Last Updated: March 26, 2025

Disclaimer: We are not qualified legal or tax professionals and are not giving advice. Always speak with a qualified professional before making any legal or financial decisions.

If you've been contacted by a debt collector, you may hear all sorts of claims. If this is your first time dealing with debt collection calls, you may not understand your consumer rights – and yes, debtors do have rights! Check out these myths and debt collection tactics used by collectors so you can handle these annoying contacts.Check out these myths and scare tactics used by debt collectors so you can handle these annoying contacts.

Know Your Debt Collector Rights

The worst debt collectors can leave you in tears or very frightened. They may count on you not knowing your rights and the law. They may also be fake debt collectors.

If you are getting debt collector calls remember these myths and then what you should or should not do.

If you are getting harassed and can prove it, you may be able to stop the debt collection!

The Statute of Limitations

Before we get into the collection agency tactics, we need to talk about the statute of limitations. Every state has a time limit on how long a debt can be collected. It depends on the type of debt and your state. Limitations runs generally between three and ten years.

Myth – Believe Everything You Are Told!

Debt collectors may be wrong – always double check your records make sure you owe the debt. Dishonest debt collectors may try to collect an old, canceled, or paid off debt. This is known as zombie debt and may get sold to other debt collection agencies for years to come. Keep your records proving you have paid the debt or it is beyond the statute of limitations.

The debt collector is required by law to send you a letter within five days with the creditor's name, the amount owed, and informing you that you can dispute the debt. If you are contacted by a collection agency, insist that they send you a debt validation before you pay anything!

Once you receive the debt validation letter, you have thirty days to dispute the debt in writing. The debt collector cannot contact you within those thirty days. Double check everything from the name on the debt to the amount owed.

If you can prove the debt is incorrect, send the proof in writing (make copies and keep the originals) and send it by certified mail. You may need to follow up with the collection agency.

Myth – You Can Pay the Original Creditor

Nope. In most cases, the original creditor and the third party debt collections have an agreement preventing the original creditor from accepting payment.

Creditors generally charge off your debt after 60 to 120 days of delinquency. The debt is then sold to a collections agency. The debt belongs to third party debt collectors.

The good news is that the debt was sold for pennies on the dollar and debt collectors may be more willing to settle your debt. This can be important when you're trying to figure out how to pay off debt collectors in a way that works for your financial situation.

Myth – All Debt Collectors Work for Real Companies

The debt collector could be a scammer! Often, these people will try to collect a debt that is past the statute of limitations or that is not valid.

Get a name, address and phone number and check them out before doing anything.

Always ask for a debt validation before you make any payments or promises.

Fair Debt Collection Practices Act

The Federal Trade Commission oversees debt collection agencies. Fair Debt Collection Practices Act (FDCPA) was enacted to protect debtors from harassment by debt collectors. This federal law detailed what debt collectors can and can not do in order to collect money. The actions detailed below are considered unfair practices.

The FDCPA prohibits debt collectors from undertaking the following collection strategies:

- Pretending to be a government official or an attorney or consumer reporting agency

- Making phone calls to you between 9 p.m. and 8 a.m. without your permission

- Threatening violence, bodily harm, or jail time

- Using profanities when speaking to you (don’t be rude to a collector. It will work against you if the phone calls are replayed in court)

- Sending letters that look like attorney or governmental letters but that are not

- Contact third parties (family members, friends and employers) about your debt or otherwise embarrassing you (keep your contact information up-to-date and the debt collection agency cannot contact third parties.).

- Calls to your employer except under limited conditions - see above

- Sending derogatory messages about you to a credit reporting agency

- Sending information on a postcard – this can include social media.

- Attempting to collect an expired debt – there is a limited amount of time to start proceedings again a debtor. Do NOT make a good faith payment on any loan.

- Hiring an unlicensed credit collection agency

- Communicating with you if you are represented by an attorney

State Fair Debt Collections Practices Act

Many states have their own fair debt collection law that covers the above illegal practices and usually extends the prohibitions to the primary creditor, not just collection agencies.

Actions to Take When Speaking with a Debt Collector

Keep a Log Book of all the debt collectors

Take notes during calls with a debt collector. This phone conversation log can be a valuable source of information to stop harassment.

Write down the date and time, name of the debt collector, what debt the collector is after, and what the debt collector says. Keep all mail, copies of texts, etc., as well.

Consider telling the debt collectors to stop contacting you

You can write to ask the company to stop calling you. However, if you want work towards a settlement, you may not want to take this step. If you choose to work with an attorney, they attorney will tell them to stop contacting you.

Tell the Collector if the debt is not correct

If this is not your debt or you do not own the debt, tell the collector.

