Last Updated: April 07, 2024

Disclaimer: We are not qualified legal or tax professionals and are not giving advice. Always speak with a qualified professional before making any legal or financial decisions.

Dealing with debt can be tough. Maybe you've hit a rough patch or things just didn't go as planned financially. That's where a debt settlement agreement comes in. It's a way to negotiate with creditors to pay off your debt for less than you owe. Sounds good, right? But figuring out how to start and what to say can be tricky.

This guide is all about helping you through that process. We'll walk you through how to put together a debt settlement letter that gets to the point and shows your creditors you're serious about sorting things out.

If you'd like to skip the article and speak to a debt specialist, get a free consultation today!

What is a Debt Settlement Agreement?

Debt settlement is working with creditors to decrease the amount of debt that you owe. The debt settlement agreement is a written, legally binding agreement to decrease your debt through debt settlement, what happens if you default, and what happens after you pay back the settled amount

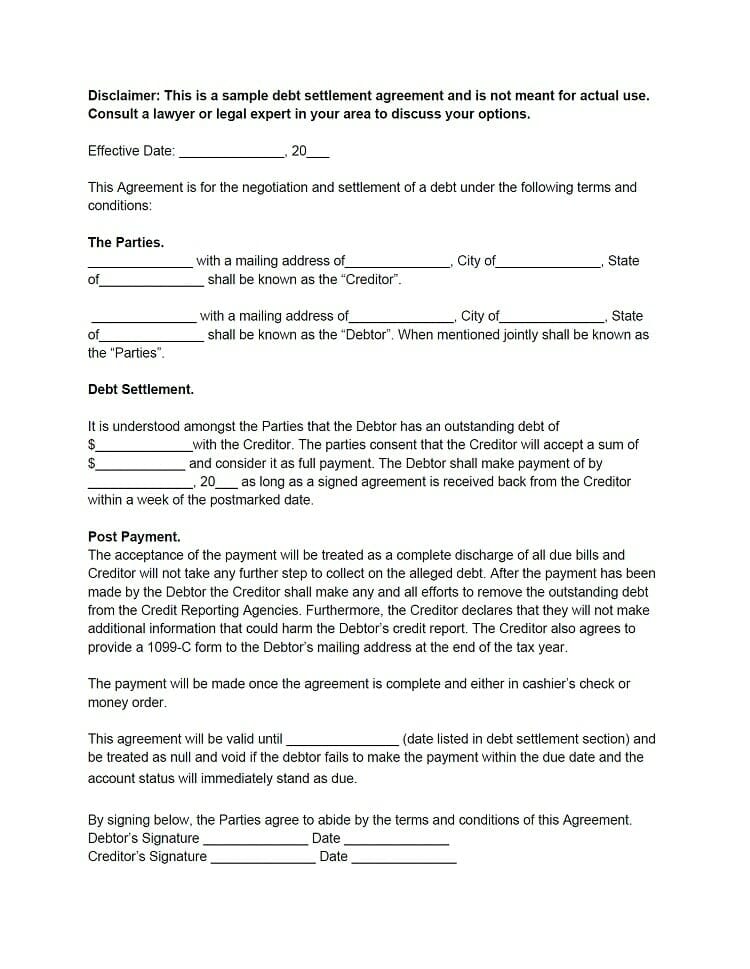

Letter for Debt Settlement Agreement Template

Since you are looking at Pacific Debt’s website, you may be considering debt settlement as a hardship option. Many people want to know if they need to work with Pacific Debt, Inc. to settle their debt. The answer is no, but there are some very good reasons for you to work with us that will save you a ton of time, and most likely, a ton of money! Let’s look at how to go about debt settlement yourself.

How to Negotiate Your Debt Settlement

Before you get started, you need to have a strategic plan in place.

- Are You Current or Behind on Payments? How old is your debt? Debt settlement works best if you are NOT current on your payments. If you are making payments on time, creditors may assume that you are capable of paying back your debt. A creditor may be more willing to negotiate a settlement if you are behind on making payments. Read our article on How to Deal With Debt Collectors When You Can’t Pay

- Collection Information. You may have more than one delinquent debt. Get a notebook and set up separate sections for each debt. Include the company, the amount, the interest rate, and the debt’s age. Every time you have contact about that debt, write down the details, including the name of the person who called, the date, and the time. Decide which debts need to be paid first. It might be the least amount, the highest interest rate, or other factors.

- Make a Repayment Timeline. Your plan should allow you to repay your debt within 24 to 48 months. Pacific Debt Inc. estimates that it will take someone using our service to take 24 to 48 months, depending on your unique circumstances.

- Consider Selling Assets. Identify anything you can sell to raise some money. If you do, put it in a separate savings account so you don’t spend it. Pacific Debt Inc. helps set up an escrow account for you if you use our service. The goal is to have a lump sum built up over time to settle your debt.

- Contact the Creditor or Collection Agency. Using your notebook, contact the creditors. Explain why you can’t pay the bill. DO NOT share bank account information or other personal financial information. Do not make promises. And importantly, don’t lose your temper! They want you to be emotional. If the company is interested in settling, it may offer a higher settlement amount. If you want to continue negotiating with them, suggest a different, lower amount. Pacific Debt Inc. knows which creditors or collection agencies are willing to negotiate and which ones don’t. It is a benefit of using our service! We have long-standing relationships established with most creditors.

