Last Updated: March 8, 2024

Protect your loved ones from being burdened with your debts

Disclaimer: We are not qualified legal or tax professionals and are not giving advice. Always speak with a qualified professional before making any legal or financial decisions.

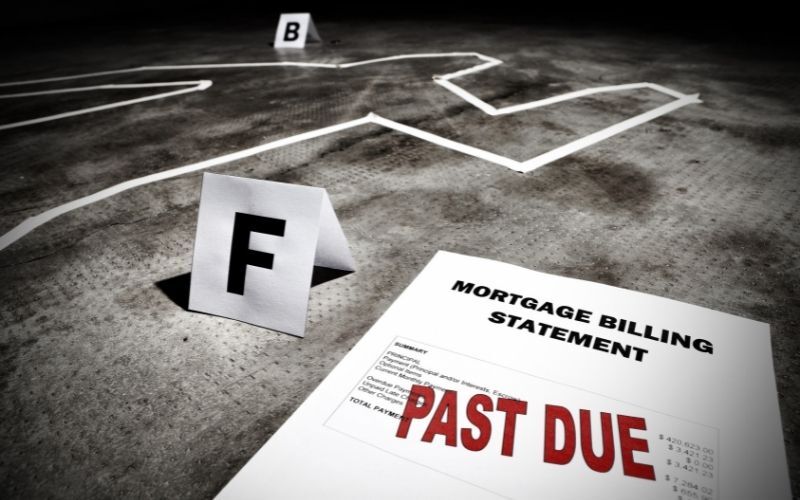

Imagine leaving a legacy free of financial burdens for your loved ones. In the journey of life, the question of what happens to our debts after we pass away looms large, stirring concerns about the financial wellbeing of those we care about most.

While it's a topic many shy away from, understanding the fate of our financial obligations after death is crucial for effective estate planning and peace of mind.

Within this detailed exploration, we'll talk about the types of debts that are forgiven at death, debunk common myths, and provide you with the knowledge to plan confidently for the future. From credit card debts to mortgages, learn how the curtain closes on your financial obligations and how to ensure your legacy is as you intended.

If you'd rather speak to a debt specialist now, click here for a free consultation.

What happens to outstanding debts when we die?

We all know that death is a subject most people don't like to think about, let alone talk about. But when it comes to money, it's important to be prepared for anything, including the possibility that your debts may not die with you. So what debts are actually forgiven at death?

Debts are forgiven at death if they are unable to be paid by the deceased person's estate. This includes unpaid bills, credit card balances, mortgage debt, and other loans.This includes unpaid bills, credit card balances, mortgage debt, and other loans. If the deceased had cosigned a loan with another person, that debt may also be forgiven. Any money owed to the government, such as taxes or student loans, is not forgiven at death.

However, it's important to note that not all debts are automatically forgiven at death, it depends on the specific situation and on the terms of the loan or agreement. So it's always important to consult with an attorney or financial planner to get specific advice about what will happen to your debt in the event of your death, especially understanding the debt collection and legal process.

How to plan for debt forgiveness

Debt forgiveness is the act of reducing or eliminating someone's debt. There are several ways to accomplish this, including debt consolidation, debt settlement, and bankruptcy.

If you're considering debt forgiveness, it's important to plan ahead. Here are some tips to help you get started. Debt forgiveness can be a great way to get out of debt, but it's not always easy to qualify for. There are a few things you can do to improve your chances of being approved.

First, strive for a good credit score. You may also want to consider enrolling in a debt management program or consolidating your debts. By taking these steps, you'll show the lender that you're serious about getting out of debt and are willing to take action.

What to do if you're expecting debt forgiveness

Are you expecting debt forgiveness? If so, there are a few things you need to do in order to prepare. Here are some tips to help you get ready for this major change in your financial life. Make sure you understand how debt forgiveness will affect your taxes. You may need to update your tax returns for the years affected by the forgiven debt.

You should also be aware of any other consequences of debt forgiveness, such as changes to your credit score or eligibility for future loans. By understanding what to expect and taking steps to prepare, you can make the most of this new opportunity.

The benefits of debt forgiveness

Did you know that there are benefits to debt forgiveness? Many people think of debt as a burden, but when it is forgiven, that burden can be lifted. Debt forgiveness can come in many forms, including through bankruptcy or loan modification.

When you get rid of your debt, you may be able to improve your credit score and your overall financial health. So if you are struggling with debt, consider seeking out help so that you can benefit from the many advantages of debt forgiveness.

There are many benefits of debt forgiveness, including reducing stress and anxiety levels, improving your credit score, and giving you a fresh start financially. While each situation is unique, debt forgiveness can be a great way to get back on track financially.

If you're considering debt forgiveness, be sure to speak with a financial advisor to see if it's the right option for you.

How to make the most of debt forgiveness

If you're considering debt forgiveness, it's important to understand how it will impact your credit score. Debt forgiveness can negatively impact your credit score in two ways.

- The forgiven debt might be reported as income on your tax return. This will cause your debt-to-income ratio to increase, which is a key metric used by lenders when assessing your creditworthiness.

- The canceled debt will be considered a negative mark on your credit history and can lower your credit score for the short term.

However, if you can successfully manage your finances after receiving debt forgiveness, the negative impact on your credit score should eventually disappear. So if you're confident that you can stay disciplined with your spending and make all of your payments on time going forward, debt forgiveness may be a great option for you.

Estate Planning Strategies for Debt Repayment

Proper estate planning is crucial if you want to protect your assets and provide for debt repayment when you pass away.