Depending on your debt, you may have a statute of limitations protecting you from paying the debt.

Tell the collector if you legitimately can't afford to pay debts

Give them a short explanation of your difficulties. They may try to work with you.

Give them your current contact information

If you are upfront about your new address or phone number, the collector has less legal right to contact employers, friends, and family. If they have your address and phone number, they cannot contact anyone but you.

Avoid the Following Actions When Speaking with a Debt Collector

Give out financial information

This includes your social security number, bank account numbers, or the value of any property (land, cars, etc) that you own.

Make a “Good Faith” payment

All this does is restart the statute of limitations on your debt.

Admit that the debt is yours, or promise to pay

Your promise can be viewed as a separate contract that extends the statute of limitations. You can make offers of settlement but do it for “the debt,” not “my debt.”

Lose your temper

Calls are recorded. If you are recorded making threats toward a polite debt collector, you will look bad in court. Let them be abusive, keep a log, and then contact your state attorney general.

Set Up a Payment Plan

If this is your debt and you can pay, consider setting up a plan. Just get it in writing! Understanding how to pay off debt collectors through a structured payment plan can help you resolve the issue while protecting your financial future.

Getting Sued For Debt

Depending the creditor or debt collection agency and the amount you owe, you face legal action in court. You can face wage garnishment or have your bank accounts frozen.

For more information about the difference between a demand letter and a summons, read this blog. For information on wage garnishment, follow this link.

Pacific Debt Relief

Pacific Debt Relief can help you to find debt relief. All it takes is a phone call for a free evaluation. We will explain your options to you. Our debt settlement companies specializes in unsecured debts like consumer debt, medical bills and credit card debt.

Being harassed by creditors, overwhelmed with debt collection calls and need debt relief? Contact Pacific Debt immediately to receive your FREE CONSULTATION.

Find out more details about our Debt Relief Program.

*Disclaimer: Pacific Debt Relief explicitly states that it is not a credit repair organization, and its program does not aim to improve individuals' credit scores. The information provided here is intended solely for educational purposes, aiding consumers in making informed decisions regarding credit and debt matters. The content does not constitute legal or financial advice. Pacific Debt Relief strongly advises individuals to seek the counsel of qualified professionals before undertaking any legal or financial actions.

References

https://www.thebalance.com/myths-about-debt-collectors-4046409

https://www.daveramsey.com/blog/myths-about-debt-collectors

https://www.debt.org/credit/collection-agencies/secrets

https://www.daveramsey.com/blog/5-bogus-threats-from-debt-collectors

https://wallethub.com/edu/which-states-statute-of-limitations-applies/25657/

✔ Accredited by Better Business Bureau with BBB A+ rating (4.92 rating and 1,700+ reviews)

✔ 7.5 star rating by BestCompany.com (over 2300+ client reviews)

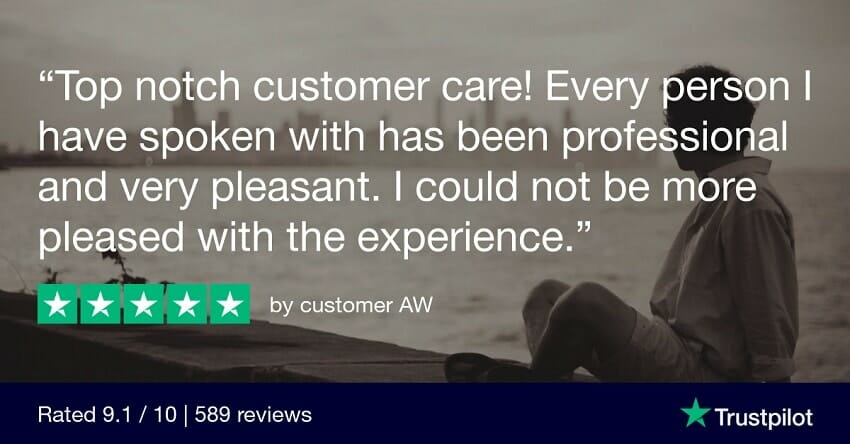

✔ 4.8 star rating by TrustPilot (over 2200+ verified consumer reviews)

✔ ConsumerAffairs.com Accredited (over 500+ verified reviews with an average rating of 5 stars)

✔ A Top 10 Rated Compan by TopTenReviews.com , ConsumersAdvocate.com and Top10debtconsolidation.com

✔ 4.6 star rating by Google (400+ client reviews)

✔ 100% rating by SuperMoney (8 client reviews)

Reduce Your Credit Card Debt By Up to Half

BBB Reviews | 4.9/5.0 Rating

Do Not Sell My Personal Information

Do Not Sell My Personal Information