Maryland Debt Relief

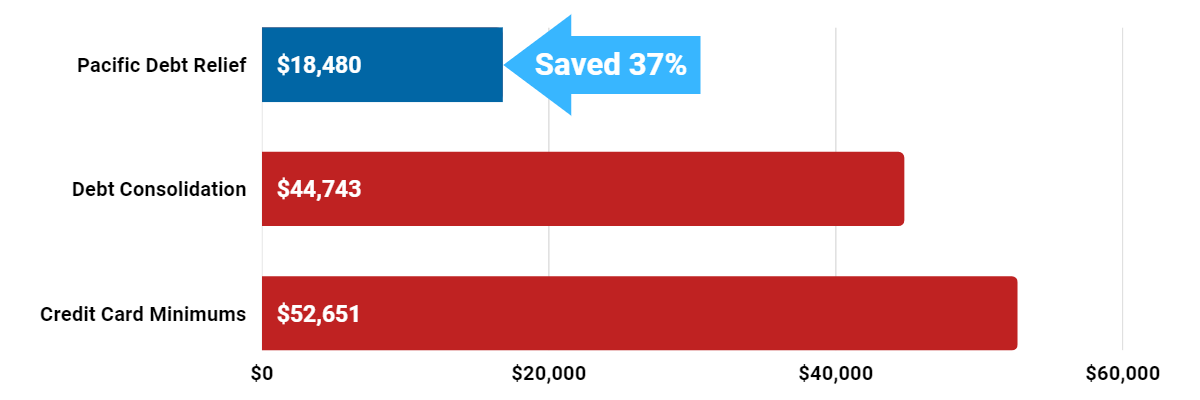

Reduce Your Credit Card Debt By Up To Half

Pacific Debt Relief offers the only solution that significantly reduces your debt to less than you currently owe. That means you get debt-free in a fraction of the time it would take with other options.

Save thousands by lowering your debt balance and wiping away years of future interest and payments. Call today for a FREE consultation!

Maryland Debt Relief Reviews

What are Maryland Debt Relief Programs?

Maryland Debt relief involves the reduction of debt through debt settlement or debt consolidation.

Pacific Debt Relief specializes in debt settlement. We work to reduce your debt for substantially less than you owe. Most types of unsecured debt qualify for our relief program, including credit card debt.

Contact us today for your FREE consultation with no obligation. We can help you choose the best option that makes sense.

Debt settlement requires the debtor to not pay bills in order to make creditors negotiate. This can result in late fees and collector phone calls. Debt settlement causes some credit score damage as a settlement does stay on your credit report for up to seven years. Consider settlement for bills that are very delinquent or already in collections.

Most people considering debt programs do not have a high credit score. Most people who successfully complete our debt settlement plan can see improvements to their credit scores.

Pacific Debt deals directly with your creditors while guiding you throughout the entire process.

Our best-rated settlement programs are available for Maryland residents. Call our certified specialists who will explain all your relief options.

Our free debt analysis will help you make an informed decision. Call to get your free quote for our services.

How Does Debt Relief Work?

Debt relief reduces the amount you owe your creditors so that you can receive financial relief. Debt settlement is one option. Pacific Debt provides relief in the form of debt settlement to Maryland residents, as well as nationally.

The first step for Maryland residents in finding relief is a FREE phone call with one of our debt specialists who can lay out all your options, so you understand your position and what steps need to be taken in order to reduce your debt.

Is Debt Relief Legit?

Pacific Debt has helped countless Maryland residents reduce their debt and live debt free. Since 2002, we've settled over $200 million in credit card debt for our clients. Contact us today to see how we can help.

If you are searching for information on debt consolidation, or a debt management plan in the state of Maryland, you could benefit from a free conversation with our debt specialists. We may be able to help lower your monthly payments or even become debt-free. If you are looking for consolidation loans but have bad credit, our debt settlement program might be perfect for you!

We understand what it's like to have your back against the wall with high-interest rates on your existing debts from creditors or your monthly payments that are out of your reach.

We are experts at debt negotiation so call to work out a custom plan for your financial situation.

We do not require loans - we negotiate to reduce interest rates, offer helpful resources, and a low total monthly payment with no upfront fees. We can help you eliminate debt faster and improve your personal finances.

The Pacific Debt's program works by you depositing an agreed monthly payment amount in your very own escrow bank account. As you build up sufficient funds, we pay off your settled accounts.

The program usually takes between 2-4 years to complete because everyone's financial situation is different.

Take time to understand how debt settlement programs work and all your Maryland relief options.