- Consider Your Tax Consequences. Debt settlement can have some tax consequences. Since we’ve already discussed these in detail in a previous article, here is a summary. The IRS may treat the charge-off amount (the debt settlement) as income for you. You may need to include a form 1099-C with your taxes. If you don’t, you may end up giving more money to the IRS than you need to.

- Get It in Writing. Click this link to find a sample debt settlement agreement. Do not make a payment until you have a debt settlement agreement signed by the company and in your possession.

Filling out the Debt Settlement Agreement Template

Here are some tips for filling out the letter of agreement for payment of debt.

- The effective date is the date you make this agreement.

- The creditor is the person you owe money to or the collection agency.

- The debtor is you.

- The outstanding debt is what you owe.

- The sum is what you agree on.

- The creditor will expect you to make payment by the specified date. If you don’t have the money to pay it, make sure that you factor that in.

- The valid date is the date you agreed to pay the debt back.

- Make two copies. Sign both and send them to the creditor. They should sign and then return it.

- Keep your agreement to pay letter in a safe place!

**We are not legal experts and have prepared this payment agreement template to only be used as a sample. It’s only intended to be a sample and it’s not meant for actual use. You should contact a legal expert in your area to discuss your options if you are intending to do a debt settlement yourself.

Should You Try Debt Settlement Yourself?

The answer to whether you should DIY debt settlement or hire debt professionals like us depends on you. Only you can answer that question. If you choose to do it yourself you will have to do all the negotiating, paying, saving, and dealing with debt collectors. It can be extremely frustrating, and upsetting, and requires a massive amount of time on the phone, as well as organization and patience.

Find out why Pacific Debt has been ranked as one of the “Best Debt Settlement Companies of 2019”.

Debt settlement is not an easy process to go through by any means. If you don’t want to try debt settlement yourself, you can contact Pacific Debt Inc. Our debt settlement experts will help you understand all your options and the initial consultation is 100% free. We’ll do all the work and keep you updated throughout the entire process.

Top Reasons to Work With a Debt Settlement Company

While it is possible to attempt debt settlement on your own, most people find better success and relief by working with a professional debt settlement company like Pacific Debt. Here are some of the top reasons to have an experienced team on your side:

- Expert Negotiators: Our debt specialists have years of experience negotiating with creditors and collectors. They know what settlement offers are realistic and how to effectively negotiate to get debts reduced. Doing it yourself often results in settling for less favorable terms.

- Established Relationships: We have long-standing relationships with many major lenders and collection agencies. This facilitates better communication and helps us negotiate debt relief solutions that individual consumers typically can't get on their own.

- Handle Communication: Our team handles all calls and paperwork with your creditors for you. This removes the stress of having to confront collectors yourself. We buffer that challenging communication so you can focus on other priorities.

- Settlement Funds Management: We set up dedicated settlement accounts (escrows) to make lump sum pay-off offers to your creditors when the timing is right. This helps secure better debt reductions compared to installment settlements.

Should You Try Debt Settlement Yourself?

While some may consider "DIY debt settlement", the downsides often outweigh potential savings:

- No Negotiation Experience: Without expertise, you may settle accounts for much less favorable terms compared to professionals. This results in paying more in the long run.

- Hours on the Phone: Trying to handle all communication with multiple creditors takes up significant time. Our specialists do this heavy lifting for clients.

- High Stress: Confronting collections agencies and negotiating intensely is stressful for anyone. Having help alleviates this burden.

- Lack of Fund Management: Creditors prefer lump sum settlement offers. We escrow client funds over months or years to make these payoffs feasible. Much harder to do alone.

FAQs

Conclusion

Debt settlement can be an effective way to resolve unsecured debts for significantly less than you owe when done correctly. While negotiating settlements on your own is certainly possible, the expertise, established relationships, administrative support, and settlement funds management that professional services provide offer important advantages not easily replicated alone.

Yes, debt settlement may impact your credit score in the short term due to missed payments that often continue even in settlement. However, eliminating debt through settlement can allow you to begin rebuilding credit after completion of the program. Partnering with a reputable settlement provider like Pacific Debt gives you the best shot at securing optimal outcomes.

The potential savings, reduced stress, and financial fresh start possible make debt settlement an option well worth exploring, especially with the level of relief leveraging professional expertise can bring compared to tackling settlements alone.

Pacific Debt Inc.

If you’d like more information on debt settlement or have more than $10,000 in unsecured debt that you can’t pay, contact Pacific Debt, Inc. We may be able to help you get out of debt in 2 to 4 years with our debt relief program. We have settled over $250 million in debt for our customers since 2002.

For more information, contact one of our debt specialists today. The initial consultation is free, and our debt experts will give you all your options.

*Disclaimer: We are not qualified legal or tax professionals and are not giving advice. Always speak with a qualified professional before making any legal or financial decisions.

RELATED POSTS

- Pacific Debt Inc Rated One of the Best Debt Settlement Companies of 2020 (February 13, 2020)

- How To Build Your Credit After Debt Settlement (October 11, 2019)

- New Study Finds Debt Settlement Helps the Economy (September 24, 2019)

- How to Get Out of Debt Yourself (June 5, 2019)

- Can You Go to Jail for Not Paying Taxes? (April 24, 2019)

Can You Go to Jail for Not Paying Taxes?How to Get Out of Debt Yourself

Reduce Your Credit Card Debt By Up to Half

BBB Reviews | 4.9/5.0 Rating

Do Not Sell My Personal Information

Do Not Sell My Personal Information