Texas Debt Relief Reviews

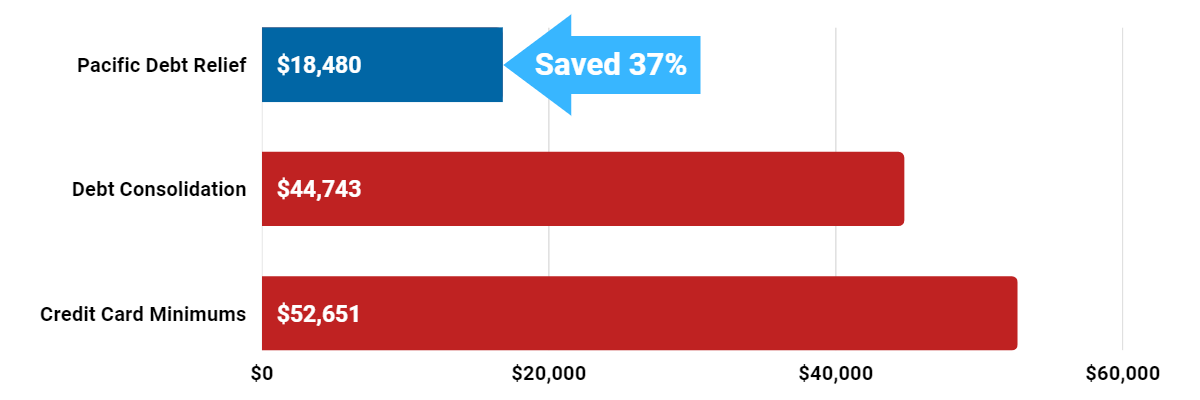

Reduce Your Credit Card Debt By Up To Half

Pacific Debt Relief offers the only solution that significantly reduces your debt to less than you currently owe. That means you get debt-free in a fraction of the time it would take with other options.

Save thousands by lowering your debt balance and wiping away years of future interest and payments. Call us today for a FREE consultation!

Texas Debt Relief Reviews

We are one of the leading debt settlement companies in the US. Pacific Debt has helped thousands of people reduce their outstanding balances, including credit card debt and personal loans. Since 2002, we've settled a national average of over $300 million in debt for our clients.

Customer Review Highlights

"Pacific Debt Relief helped me finally become debt-free after years of struggling. Their debt specialists worked with me to create a customized program that fit my budget. I can't thank them enough!" - James, Houston

"As a Texas resident overwhelmed by high-interest credit card debt, I turned to Pacific Debt Relief for help. They negotiated with my creditors to substantially lower my debt. I'm now on track to be debt-free!" - Sarah, Austin

"If you're looking for honest Texas debt relief reviews, look no further. Pacific Debt Relief provides 5-star service in helping Texas residents like me reduce debt." - Chris, Dallas

We have more Texas debt relief reviews from our customers to read in cities like Dallas, Austin, and Houston.

Get a FREE consultation with no obligation. We can help you reduce your debt.

Pacific Debt Relief Customer Reviews and Accreditation

Pacific Debt Relief, located at 750 B Street Suite 1700 San Diego, CA 92101, is an A+ rated business by the Better Business Bureau with over 797 positive reviews and a rating of 4.92 stars out of 5. We have helped thousands of Texas residents substantially reduce their debt since 2002 through our customized Texas debt relief program.

As one of the top debt settlement companies in Texas, Pacific Debt Relief has extensive experience navigating the unique financial challenges faced by Texas residents. Our dedicated debt specialists work tirelessly to negotiate with creditors on your behalf, seeking to lower your overall debt and reduce your interest rates. And, as part of our commitment to transparent pricing, we ensure our fees are clear and upfront, so you always know where you stand.

Start your journey towards financial freedom with Pacific Debt Relief, a trusted leader in Texas debt relief. Contact us today for a free consultation with no obligation so we can help you too!

Pacific Debt Relief is proud to be accredited by the following organizations.

- The International Association of Professional Debt Arbitrators

- The Consumer Debt Relief Initiative

- Better Business Bureau

In addition, the Federal Trade Commission, a government program, oversees debt settlement companies and debt consolidation companies.

Always check the accreditation of debt settlement companies as there are debt relief scams.

What Texas Consumers can expect from our Debt Settlement Services

Pacific Debt Relief provides debt settlement services to Texas residents struggling with unsecured debt like credit cards, personal loans, and medical bills. Our team has settled over $300 million in debt nationwide.If you're searching for debt consolidation or debt management plans in Texas, contact us today for a free consultation.

