Last Updated: March 26, 2025

Disclaimer: We are not qualified legal or tax professionals and are not giving advice. Always speak with a qualified professional before making any legal or financial decisions.

Equifax, TransUnion, and Experian dominate credit reporting, yet their scores often differ, creating confusion. These discrepancies stem from variations in data collection and interpretation methods. Understanding your Equifax credit score and how it compares to others is crucial for effective financial management.

The differences in credit scores can significantly impact your financial outlook. Factors like incorrect information or naming errors on your Equifax credit report can lead to unexpected variations. Knowing why these disparities occur and how to improve your Equifax credit score is essential for maintaining your credit health and making informed financial decisions.

If you'd rather skip the article and speak to a debt specialist right away, we offer a FREE consultation.

Who Are the Credit Reporting Agencies? Understanding Where Your Credit Scores Come From

Understanding your Equifax credit score is crucial for your financial health. Many worry about poor scores, often questioning the worst or lowest possible credit scores. To maintain accuracy, it's essential to verify your credit information across all agencies: TransUnion, Equifax, Experian.

Creditors report your payment history to one or more credit bureaus. After six months of credit history, FICO or VantageScore models generate your Equifax credit score based on five factors: payment history (35%), credit utilization (30%), credit age (15%), credit mix, and application history.

Payment history significantly impacts your Equifax credit score, with late payments negatively affecting it. Credit utilization, the ratio of used credit to available credit, is the second most important factor. The age of your credit accounts also plays a role, with longer credit histories generally improving your score. Learn more about how to build credit when you have none.

Your Equifax credit score is influenced by your credit mix and application history, each accounting for 10% of the score. A diverse credit portfolio, including various types of loans, can positively impact your score. However, be cautious with credit applications, as "hard pulls" can temporarily lower your Equifax credit score, while "soft pulls" have no effect.

Who Are the Three Major Credit Bureaus?

There are three different major credit bureaus: TransUnion, Equifax, Experian. Each credit bureau collects financial data from creditors. The data is then scored by FICO or VantageScore.

While Equifax credit scores are widely used, specialized agencies like CoreLogic Credco offer additional financial data services. Your Equifax credit score can be accessed by authorized parties such as employers or lenders. Score differences between bureaus are common due to varying data collection and scoring models. If significant discrepancies arise, investigate the cause. For added security against fraud, consider options like a CoreLogic credit freeze, which restricts access to your credit report.

Equifax Vs Experian Vs TransUnion

You are entitled to free credit reports, including the comprehensive Equifax 3 in 1 credit report, once a year. You can view these free credit reports for free through AnnualCreditReport.com. Additionally, some platforms offer free credit scores for users to monitor their credit health.

Equifax Credit Reports

Equifax Credit Reports charges for reports ordered through the website. If you need to contact them for any clarifications, you might consider using the Equifax fax number. It's also essential to understand what Equifax means in terms of credit reporting, particularly the Equifax credit score, which ranges from 300 to 850, and to regularly check your Equifax credit info to ensure accuracy. You may need to communicate your zip code for verification purposes.

Experian Credit Reports

- charges for reports ordered through website

- dispute button on website

- will notify the other credit bureau if you notify them of a fraud

- credit freeze fraud alerts available, but must notify all three yourself

- Experian credit scores – 300 – 850

TransUnion Credit Reports

- charges for reports ordered through website

- dispute button on website

- paid credit monitoring subscription through TransUnion credit monitoring service

- will notify the other credit bureau if you notify them of a fraud

- credit freeze fraud alerts available, but must notify all three yourself

- TransUnion credit score – 300 – 850

To further simplify the understanding of credit scores, resources like the TransUnion credit score chart are invaluable. They categorize scores into different ranges, helping consumers easily interpret where they stand and, determine if Discover Credit Scorecard is accurate.

Credit Report Common Questions

Types of Credit Scores: FICO vs VantageScore

Credit reports often use one of two credit scores –FICO scoring model or VantageScore scoring model. FICO is the most common. The credit bureaus create a FICO score based on what is reported to them. This accounts for any difference in FICO scores among different credit bureaus.

