risk of racking up more credit card debt before paying off the loan

Before taking out a debt consolidation loan, be sure to compare interest rates and fees to other debt relief options like credit counseling and debt settlement. Consolidation can save money but also comes with eligibility requirements and the risk of returning to past spending habits.

FAQs

Conclusion

Paying only the minimum payment on credit card balances results in thousands of dollars lost to interest fees over time. To pay off debt faster, pay at least 2-3 times the minimum payment if possible. Explore fixed monthly payment options rather than minimum payments to eliminate debt years sooner.

Creating a budget, tracking spending, and monitoring financial progress can help build better money management habits long-term. With discipline and a clear debt repayment plan tailored to your individual circumstances, becoming debt-free is an achievable goal. Paying off credit card debt takes strategy and perseverance, but the financial freedom you gain is well worth the effort.

The key is picking a debt relief strategy that fits your budget and committing to paying off balances as fast as realistically feasible. Every extra dollar paid upfront saves significant money on interest fees down the road. Be informed, get expert assistance if needed, and focus on the end goal of eliminating debt.

Pacific Debt, Inc

We are a reputable and award-winning debt settlement company. If you’d like more information, we are happy to help. We will explain all your options and help you decide which is the best option for you. We can even refer you to trusted partners who can better assist you.

If you have more questions, contact one of our debt specialists today. We offer a free consultation and our debt experts will explain your options to you.

*Disclaimer: Pacific Debt Relief explicitly states that it is not a credit repair organization, and its program does not aim to improve individuals' credit scores. The information provided here is intended solely for educational purposes, aiding consumers in making informed decisions regarding credit and debt matters. The content does not constitute legal or financial advice. Pacific Debt Relief strongly advises individuals to seek the counsel of qualified professionals before undertaking any legal or financial actions.

✔ Accredited by Better Business Bureau with BBB A+ rating (4.93 rating and 1678 reviews)

✔ US News and World Reports and Bankrate ranked Pacific Debt Relief as one of “The Best Debt Relief Companies of 2024”

✔ 6.9 star rating by BestCompany.com (over 2379 client reviews)

✔ 4.8 star rating by TrustPilot based (over 1613 verified consumer reviews)

✔ ConsumerAffairs.com Accredited (over 544 verified reviews with an average rating of 5 stars)

✔ A Top 10 Rated Compan by TopTenReviews.com , ConsumersAdvocate.com and Top10debtconsolidation.com

✔ 4.6 star rating by Google (229 client reviews)

✔ 100% rating by SuperMoney (9 client reviews)

Reduce Your Credit Card Debt By Up to Half

BBB Reviews | 4.9/5.0 Rating

Do Not Sell My Personal Information

Do Not Sell My Personal Information