Our debt specialists will work with you each step of the way to:

- Create a single affordable monthly payment based on your budget

- Resolve your debt in 24-48 months on average

- Provide personal support from a dedicated account manager

- Negotiate with your creditors for reduced balances and interest rates

Avoid debt relief scams - work only with reputable companies like Pacific Debt Relief. As an accredited member of the Consumer Debt Relief Initiative (CDRI), we pride ourselves on transparent pricing and stellar customer service. Contact us today to start your path to financial freedom.

We'll review your financial situation and recommend the best debt relief option for you.

- A single monthly payment based on your budget

- Resolve your situation in 2-4 years, based on national average

- No fees upfront - fees vary from 15-25% of the total enrolled amount and state of registration-- and low monthly fees as well!

- Personal attention from our Client Success team

- Develop a debt management plan and lower negotiated rate and possibly decreased interest rates. This is not full balance debt resolution.

- Excellent Customer Service & Support

- We negotiate decreased balances and lowered interest rate with individual creditors

- We don't lend money and your financial data is safe with us!

While bankruptcy may seem easier than our debt settlement program, the after-effects of bankruptcy will last at least ten years and can result in poor credit ratings and less than a good credit score.

Texas Debt Relief Specialties

As a leading provider of Texas debt relief, Pacific Debt has extensive experience navigating the unique financial challenges faced by Texas residents. From the bustling cities of Houston and Dallas to the rural expanses of West Texas, we understand the diverse economic pressures and work to tailor our debt relief strategies to fit your individual circumstances.

With our Texas debt relief program, you're not just a number—you're a valued client. We strive to make the process of reducing your debt as straightforward as possible, giving you the peace of mind to focus on what matters most. Our dedicated professionals work tirelessly to negotiate with creditors on your behalf, seeking to lower your overall debt and reduce your interest rates. And, as part of our commitment to transparent pricing, we ensure our fees are clear and upfront, so you always know where you stand.

Start your journey towards financial freedom with Pacific Debt, a trusted leader in Texas debt relief.

Texas Bankruptcy Information

If you're struggling with overwhelming debt, bankruptcy may seem like an option. However, it's important to understand the pros and cons of bankruptcy before pursuing it.

At Pacific Debt Relief, we take a personalized approach to assess all of your debt relief options, not just bankruptcy. Our debt specialists will explain alternatives like debt consolidation and settlement, and help you determine if bankruptcy is the right choice for your unique situation.

If you do decide bankruptcy is best, we will walk you through the complex process. Our partners can refer you to reputable bankruptcy lawyers and trustees to handle the filing details. With decades of experience, we have the knowledge to guide you through Chapter 7 or Chapter 13 efficiently.

Don't go through the bankruptcy process alone. Lean on the expertise of Pacific Debt Relief to understand if bankruptcy is right for you, and handle the process smoothly. Contact us at for a free consultation today.

Please let me know if you have any other feedback or if there are additional existing sections you would like me to optimize next.

Chapter 7 Bankruptcy

Filing for

Chapter 7 bankruptcy in Texascan provide you with a fresh start by discharging most of your unsecured debt. This means that you usually will not be legally obligated to pay any of your remaining debt, including credit card bills, medical bills, and personal loans. In addition, as part of the bankruptcy process, some or all of your property may be sold in order to repay your creditors.

However, before filing for Chapter 7 bankruptcy in Texas it is important to consider whether you are eligible for bankruptcy and whether it is the right option for you.

Chapter 13 Bankruptcy

Chapter 13 is a reorganization bankruptcy, which means that you'll have to make monthly payments to your creditors over a period of three to five years. This is typically the best option for people who have a regular income and significant debts.

Click here for more information about

Chapter 13 Bankruptcy in Texas.

Common Questions

Successful Debt Settlement Case Studies & Reviews

Don't just take our word for it - read real reviews from Pacific Debt Relief clients in Texas and across the nation:

I am having a very difficult time paying the debt down while dealing with high interest rates and the balances.

Location: Houston, Texas

I am current on my accounts and now I need to get out of debt. I want a payment that will be affordable and allow me to be debt free quickly.

Location: Dallas, Texas

Better Business Bureau of Texas

Pacific Debt Relief is an

A+ rated Business with the Better Business Bureau for

debt negotiation services to individuals and families struggling with unsecured debt. We have been

accredited since 2010 and in business since 2002. We specialize in the settlement of unsecured debts.

We have helped thousands of people in Texas with accredited debt relief. Call us today, we can help you too! We can help you understand all your financial options and create a debt management plan with our debt settlement specialists. If you do not live in Texas, we are a national debt relief company.