What to expect from our Maryland Debt Settlement Program

- Affordable monthly payments based on your budget

- Resolve your situation in 2-4 years

- No upfront fees with low monthly fees- fees vary from 15-25% of the total enrolled amount and state of registration.

- Personal attention from our Client Success team

- Repayment plan and possibly lower interest rates.

- Excellent Customer Service & Support

- We negotiate decreased balances and lower interest rates

- We don't lend money and your financial data is safe with us!

Who qualifies for debt settlement?

You must meet the following:

- Outstanding balances of at least $10,000 in unsecured debts (credit card bills, payday loans, personal loans, doctor bills, collections and repossessions, business debts, and some student loans).

- Difficulties making minimum payments.

We are not a full balance debt resolution option. As a result, there are some tax consequences. Before pursuing debt settlement, discuss potential tax consequences with a tax professional.

We are also not a law firm and are not giving legal advice.

Pacific Debt Accreditation

Pacific Debt Relief is proud to be accredited by the following organizations.

- The International Association of Professional Debt Arbitrators

- The Consumer Debt Relief Initiative

- Better Business Bureauau

Maryland Debt Relief Testimonials

BBB of Maryland

Pacific Debt Relief is an A+ rated Business with the BBB for debt negotiation services to individuals and families struggling with unsecured debt. We have been accredited since 2010 and in business since 2002.

We have helped countless people struggling to pay their credit card balances. Our debt specialists can help you with a FREE consultation.

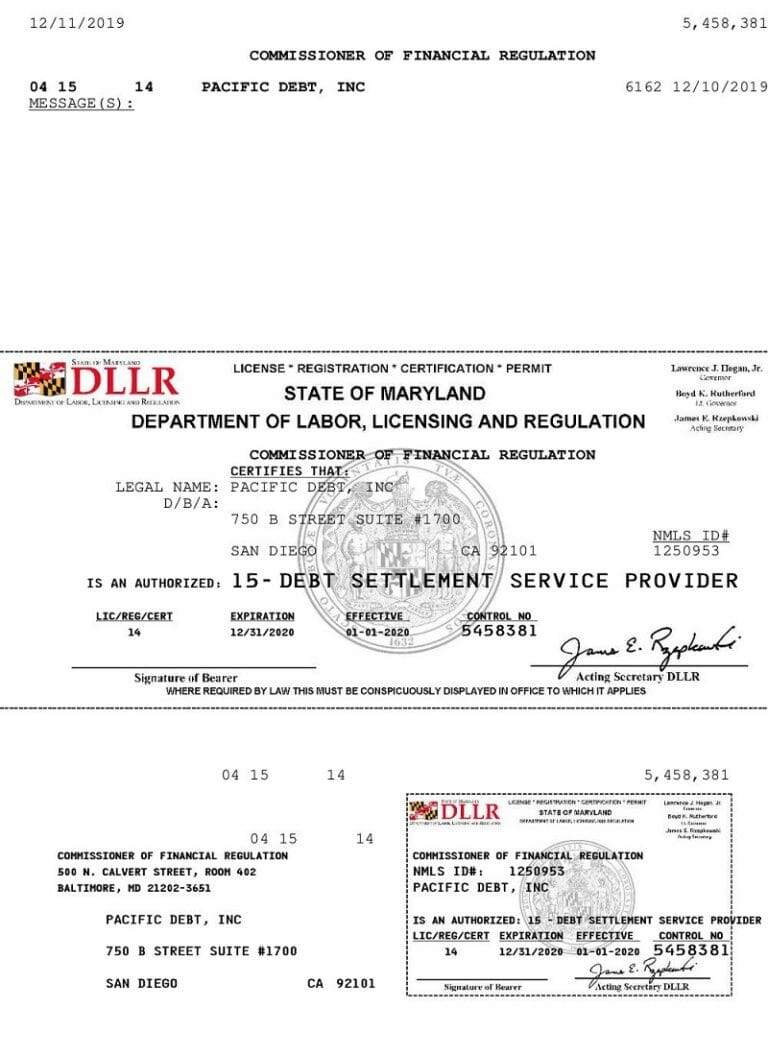

Debt Consolidation Maryland Department of Labor 2020 Licensing & Regulation

View the List of Official Debt Settlement Service Providers located in the state of Maryland.

See the Updated State Laws regarding Debt Settlement

The State of Maryland

Maryland offers an incredible history, notable people, and scenery from the ocean to the Appalachians. The Chesapeake Bay is at the heart of the state and our national anthem was inspired at Fort McHenry. Maryland has a diverse economy that supports the federal government, military, and some manufacturing. Maryland is ranked #19 for population and #5 for population density.