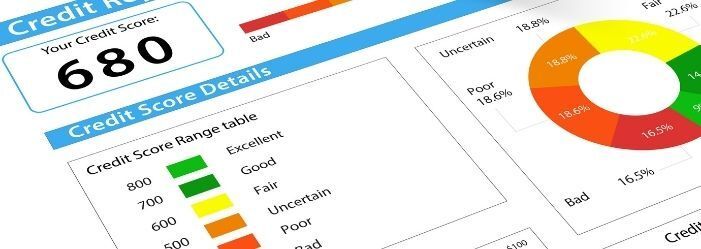

Your credit score is reported as a three-digit number with the higher the number, the less credit usage rate and better the score. VantageScore is an algorithm developed that uses the consumer credit information on file. It is particularly good for people with thin credit history or very young history. VantageScore and FICO use the same score divisions to determine their credit scores:

- Excellent = 750 and above

- Good = 700-749

- Fair = 650-699

- Poor = 550-649

- Bad = Below 550

Good credit scores are those over 670 for FICO, with a 722 FICO score being considered a strong indicator of financial responsibility. A VantageScore score over 661 can be considered good. The score differences come from the different reported data and their different credit scoring models. However, people often question their scores, wondering things like "Is a 744 credit score good or bad?" or "Is a 777 credit score good or bad?"

The major difference between FICO and non-FICO scores is that each reporting company uses a slightly different model based on each company's preferences. FICO requires a credit history that is at least six months old and with activity within the last six months. Your three credit scores should be roughly the same, with Equifax credit scores being lower than others in many cases.

Why is My Equifax Score Lower Than TransUnion?

Many people wonder why their Equifax credit score is often lower than their TransUnion score. This difference arises because TransUnion factors in personal and employment data, while Equifax focuses solely on credit information. Despite these variations, both Equifax and TransUnion scores provide valid indicators of your financial responsibility.

TransUnion's scoring model typically weighs employment history and residential stability more heavily than Equifax does. For example, if you've maintained the same job and address for several years, TransUnion might award extra points for stability that Equifax doesn't include in its calculations. Additionally, TransUnion may be more lenient with certain negative items like late payments, giving them slightly less impact on your overall score.

Another significant factor is that lenders don't always report to all three bureaus simultaneously. Some creditors may report to TransUnion faster than Equifax, meaning recent positive payment activity might appear on your TransUnion report first, temporarily creating a score gap between the two bureaus.

The scoring models themselves also differ. While both use FICO or VantageScore algorithms, they customize these models, resulting in different interpretations of the same credit activities. For example, Equifax's model might assign more negative weight to high credit utilization than TransUnion's model does.

TransUnion's scoring model typically weighs employment history and residential stability more heavily than Equifax does. For example, if you've maintained the same job and address for several years, TransUnion might award extra points for stability that Equifax doesn't include in its calculations. Additionally, TransUnion may be more lenient with certain negative items like late payments, giving them slightly less impact on your overall score.

Another significant factor is that lenders don't always report to all three bureaus simultaneously. Some creditors may report to TransUnion faster than Equifax, meaning recent positive payment activity might appear on your TransUnion report first, temporarily creating a score gap between the two bureaus.

The scoring models themselves also differ. While both use FICO or VantageScore algorithms, they customize these models, resulting in different interpretations of the same credit activities. For example, Equifax's model might assign more negative weight to high credit utilization than TransUnion's model does.

Why Are My TransUnion and Equifax Scores So Different?

It's normal to see variations of 20-40 points between your TransUnion and Equifax credit scores. These differences aren't errors—they reflect the unique approaches each bureau takes to evaluate your creditworthiness.

The primary reasons for these differences include:

- Different Information in Your Reports: Not all lenders report to all bureaus. Your auto loan might report to Equifax but not TransUnion, while your credit card company might report to TransUnion but not Equifax. This creates information gaps that result in score variations.

- Different Timing of Updates: Each bureau updates their records at different times. If TransUnion updated your report yesterday but Equifax won't update until next week, recent payments or credit activities might be reflected in one score but not the other.

- Different Scoring Models: While both bureaus use similar scoring frameworks (FICO or VantageScore), each customizes these models. TransUnion might weight your payment history at 38% of your score while Equifax weights it at 35%.

