Alaska Debt Relief

Reduce Your Credit Card Debt By Up To Half

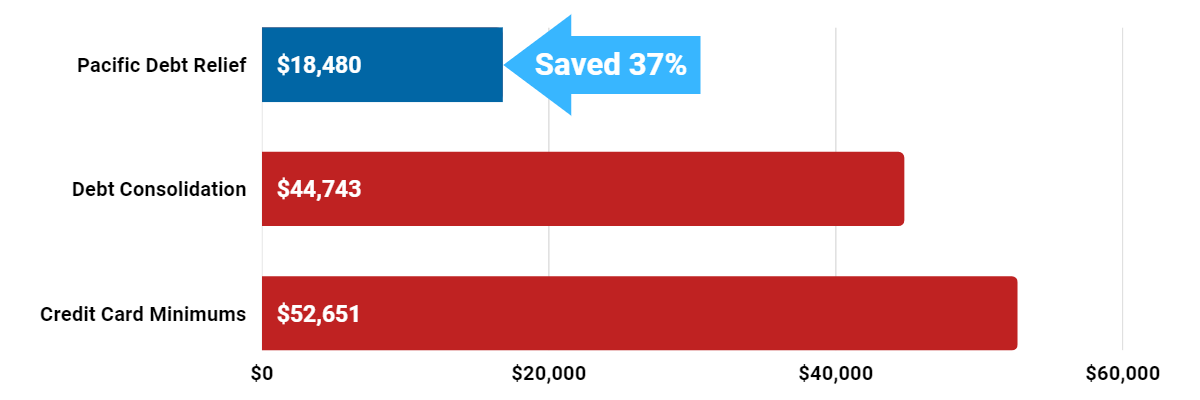

Pacific Debt Relief offers the only solution that significantly reduces your debt to less than you currently owe. That means you get debt-free in a fraction of the time it would take with other options.

Save thousands by lowering your debt balance and wiping away years of future interest and payments. Call today for a FREE consultation!

Alaska Debt Relief Reviews

Alaska Debt Relief Testimonials

Alaska

Alaska is the largest state in the union. Known of natural beauty, Alaska is a frontier and an escape for many people tough enough to live in the Land of the Midnight Sun.

As a result of size and population, Alaska is ranked #48 for population and #50 for population density. Over 738,000 people called Alaska home. Anchorage is the largest city in Alaska.

Alaska Income

The median state income is $76,400. As of 2018, the minimum wage is $9.84 per hour. Unfortunately, 13.8% of Alaskan children under 18 live in poverty. For residents overall, 9.9% of all people in Alaska live under the poverty level.

- Median state income: $76,400

- Minimum wage: $9.84/hour

- Children in poverty: 13.8%

- People in poverty: 9.9%

Is Alaska a Community Property State?

Unfortunately, Alaska is not a community property state. Therefore your assets are not seen as equally owned by you and your spouse. Currently, there are only 10 states that are community property states. In the state of Alaska, the judge will decide which assets are shared by you and your spouse, and what the equity is for each.

There are 10 community property states in which the state sees your assets as community property are Louisiana, Arizona, California, Texas, Washington, Idaho, Nevada,

New Mexico, and Wisconsin.

Homeowners

More than half (65.5%) of Alaskans hold a mortgage. The median home price in Alaska is $307,900 (2018). Of course, that median price depends on the location with some areas being much higher.

- Homeowner rate: 65.5%

- Median home price: $307,900

Employment

Alaska has a current unemployment rate of 7.3%. The underemployment rate is 12.8%. Underemployment is the percentage of civilian workers who are unemployed, employed part-time, or are not seeking employment.

If this is you, we can help. Pacific Debt offers Alaska debt relief solutions tailored to your unique situation and budget. Our certified counselors help you work up a budget and explain your options.

- Unemployment: 7.3% (2018)

- Underemployment: 12.8% (2017)

Alaska Debt

Alaskans carry a lot of debt. The average credit card debt is $13,048 (2018) – the highest in the US. The average student loan debt is $26,171. When you add all that debt on top of the cost of homes (rental or owned), versus the median income, it is very easy for Alaskans to get into debt.

- Avg credit card debt: $13,048 (2018)

- Avg mortgage debt: $228,088 (2017)

- Avg student loan debt: $26,171 (2017)

Alaska Statute of Limitations

Alaska’s statute of limitations lays out maximum time periods that debt collectors can take action against a delinquent debt. These statutes of limitations begin on the date that your debt goes delinquent.

For debts taken out in Alaska, the following are the statutes of limitations for different types of debt.

