Arizona Debt Relief

Arizona Debt Relief Reviews

Arizona Better Business Bureau

Pacific Debt is an A+ rated business with the BBB. We have been accredited since 2010. We have received 4.87 out of five stars based on 40 customer reviews with the BBB.

Pacific Debt settlement

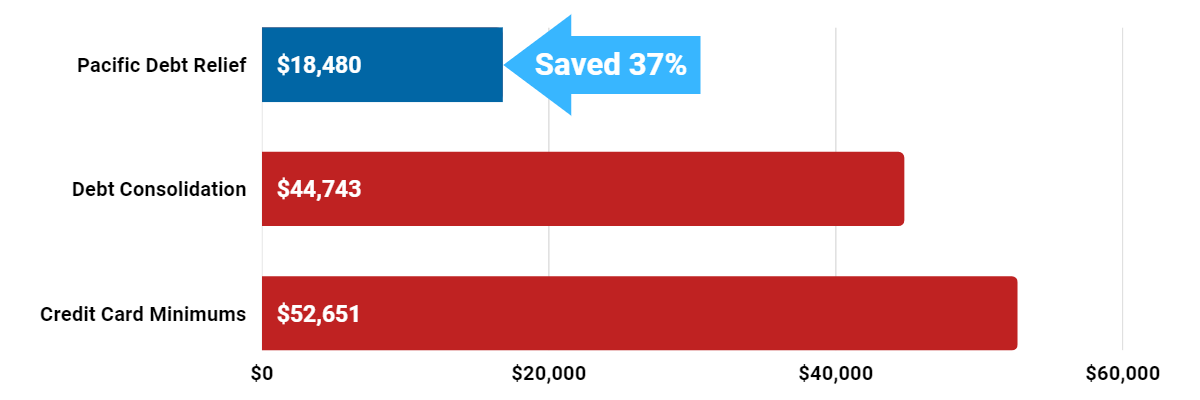

Pacific Debt is a debt relief agency that has helped Arizona residents reduce debt significantly through debt settlement . Since 2002, we've settled over $200 million in debt for our customers. If you are an Arizona resident and struggling with credit card balances, medical debt, or any other unsecured debt.

Contact us today for your FREE consultation with no obligation.

Our debt settlement program could save you from an Arizona bankruptcy. Our debt relief agency is your best alternative to debt consolidation or bankruptcy with a law firm.

Debt Relief Testimonials

Common Questions for Debt Solutions

Reasons to Get Debt Relief in Arizona

There are many reasons why you want relief from debt in Arizona. Perhaps you lost your job or were hit by the recent recession. Maybe you have medical bills or are struggling to keep up with credit card company payments.

If you are looking for Arizona debt settlement companies, you could benefit our free consultation. Our experts explain the available Arizona relief programs. We'll go over your debts and look at the current interest rate of any unsecured loan.

Relief isn't easy, but it's not impossible! Our staff is standing by with a free consultation and no upfront fees.

Common Types of Debt Relief Options

Each debt solution has pros and cons. Everyone's financial situation is unique so speak to a specialist who can help you understand your options .

- Debt Consolidation Loan

- Debt Settlement

- Credit Counseling

- Debt Management Program

- Bankruptcy

Debt Consolidation Loans

Debt consolidation loans roll debt into one loan. This low interest loan is used to consolidate debt and then pay the total. The loan is paid with a consolidated monthly payment. This one monthly payment can make debt repayment manageable.

Debt consolidation depends on your total debt and finding someone to lend money to you.

Debt Settlement Services

Debt settlement can be helpful in resolving unsecured debt. An Arizona debt settlement company negotiates a lower amount. While negotiations are underway, you save sufficient funds to pay the negotiated debt. The company may get creditors to forgive some debt.

You make a monthly payment into an insured savings account. The payments are used to pay down debt according to your payment plan.

Do research before choosing a debt settlement company.

Pacific Debt is one of the best debt settlement companies because of our exceptional customer service. We have relationships with most credit card companies and lenders throughout the United States.

If you have debt, our debt settlement programs can help.

If you live in Arizona and want out of debt, then a debt settlement company could be your best solution.

Credit Counseling

Credit counseling involves working closely with a credit counselor at a credit counseling agency to develop a debt repayment plan. A credit counseling agency can help you negotiate with creditors and develop a budget to pay off debts.

Credit counseling may help lower interest rates or waive certain fees. through a full balance debt resolution program. Look for an accredited, not-for-profit debt counseling agency and a professional credit counselor.

Debt Management Program

Debt Management Programs are formal agreements between debtors and creditors to repay a monitary percentage over a fixed period of time. A debt management plan can help consumers struggling to make minimum payments on credit cards or other debts.

Under a DMP, the collection agency stops all collection activity against the debtor. The creditor may reduce or eliminate interest charges and late fees. The DMP goal is to help the debtor get back on track financially so they can pay off their entire debt balance.

Bankruptcy

Bankruptcy is a legal action by a person who cannot repay debts owed to creditors.

When a person declares bankruptcy, they declare they are unable to pay back debts. This can be due to financial difficulties, such as high levels of debt or unemployment. Often, bankruptcy results in liquidation, meaning all assets are sold off to repay their debts.

Bankruptcy is the most damaging to your credit score. Bankruptcy is very expensive.

More about Bankruptcy.

Bankruptcy Court Information

Bankruptcy erases most debt as well as your credit history. It is not an action to take lightly. Arizona residents must follow the following Arizona Bankruptcy law.

Persons filing for bankruptcy must:

- Complete credit counseling within six months before filing for bankruptcy.

- Complete a financial management instructional course after filing bankruptcy.