As of 2018, over 6 million people called Maryland home. Baltimore is the largest city in Maryland.

Maryland Income

The median state income is $78,945. As of 2018, the minimum wage is $10.10 per hour. Unfortunately, 12.4% of Marylander children under 18 live in poverty. For residents overall, 9.7% of all people in Maryland live under the poverty level.

- Median state income: $78,945

- Minimum wage: $10.10/hour

- Children in poverty: 12.4%

- People in poverty: 9.7%

Is Maryland a Community Property State?

Maryland is not a community property state. Therefore your assets are not seen as equally owned by you and your spouse. Currently, there are only 9 states that are community property state including Louisiana, Arizona, California, Texas, Washington, Idaho, Nevada, New Mexico, and Wisconsin.

In the state of Maryland, the judge will decide which assets are shared by you and your spouse, and what the equity is for each.

Homeowners in Maryland

More than half (66.9%) of Marylanders hold a mortgage. The median home price in Kentucky is $284,000 (2018). Of course, that median price depends on the location with some areas being much higher.

- Homeowner rate: 66.9%

- Median home price: $284,000

Employment in Maryland

Maryland has a current unemployment rate of 4.3%. However, the underemployment rate is 8.1%. Underemployment is the percentage of civilian workers who are unemployed, employed part-time or are not seeking employment.

If this is you, we can help. Pacific Debt offers Maryland debt relief solutions tailored to your unique situation and budget. Our certified counselors help you work up a budget and explain your options.

- Unemployment: 4.3% (2018)

- Underemployment: 8.1% (2017)

Maryland Debt Statistics

Maryland residents carry a lot of debt. The average credit card debt is $7,913 (2018). The average student loan debt is $27,672. In addition, Maryland is in the top 10 states with the highest average mortgage debt. When you add all that debt on top of the cost of homes (rental or owned), versus the median income, it is very easy for Maryland consumers to get into debt.

- Avg credit card debt: $7,913 (2018)

- Avg mortgage debt: $256,744(2017)

- Avg student loan debt: $27,672 (2017)

Statute of Limitations in Maryland

Maryland’s statute of limitations lays out maximum time periods that debt collectors can take action against a delinquent debt. These statutes of limitations begin on the date that your debt goes delinquent.

For debts taken out in Maryland, the following are the statutes of limitations for different types of debt.

- Oral agreements: 3 years

- Written contracts: 3 years

- Promissory notes: 12 years

- Credit cards and other revolving loans: 3 years

Maryland Debt Relief & Consolidation

If you have more debt than you can pay off, Pacific Debt can help you consolidate your debt and learn to live debt free. We are a nationally top ranked debt relief company located in San Diego.

We will help you work through our proven and comprehensive relief program. Your certified debt settlement counselor will review all your options.

If debt settlement is right for you, we move forward with our settlement plan and work to save money on your enrolled unsecured debt like credit card accounts and medical bills.

It is not an easy process and it won't happen overnight, but you can do it. Pacific Debt will be there every step of the way to help.

We will help you work through our proven program that involves one monthly payment into a savings account.

Debt Collection Laws in Maryland

Marylanders are protected against unscrupulous debt collectors. The federal Fair Debt Collection Practices Act (FDCPA) prohibits debt collectors from using abusive or harassing bill collection practices.In addition, the Maryland Fair Debt Collection Practices Act (MFDCPA) adds protections against more types of collectors and actions. If you are a victim of any of these actions, you may take legal action against them.

Overall, debt collectors can NOT:

- Charges more than 10% interest

- Garnish more than 25% of wages

- U se/threaten physical force or criminal tactics to harm you, your property, or your reputation

- Accusing you of committing a crime for not paying the debt

- Make/threaten to make defamatory statements to someone else

- Threaten arrest, to seize assets, or garnish wages unless actually planning to take such action

- Use obscene or profane language

- Cause you to spend money you wouldn’t otherwise have spent (ie long-distance telephone calls)

- Call you repeatedly or let your phone ring repeatedly

- Call frequently

- Contact your employer, except to verify employment or health insurance status, garnish wages or locate you

- Reveal information about debt to anyone except your spouse or your parents if a minor.

- Publicly publish your name for failing to pay

- Send a postcard or letter with revealing information on the envelope

- Claim to be someone other than a debt collector, including a governmental official

- Use stationery that appears to be from a law firm

- Charge you collection or attorney’s fees unless legally allowable

- Threaten to report you to a credit reporting agency if they have no intention of doing so

- Send a letter claiming to come from a claim, credit, audit, or legal department unless it actually is

Debt collectors must:

- Disclose caller identification

- May contact your family to locate you

- Must serve you with notice of a lawsuit if suing you

MD Bankruptcy Court Information

Bankruptcy is a legal action that can erase most of your debt as well as your credit history.