- Oral agreements: 6 years

- Written contracts: 6 years

- Promissory notes: 3 years

- Credit cards and other revolving loans: 3 years

Alaska Debt Relief and Debt Consolidation

If you have more debt than you can pay off, Pacific Debt can help you consolidate your debt and learn to live debt free. Since 2002, we’ve settled over $200 million in debt for thousands of clients. We are a nationally top ranked debt relief company located in San Diego.

We will help you work through our proven and comprehensive debt relief program. Your certified debt relief counselor will review all your options. If debt settlement is right for you, we move forward with our debt consolidation program and work to save you money. Pacific Debt can help with most unsecured debt like credit cards, personal loans, medical bills, and repossessions.

It is not an easy process and it won’t happen overnight, but you can do it. Pacific Debt will be there every step of the way to help.

Debt Collection Laws

Alaskans are protected against unscrupulous debt collectors. The federal Fair Debt Collection Practices Act (FDCPA) prohibits debt collectors from using abusive or harassing bill collection practices. In addition, the Alaska Fair Debt Collection Practices Act (AFDCPA) adds protections against more types of collectors and actions. If you are a victim of any of these actions, you may take legal action against them.

Overall, debt collectors can NOT:

- Charges more than 10% interest

- Garnish more than 25% of wages

- U se/threaten physical force or criminal tactics to harm you, your property, or your reputation

- Accusing you of committing a crime for not paying the debt

- Make/threaten to make defamatory statements to someone else

- Threaten arrest, to seize assets, or garnish wages unless actually planning to take such action

- Use obscene or profane language

- Cause you to spend money you wouldn’t otherwise have spent (ie long-distance telephone calls)

- Call you repeatedly or let your phone ring repeatedly

- Call frequently

- Contact your employer, except to verify employment or health insurance status, garnish wages or locate you

- Reveal information about debt to anyone except your spouse or your parents if a minor.

- Publicly publish your name for failing to pay

- Send a postcard or letter with revealing information on the envelope

- Claim to be someone other than a debt collector, including a governmental official

- Use stationery that appears to be from a law firm

- Charge you collection or attorney’s fees unless legally allowable

- Threaten to report you to a credit reporting agency if they have no intention of doing so

- Send a letter claiming to come from a claim, credit, audit, or legal department unless it actually is

Debt collectors must:

- Disclose caller identification

- May contact your family to locate you

- Must serve you with notice of a lawsuit if suing you

Alaska Bankruptcy Court Information

Bankruptcy is a legal action that can erase most of your debt as well as your credit history. It is not an action to take lightly. If you do, you must follow the following steps in Alaska.

Persons filing for bankruptcy must:

- Complete credit counseling within six months before filing for bankruptcy.

- Complete a financial management instructional course after filing bankruptcy.

- Complete a Bankruptcy Act Means Test to determine if you are eligible for a Chapter 7 or 13 bankruptcy

- Itemize current income sources; major financial transactions; monthly living expenses; debts (secured and unsecured); and property (all assets and possessions, not just real estate).

- Collect last 2 years of tax returns, deeds to real estate you own, car titles, and loan documents