- Regional Variations: Depending on where you live, one bureau might have more comprehensive data. TransUnion historically has stronger reporting in western states, while Equifax has traditionally had better coverage in the eastern U.S.

- Industry-Specific Scores: When you apply for specific types of credit (auto loans, mortgages), lenders often use industry-specific score versions. TransUnion and Equifax might emphasize different factors in these specialized scores.

If you notice extreme differences (more than 100 points), this could signal a reporting error or potential identity theft issue that needs immediate investigation.

How Do I Know If My Credit Report Is Correct?

Mistakes happen during your credit history, so always check your credit regularly from all three credit reporting agencies: TransUnion, Equifax, Experian. There are several ways to access your credit report from these bureaus. You are legally entitled by federal law to one free copy of your report per agency per year.

For instance, request one agency report in January, one of the second in May, and one from the final in September. This is a fairly simple way to keep an eye on your financial information and your credit history. Many people have discovered identity theft can ruin your credit score from a sudden drop in your credit report. Access free credit reports and annual credit reports through AnnualCreditReport.com.

Another way to monitor your credit report regularly is to sign up to free credit score websites, or websites like CreditSesame or Credit Karma. Credit Karma will actually try to help you build your credit score by suggesting credit card offers that you could be eligible to sign up for.

Credit Karma also updates you with breaches to credit breaches that include any of your information. Since Credit Karma is free, it is a good way to keep an eye on your credit profile and your overall credit history and health.

Additionally, review any specific credit accounts you've opened, such as a Best Buy credit card, to ensure they are correctly reported and there are no unauthorized transactions.

Once you have your credit reports, check them carefully. Look for:

- Correct name

- Correct address

- Correct Employer

- Lines of credit that you have or have not authorized

- Credit cards that you have or have not authorized

- Personal Loans that you have or have not authorized

- Aged out debt issues like bankruptcy (generally 10 years), collections (generally 7 years)

- Aged out judgments based on your state’s statute of limitations

If you find an error, send COPIES of documentation to the credit bureau along with explanations or the errors. You may have to do it several times and stay on top of them. If you are denied credit based on your credit score, you can request the reason and a new report.

If you have had identity theft, you can contact each of the major credit bureaus individually and place a fraud freeze on your credit until you get the issue solved.

How Can I Improve My Credit Score?

To improve your Equifax credit score, focus on key factors: timely payments (35% of your score), low credit utilization (30%), credit age (15%), credit variety (10%), and minimal new credit inquiries (10%). Pay bills on time and consider debt consolidation for low scores. Your Equifax credit score can be significantly boosted by managing these elements effectively. Keep credit utilization low by paying down balances or requesting higher limits. Maintain older accounts and diversify credit types. Be cautious with new credit applications and balance transfer fees, as these can temporarily impact your score. If you're considering applying for credit, first check current personal loan rates or compare credit card offers to find the best options for your situation. Many lenders will ask you to input your home zip or communicate your zip code during the application process to determine regional offers.

If you're interested in an insurance quote request, remember that some insurers check your credit score during the application process, making a good score even more important.

By addressing these aspects, you can enhance your overall creditworthiness.

Differences Between TransUnion and Equifax

TransUnion and Equifax, both major credit reporting agencies, have distinct characteristics despite collecting similar information. The importance of your Equifax credit score versus TransUnion's often raises questions. Key differences lie in their proprietary scoring models, lender partnerships, and additional services, making each agency unique in its approach to credit reporting.

- Scoring Models: Both agencies use slightly different scoring models to calculate credit scores. This means that the same credit activity can have different impacts on the scores calculated by each agency. They each also consider certain factors more heavily than others when calculating scores.

- Partner Lenders: Not all lenders report to all three major credit bureaus. Some lenders might choose to report to only one or two bureaus, which can lead to discrepancies in the information each bureau has and, consequently, differences in the credit scores they calculate.

- Additional Services: Both TransUnion and Equifax offer additional services beyond just credit reporting, such as credit monitoring. These can include credit monitoring, identity theft protection, and tailored credit information products. The exact services and their cost can vary between the two bureaus.