- Complete a Bankruptcy Act Means Test

- Itemize current income sources; major financial transactions; monthly living expenses; debts (secured and unsecured); and property (all assets and possessions, not just real estate).

- Collect the last 2 years of tax returns, deeds to real estate you own, car titles, and loan documents

- File for bankruptcy

- Chapter 7 fee is $306

- Chapter 13 fee is $281

- Meet with court assigned bankruptcy trustee

- Attend a Meeting of Creditors

- Confirm plan if filing for Chapter 13 bankruptcy

DISCLAIMER: We are not lawyers and are not giving legal advice. Before filing bankruptcy, talk to a lawyer in your state.

The information included on this site is for educational purposes only. Your state may not qualify for the Pacific Debt, Inc debt relief . If it does not qualify, we can refer you to a Trusted Partner or assist in connecting you with a provider who offers services in your state of residence.

The Pros of Our Debt Relief Program

We have no upfront fees and provide a free debt analysis consultation to see how we can help. If you want a reputable company to help you reduce debt, we are your company.

We may help you settle your debt for less than what you owe with the possibility of becoming debt-free in 24-48 months.

There are other Arizona debt reduction programs and debt solutions but we are leaders in the debt industry and have a successful track record with Arizona debt negotiation

Debt Relief For the Following Arizona Cities:

Ajo

Arizona City

Avra Valley

Bisbee

Bluewater

Burnside

Carefree

Catalina Foothills

Chilchinbito

Cibecue

Clifton

Cordes Lakes

Cottonwood-Verde Village

Dilkon

Drexel Heights

East Fork

El Mirage

Florence

Fountain Hills

Gila Bend

Globe

Grand Canyon Village

Hayden

Houck

Kachina Village

Keams Canyon

Lake Havasu City

Litchfield Park

Mammoth

Mayer

Moenkopi

Mountainaire

New Kingman-Butler

Oracle

Parker

Paulden

Peoria

Pima

Pirtleville

Prescott Valley

Red Mesa

Rio Rico Southwest

Round Rock

St. David

San Carlos

Santa Rosa

Sedona

Shonto

Snowflake

Springerville

Strawberry

Sun Lakes

Surprise

Taylor

Three Points

Tonto Basin

Tubac

Tumacacori-Carmen

Wellton

Wickenburg

Williamson

Winslow

Youngtown

Ak-Chin Village

Arizona Village

Bagdad

Bitter Springs

Bouse

Cameron

Casa Grande

Cave Creek

Chinle

Cibola

Colorado City

Cornville

Dennehotso

Dolan Springs

Dudleyville

East Sahuarita

Eloy

Flowing Wells

Fredonia

Gilbert

Gold Camp

Greasewood

Heber-Overgaard

Huachuca City

Kaibab

Kearny

Lake Montezuma

Littletown

Many Farms

Mesa

Mohave Valley

Munds Park

New River

Oro Valley

Parker Strip

Payson

Peridot

Pine

Pisinemo

Quartzsite

Rio Rico Northeast

Rio Verde

Sacaton

St. Johns

San Luis

Sawmill

Seligman

Show Low

Somerton

Spring Valley

Summit

Sun Valley

Swift Trail Junction

Teec Nos Pos

Tolleson

Top-of-the-World

Tuba City

Tusayan

Wenden

Wilhoit

Willow Valley

Winslow West

Yuma

Amado

Ash Fork

Benson

Black Canyon City

Buckeye

Camp Verde

Casas Adobes

Central Heights-Midland City

Chino Valley

Clarkdale

Congress

Corona de Tucson

Desert Hills

Douglas

Duncan

Ehrenberg

First Mesa

Fort Defiance

Gadsden

Gisela

Golden Valley

Green Valley

Holbrook

Jeddito

Kaibito

Kingman

Lechee

Lukachukai

Marana

Mesquite Creek

Mojave Ranch Estates

Naco

Nogales

Page

Parks

Peach Springs

Phoenix

Pinetop-Lakeside

Poston

Queen Creek

Rio Rico Northwest

Rock Point

Safford

St. Michaels

San Manuel

Scottsdale

Sells

Sierra Vista

Sonoita

Stanfield

Sun City

Supai

Tacna

Tempe

Tombstone

Tortolita

Tucson

Vail

Whetstone

Willcox

Window Rock

Yarnell

Apache Junction

Avondale

Big Park

Blackwater

Bullhead City

Canyon Day

Catalina

Chandler

Chuichu

Claypool

Coolidge

Cottonwood

Dewey-Humboldt

Drexel-Alvernon

Eagar

Elgin

Flagstaff

Fortuna Foothills

Ganado

Glendale

Goodyear

Guadalupe

Hotevilla-Bacavi

Jerome

Kayenta

Kykotsmovi Village

Leupp

McNary

Maricopa

Miami

Morenci

Nazlini

Oljato-Monument Valley

Paradise Valley

Patagonia

Peeples Valley

Picture Rocks

Pinon

Prescott

Queen Valley

Rio Rico Southeast

Rough Rock

Sahuarita

Salome

Santan

Second Mesa

Shongopovi

Sierra Vista Southeast

South Tucson

Steamboat

Sun City West

Superior

Tanque Verde

Thatcher

Tonalea

Tsaile

Tucson Estates

Valencia West

Whiteriver

Williams

Winkelman

Young

Disclaimer: In some states, PDR may not be able to offer our services directly due to state regulations related to debt settlement. In those instances, PDR will refer you to a reputable debt relief provider or attorney firm for assistance with your debt. We are not lawyers and are not giving legal advice. Before filing bankruptcy, talk to a lawyer in your state. The information included on this site is for educational purposes only.

Do Not Sell My Personal Information

Do Not Sell My Personal Information