- File for bankruptcy

- Chapter 7 bankruptcy fee is $306

- Chapter 13 bankruptcy fee is $281

- Meet with court assigned bankruptcy trustee

- Attend a Meeting of Creditors

- Confirm plan if filing for Chapter 13 bankruptcy

Alaska Cities Served by Pacific Debt

Adak

Akutan

Aleknagik

Ambler

Anderson

Arctic Village

Attu Station

Beluga

Big Lake

Buffalo Soapstone

Chalkyitsik

Chevak

Chignik Lagoon

Chistochina

Clam Gulch

Cold Bay

Copper Center

Craig

Deering

Dillingham

Dry Creek

Eek

Elfin Cove

Evansville

Farm Loop

Fort Greely

Fox River

Galena

Glacier View

Grayling

Halibut Cove

Healy Lake

Homer

Houston

Hyder

Juneau city and borough

Kalifornsky

Kasigluk

Ketchikan

Kipnuk

Knik-Fairview

Kodiak Station

Kotlik

Kupreanof

Lake Minchumina

Levelock

Lower Kalskag

McKinley Park

Meadow Lakes

Metlakatla

Moose Creek

Mud Bay

Napaskiak

Nenana

Newtok

Nikolai

Nome

Northway

Nulato

Ouzinkie

Pelican

Pilot Point

Pleasant Valley

Point MacKenzie

Port Alsworth

Port Lions

Quinhagak

Ridgeway

St. Mary's

Salcha

Scammon Bay

Seward

Shishmaref

Skagway

Soldotna

Stevens Village

Sutton-Alpine

Tanaina

Teller

Thorne Bay

Tolsona

Tuntutuliak

Tyonek

Upper Kalskag

Wales

Whitestone Logging Camp

Wiseman

Yakutat

Akhiok

Alakanuk

Aleneva

Anaktuvuk Pass

Angoon

Atka

Barrow

Bethel

Birch Creek

Butte

Chase

Chickaloon

Chignik Lake

Chitina

Clark's Point

Coldfoot

Copperville

Crooked Creek

Delta Junction

Diomede

Eagle

Egegik

Elim

Excursion Inlet

Ferry

Fort Yukon

Fritz Creek

Gambell

Glennallen

Gulkana

Happy Valley

Hobart Bay

Hoonah

Hughes

Igiugig

Kachemak

Kaltag

Kasilof

Kiana

Kivalina

Knik River

Kokhanok

Kotzebue

Kwethluk

Lakes

Lime Village

Lutak

Manley Hot Springs

Mekoryuk

Meyers Chuck

Moose Pass

Naknek

Naukati Bay

New Allakaket

Nightmute

Nikolski

Nondalton

Northway Junction

Nunapitchuk

Palmer

Perryville

Pilot Station

Point Baker

Pope-Vannoy Landing

Port Clarence

Port Protection

Rampart

Ruby

St. Michael

Sand Point

Selawik

Shageluk

Shungnak

Skwentna

South Naknek

Stony River

Takotna

Tanana

Tenakee Springs

Togiak

Tonsina

Tununak

Ugashik

Valdez

Wasilla

Whittier

Womens Bay

Akiachak

Alatna

Allakaket

Anchorage municipality

Aniak

Atmautluak

Bear Creek

Bettles

Brevig Mission

Cantwell

Chefornak

Chicken

Chiniak

Chuathbaluk

Coffman Cove

College

Cordova

Crown Point

Deltana

Dot Lake

Eagle Village

Eielson AFB

Emmonak

Fairbanks

Fishhook

Four Mile Road

Funny River

Game Creek

Golovin

Gustavus

Harding-Birch Lakes

Hollis

Hooper Bay

Huslia

Iliamna

Kake

Karluk

Kenai

King Cove

Klawock

Kobuk

Koliganek

Koyuk

Kwigillingok

Larsen Bay

Livengood

McCarthy

Manokotak

Mendeltna

Miller Landing

Mosquito Lake

Nanwalek

Nelchina

Newhalen

Nikiski

Ninilchik

Noorvik

Northway Village

Old Harbor

Paxson

Petersburg

Pitkas Point

Point Hope

Portage Creek

Port Graham

Primrose

Red Devil

Russian Mission

St. Paul

Savoonga

Seldovia

Shaktoolik

Silver Springs

Slana

Stebbins

Sunrise

Talkeetna

Tatitlek

Tetlin

Tok

Trapper Creek

Twin Hills

Unalakleet

Venetie

Whale Pass

Willow

Wrangell

Akiak

Alcan Border

Alpine

Anchor Point

Anvik

Atqasuk

Beaver

Big Delta

Buckland

Central

Chenega

Chignik

Chisana

Circle

Cohoe

Cooper Landing

Covenant Life

Cube Cove

Diamond Ridge

Dot Lake Village

Edna Bay

Ekwok

Ester

False Pass

Flat

Fox

Gakona

Gateway

Goodnews Bay

Haines

Healy

Holy Cross

Hope

Hydaburg

Ivanof Bay

Kaktovik

Kasaan

Kenny Lake

King Salmon

Klukwan

Kodiak

Kongiganak

Koyukuk

Lake Louise

Lazy Mountain

Lowell Point

McGrath

Marshall

Mentasta Lake

Minto

Mountain Village

Napakiak

Nelson Lagoon

New Stuyahok

Nikolaevsk

Noatak

North Pole

Nuiqsut

Oscarville

Pedro Bay

Petersville

Platinum

Point Lay

Port Alexander

Port Heiden

Prudhoe Bay

Red Dog Mine

St. George

Salamatof

Saxman

Seldovia Village

Sheldon Point (Nunam Iqua)

Sitka city and borough

Sleetmute

Sterling

Susitna

Tanacross

Tazlina

Thoms Place

Toksook Bay

Tuluksak

Two Rivers

Unalaska

Wainwright

White Mountain

Willow Creek

Yukataga

Disclaimer: In some states, PDR may not be able to offer our services directly due to state regulations related to debt settlement. In those instances, PDR will refer you to a reputable debt relief provider or attorney firm for assistance with your debt. We are not lawyers and are not giving legal advice. Before filing bankruptcy, talk to a lawyer in your state. The information included on this site is for educational purposes only.

Do Not Sell My Personal Information

Do Not Sell My Personal Information