Remember, while your scores may differ between these two bureaus due to these differences, it's crucial to maintain good credit habits. Regularly reviewing your credit reports from all three major credit bureaus - TransUnion, Equifax, Experian - will help you understand your financial health better.

The Importance of Good Credit

Your credit report data is crucial for various aspects of life, from buying a house to securing a job. The Equifax credit score, along with scores from other bureaus, plays a significant role in these decisions. While there are slight differences among Experian, Equifax, and TransUnion, all need monitoring for accuracy. If credit card debt is lowering your score and you're struggling with payments, consider seeking help from debt relief services to improve your financial situation.

What is a good Equifax credit score?

Understanding what constitutes a good Equifax credit score is essential for managing your financial health. A good credit score typically falls within the range of 670 to 739. This strong credit score indicates a solid credit history and demonstrates to lenders that you are a reliable borrower. Maintaining a good Equifax credit score can open doors to various financial opportunities, such as favorable interest rates on loans, credit cards, other credit accounts, and even potential rental applications. It reflects your creditworthiness and lenders' confidence in your ability to repay debts responsibly.

It's important to note that credit score ranges may differ slightly depending on the scoring model used. Equifax, one of the major credit reporting agencies, employs the FICO scoring model, which ranges from 300 to 850. In this context, a good Equifax credit score would be closer to the upper end of that scale.

Remember, achieving and maintaining a good credit score requires responsible financial habits, including making timely payments, keeping credit card balances low, and managing your debts effectively.

By understanding what a good Equifax credit score entails and implementing healthy credit practices, you can enhance your financial well-being and improve your chances of accessing credit on favorable terms. Moreover, a good credit score can provide you with better terms when you 'buy purchases' on installment or finance. This can lead to significant savings in the long run.

FAQs

Conclusion

Understanding the differences between your Equifax credit score and TransUnion score is crucial for managing your financial health. These variations often stem from the unique data collection methods and scoring models each bureau employs. While your Equifax credit score might be lower than others, it doesn't necessarily indicate a problem with your credit.

To maintain a healthy credit profile, regularly monitor both scores and review your credit reports for accuracy. Remember that lenders may use either score, so focusing on overall good credit habits such as timely payments and low credit utilization is more important than fixating on score differences. By staying informed and practicing responsible credit management, you can work towards improving your scores across all credit bureaus.

*Disclaimer: Pacific Debt Relief explicitly states that it is not a credit repair organization, and its program does not aim to improve individuals' credit scores. The information provided here is intended solely for educational purposes, aiding consumers in making informed decisions regarding credit and debt matters. The content does not constitute legal or financial advice. Pacific Debt Relief strongly advises individuals to seek the counsel of qualified professionals before undertaking any legal or financial actions.

RELATED POSTS

- The 5 Main Credit Score Factors You Need To Know (November 23, 2020)

- How To Do A Credit Card Balance Transfer (November 4, 2020)

- The 8 Best Apps for Monitoring Your Credit Score (October 12, 2020)

- What You Should Do If You Experience a Data Breach (September 24, 2020)

- How To Rent An Apartment With Bad Credit (February 7, 2020)

Bruce from Portage Indiana Debt Relief Review

Arpik from Glendale California Debt Relief Review

✔ Accredited by Better Business Bureau with BBB A+ rating (4.93 rating and 1678 reviews)

✔ US News and World Reports and Bankrate ranked Pacific Debt Relief as one of “The Best Debt Relief Companies of 2024”

✔ 6.9 star rating by BestCompany.com (over 2379 client reviews)

✔ 4.8 star rating by TrustPilot based (over 1613 verified consumer reviews)

✔ ConsumerAffairs.com Accredited (over 544 verified reviews with an average rating of 5 stars)

✔ A Top 10 Rated Compan by TopTenReviews.com , ConsumersAdvocate.com and Top10debtconsolidation.com

✔ 4.6 star rating by Google (229 client reviews)

✔ 100% rating by SuperMoney (9 client reviews)

Reduce Your Credit Card Debt By Up to Half

BBB Reviews | 4.9/5.0 Rating

Do Not Sell My Personal Information

Do Not Sell My Personal Information