DISCLAIMER: We are not lawyers and are not giving legal advice. Before filing bankruptcy, talk to a lawyer in your state.

The information included on this site is for educational purposes only.

Your state may not qualify for the Pacific Debt, Inc debt relief program. If it does not qualify, we can refer you to a Trusted Partner or assist in connecting you with a provider who offers servicing in your state of residence.

Pacific Debt Relief

We are a nationally top-ranked company specializing in debt settlement and we have helped countless Maryland residents with our national program. Contact our professional debt negotiators today so we can help you too!

Call us and ask our award-winning debt specialists about our settlement program and how it can help you reduce debt faster.

Since we are a national debt relief company, we may be able to help your relatives as well. If we cannot, we will refer you to other programs including debt consolidation programs that we trust.

Other Debt Relief Programs

We are a debt settlement company and have discussed debt settlement in detail. Click here to learn more about debt settlement.

We want you to understand your options and reach financial stability. These include debt consolidation, credit counseling, and bankruptcy.

Read all program materials prior to enrolling with any program.

Debt Consolidation program

Debt consolidation works to consolidate debt by rolling all debt into a low interest rate debt consolidation loan, often home equity loans, or work with a debt consolidation company to set up a consolidation plan.

Click here to learn more about debt consolidation and finding a debt consolidation loan.

Credit Counseling

Credit counseling helps you learn money management including developing a budget, helping you understand your credit score, and set up a debt management program. Look for professional credit counselors from a non-profit credit counseling organization.

Click here to learn more about Credit Counseling.

File Bankruptcy

Filing bankruptcy is a last resort option – this legal action wipes out most of your total debt, severely damages your credit for up to ten years, and is expensive and time-consuming.

Click here to learn more about bankruptcy.

Avoid credit repair services as there is nothing they can do that you cannot do for yourself to improve your credit report.

Contact Pacific Debt today so we can help you with your creditors.

Debt Collection Laws

Maryland s have laws to protect them against unscrupulous debt collectors. The federal Fair Debt Collection Practices Act (FDCPA) prohibits debt collectors from using abusive or harassing bill collection practices.

In addition, the Maryland Fair Debt Collection Practices Act adds protection against more types of collectors and actions. If you are a victim of any of these actions, you may take legal action against them.

Providing Debt Relief to Maryland Cities

Aberdeen

Adelphi

Arbutus

Aspen Hill

Barnesville

Bel Air South

Berwyn Heights

Boonsboro

Brandywine

Brookmont

Burkittsville

Calvert Beach-Long Beach

Cape St. Claire

Catonsville

Chance

Chesapeake City

Cheverly

Chevy Chase Section Three village

Chillum

Clear Spring

Cockeysville

Columbia

Cresaptown-Bel Air

Cumberland

Deale

Denton

Dunkirk

East Riverdale

Edmonston

Elkton

Fairland

Federalsburg

Forestville

Fountainhead-Orchard Hills

Friendship Village

Funkstown

Garrett Park

Glenarden

Goddard

Grasonville

Green Haven

Halfway

Havre de Grace

Highfield-Cascade

Hillsboro

Hurlock

Jessup

Kensington

Kingsville

Landover Hills

La Plata

Laytonsville

Linganore-Bartonsville

Lonaconing

Lutherville-Timonium

Marlton

Maugansville

Middletown

Mitchellville

Mountain Lake Park

Mount Vernon

New Carrollton

North Bethesda

North Kensington

Ocean City

Overlea

Oxon Hill-Glassmanor

Pasadena

Pikesville

Poolesville

Potomac Heights

Pumphrey

Redland

Riva

Robinwood

Rosaryville

Rossville

St. Michaels

Seat Pleasant

Severna Park

Silver Spring

Solomons

South Laurel

Sudlersville

Taneytown

Tilghman Island

Union Bridge

Waldorf

Westernport

West Pocomoke

White Oak

Woodlawn CDP (Baltimore County)