Here are some strategies to consider:

- Take out a life insurance policy and designate your estate as the beneficiary. This can provide funds to pay off debts. Make sure the death benefit is enough to cover outstanding debts.

- Set up a trust and transfer assets to it. Assets in a properly structured trust are shielded from creditors. Work with an estate planning attorney to set up a trust designed to provide for debt repayment.

- Consider gifting assets before you pass away. Any gift over $15,000 per year requires filing a gift tax return. But gifts aren't subject to estate tax, so this can reduce the size of your estate.

Work with a financial advisor or estate planning attorney to implement strategies to address your debts and preserve more of your assets for heirs.

Handling Debts You've Co-Signed

If you've co-signed a loan for a family member or friend, you remain obligated to repay the debt if that primary borrower dies.

Here's how to handle it:

- Contact the lender upon the primary borrower's death and request information on the outstanding balance and loan terms. Make sure you aren't removed from the loan.

- Consider using life insurance proceeds from the deceased primary borrower to pay off the loan. Make sure you're listed as the beneficiary on their policy.

- See if you can refinance the loan solely in your name. This removes the deceased borrower and gives you more manageable terms.

- If repaying the loan is beyond your means, discuss options with the lender like loan modification or hardship plans.

- In certain cases, the lender may release you from the obligation of a co-signed loan if you can prove significant financial hardship resulting from the co-signer's death.

Managing the Deceased's Accounts and Memberships

Another task that must be handled after someone passes away is closing or transferring their various financial accounts and memberships.

Here are some tips:

- Review all the deceased's monthly bills and subscriptions. Cancel any unnecessary accounts.

- For essential utilities, transfer service into the name of a spouse or other family member. Contact each provider to learn their requirements.

- Close bank and investment accounts. Withdraw any remaining funds and distribute them according to the will.

- End club and organization memberships as well as online accounts. Redirect incoming mail.

- Be sure to notify major credit bureaus to close any lines of credit. This prevents identity theft.

- Consult professionals as needed. For example, an accountant can file any outstanding tax returns.

Handling the logistics of financial accounts and memberships takes time and diligence. Make a list of all accounts and contacts to help stay organized.

Risks of Debt Consolidation

While debt consolidation can provide some benefits, there are also potential risks to be aware of:

- Closing multiple accounts lowers your overall available credit. This can cause your credit utilization ratio to increase, lowering your credit score.

- Debt consolidation loans create a new monthly payment you are responsible for. Failure to pay can seriously impact your creditworthiness.

- If you use a home equity loan or line of credit to consolidate debt, your home is now on the line if you default. You risk foreclosure.

- Transferring credit card balances can mean losing out on rewards points and other cardholder benefits.

- Consolidation often tempts borrowers to rack up more credit card debt, putting them right back where they started.

Carefully weigh the pros and cons of debt consolidation. Your credit scores, debt amounts, and financial discipline should guide your decision.

Seeking Professional Help

Trying to resolve debt after someone's death can be complex.

Consider enlisting help from experts:

- Contact an attorney - They can advise on the legal obligations for debts and the probate process.

- Talk to a tax professional - They can offer guidance on any tax liabilities from canceled debts.

- Consult a financial advisor - They can review assets, accounts, and debt repayment strategies.

- Work with an accountant - They can properly handle things like filing final tax returns on the deceased's behalf.

- Hire an estate sale service - They can value assets and facilitate liquidating belongings to raise funds.

Don't take on the burden alone. The right professionals can help navigate each aspect of post-death debt resolution.

Charitable Donations

Some may want to make a charitable donation or gift in memory of a deceased loved one.

Here are a few tips:

- Identify causes and organizations that were meaningful to the deceased. These could be nonprofits they supported.

- Consider making donations in lieu of sending flowers for the funeral or memorial service.

- Donations can be made directly from the estate bank account once you gain access.

- Talk to an estate planning attorney about setting up a charitable trust that makes ongoing gifts.

- Name a nonprofit organization as a beneficiary to receive a percentage of assets from the estate.

Donating to a worthy cause is a thoughtful way to honor someone's legacy. Be sure to track gifts for tax purposes.

FAQs

Conclusion

In the United States, there are a number of debts that are forgiven or discharged upon the death of the debtor. These include most unsecured debts, such as credit card bills and medical expenses. Some secured debts may also be forgiven, such as a mortgage or car loan.

However, certain types of debt cannot be discharged in bankruptcy proceedings and will still need to be repaid by the estate of the deceased. This includes student loans and child support payments.

As you can see, there are a variety of debts that may be forgiven or discharged upon the death of the debtor. This can provide some relief for families who are dealing with the loss of a loved one.

If you are struggling with overwhelming debt and want to explore your debt relief options, Pacific Debt Relief offers a free consultation to assess your financial situation. Our debt specialists can provide objective guidance relevant information and support to help find the right debt relief solution.

*Disclaimer: Pacific Debt Relief explicitly states that it is not a credit repair organization, and its program does not aim to improve individuals' credit scores. The information provided here is intended solely for educational purposes, aiding consumers in making informed decisions regarding credit and debt matters. The content does not constitute legal or financial advice. Pacific Debt Relief strongly advises individuals to seek the counsel of qualified professionals before undertaking any legal or financial actions.

Reduce Your Credit Card Debt By Up to Half

BBB Reviews | 4.9/5.0 Rating

Do Not Sell My Personal Information

Do Not Sell My Personal Information