Aberdeen Proving Ground

Algonquin

Arden-on-the-Severn

Ballenger Creek

Barton

Beltsville

Bethesda

Bowie

Brentwood

Brookview

Burtonsville

Calverton

Capitol Heights

Cavetown

Charlestown

Chesapeake Ranch Estates-Drum Point

Chevy Chase

Chevy Chase View

Church Creek

Clinton

Colesville

Coral Hills

Crisfield

Damascus

Deal Island

Discovery-Spring Garden

Eagle Harbor

Eden

Eldersburg

Ellicott City

Fairmount

Ferndale

Fort Meade

Frederick

Friendsville

Gaithersburg

Garrison

Glen Burnie

Golden Beach

Greater Landover

Greensboro

Hampstead

Hebron

Highland Beach

Hillsmere Shores

Hyattsville

Joppatowne

Kent Narrows

Kitzmiller

Langley Park

Largo

Leitersburg

Linthicum

Londontowne

Manchester

Martin's Additions village

Mayo

Midland

Montgomery Village

Mount Airy

Myersville

New Market

North Brentwood

North Laurel

Ocean Pines

Owings

Paramount-Long Meadow

Perry Hall

Pittsville

Port Deposit

Preston

Queen Anne

Reisterstown

Riverdale Park

Rock Hall

Rosedale

St. Charles

Salisbury

Secretary

Shady Side

Smith Island

Somerset

Springdale

Suitland-Silver Hill

Temple Hills

Towson

University Park

Walker Mill

West Laurel

Whaleyville

Willards

Woodlawn CDP (Prince George's County)

Accident

Andrews AFB

Arnold

Baltimore

Bel Air

Bennsville

Betterton

Bowleys Quarters

Brookeville

Brunswick

Cabin John

Cambridge

Carmody Hills-Pepper Mill Village

Cecilton

Charlotte Hall

Chester

Chevy Chase

Chevy Chase Village

Church Hill

Clover Hill

College Park

Cordova

Crofton

Dames Quarter

Deer Park

District Heights

East New Market

Edgemere

Eldorado

Emmitsburg

Fairmount Heights

Forest Glen

Fort Ritchie

Frenchtown-Rumbly

Frostburg

Galena

Germantown

Glen Echo

Goldsboro

Greater Upper Marlboro

Green Valley

Hampton

Henderson

Hillandale

Hughesville

Indian Head

Keedysville

Kettering

Lake Arbor

Lanham-Seabrook

Laurel

Leonardtown

Lochearn

Luke

Mardela Springs

Marydel

Mays Chapel

Milford Mill

Morningside

Mount Lena

Naval Academy

New Windsor

North Chevy Chase village

North Potomac

Odenton

Owings Mills

Parkville

Perryman

Pleasant Hills

Port Tobacco Village

Prince Frederick

Queenstown

Ridgely

Riverside

Rockville

Rosemont village

St. James

San Mar

Selby-on-the-Bay

Sharpsburg

Smithsburg

South Gate

Stevensville

Sykesville

Templeville

Trappe

Upper Marlboro

Walkersville

Westminster

Wheaton-Glenmont

Williamsport

Woodmore

Accokeek

Annapolis

Ashton-Sandy Spring

Barclay

Bel Air North

Berlin

Bladensburg

Braddock Heights

Brooklyn Park

Bryans Road

California

Camp Springs

Carney

Centreville

Chesapeake Beach

Chestertown

Chevy Chase Section Five village

Chewsville

Clarksburg

Cloverly

Colmar Manor

Cottage City

Crownsville

Darnestown

Delmar

Dundalk

Easton

Edgewood

Elkridge

Essex

Fallston

Forest Heights

Fort Washington

Friendly

Fruitland

Galestown

Girdletree

Glenn Dale

Grantsville

Greenbelt

Hagerstown

Hancock

Herald Harbor

Hillcrest Heights

Huntingtown

Jarrettsville

Kemp Mill

Kingstown

Lake Shore

Lansdowne-Baltimore Highlands

La Vale

Lexington Park

Loch Lynn Heights

Lusby

Marlow Heights

Maryland City

Middle River

Millington

Mount Aetna

Mount Rainier

Newark

North Beach

North East

Oakland

Olney

Oxford

Parole

Perryville

Pocomoke City

Potomac

Princess Anne

Randallstown

Rising Sun

Riviera Beach

Rohrersville

Rossmoor

St. Leonard

Savage-Guilford

Severn

Sharptown

Snow Hill

South Kensington

Stockton

Takoma Park

Thurmont

Travilah

Vienna

Washington Grove

West Ocean City

White Marsh

Wilson-Conococheague

Woodsboro

Disclaimer: In some states, PDR may not be able to offer our services directly due to state regulations related to debt settlement. In those instances, PDR will refer you to a reputable debt relief provider or attorney firm for assistance with your debt. We are not lawyers and are not giving legal advice. Before filing bankruptcy, talk to a lawyer in your state. The information included on this site is for educational purposes only.

Do Not Sell My Personal Information

Do Not Sell My Personal Information