Read our

national debt relief reviews and case studies to see how Pacific Debt helped people eliminate their existing debts. We have a staff of dedicated debt settlement negotiators who are ready to help you negotiate with your creditors. We also have

reviews from our Texas debt relief customers available for you to read.

Be aware that your credit report and average credit score may take a hit during a debt settlement program as you will be stopping payments, but should recover with time.

Take a look at our debt relief reviews from verified customers. Be alert for debt relief scams by checking out each program carefully!

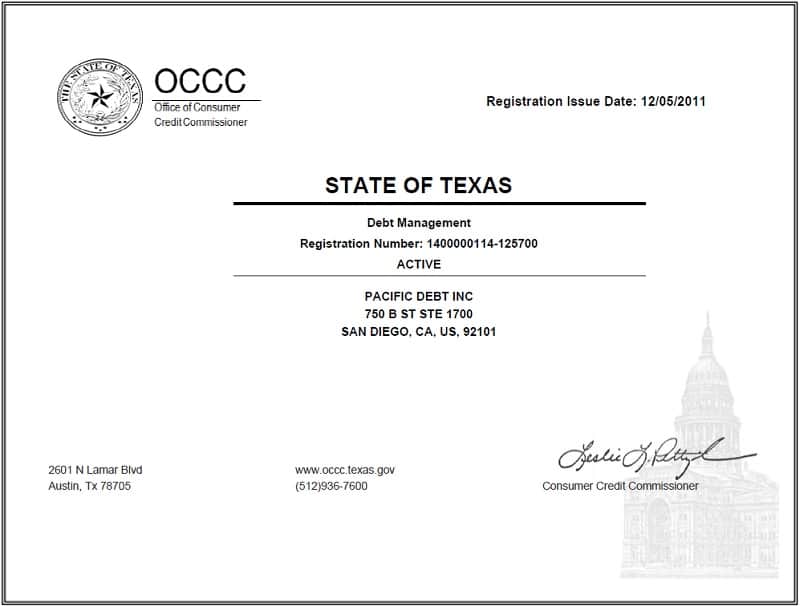

Texas Office of Consumer Credit Commissioner Business Search

Helpful Links for Consumers and Licensees

View our Pacific Debt Inc 2020 State of Texas Debt Management Registration

Texas Debt Relief Help

Click here to get your FREE Consultation & Savings Estimate, or call us at

800-909-9893

We can help you and your family with debt relief in the state of Texas. We are also a national company and have contacts all over the US.

Remember, we offer a free consultation and offer a free analysis. You may also want to enroll in a nonprofit credit counseling program.

The State of Texas

Texas is the second-largest state in both population and size. Texas’ GDP is larger than Australia’s and comes from abundant natural resources. Texas is ranked #32 for population and #40 for population density.

As of 2018, over 27 million people called Texas home. Houston is the largest city in Texas.

Income in Texas

The median state income in Texas is $56,565. As of 2018, the minimum wage is $7.25 per hour. Unfortunately, 22.2% of Texan children under 18 live in poverty. For residents overall, 15.6% of all people in Texas live under the poverty level.

As of 2018, over 27 million people called Texas home. Houston is the largest city in Texas.

- Median state income: $56,565

- Minimum wage: $7.25/hour

- Children in poverty: 22.2%

- People in poverty: 15.6%

Homeowners in Texas

Many Texans, more than half (61.7%) hold a home mortgage. The median home price in Texas is $185,900. (2018). Of course, that median price depends on the location with some areas being much higher.

- Homeowner rate: 61.7%

- Median home price: $185,900

Employment in Texas

Texas residents have a current employment rate of 4.0%. However, the underemployment rate is 8.6%. Underemployment is the percentage of civilian workers who are unemployed, employed part-time, or are not seeking employment.

If this is you, we can help. Pacific Debt Relief offers debt settlement solutions tailored to your unique situation and budget. Our certified counselors help you work up a budget and explain your options.

- Unemployment: 4.0% (2018)

- Underemployment: 8.6% (2017)

Texas Debt Statistics

The average Texan carries a lot of debt as far as their average credit card balance. The average credit card debt in the lone star state is $7,692 (2018). The average student loan debt is $26,236. When you add all that debt on top of the cost of homes (rental or owned), versus the median income, it is very easy for Texans to get into debt.

- Average credit card debt: $7,692 (2018)

- Average mortgage debt: $166,762 (2017)

- Average student loan debt: $26,236 (2017)

Texas Statute of Limitations

Texas’ statute of limitations lays out maximum time periods that debt collectors can take action against a delinquent debt. These statutes of limitations begin on the date that your debt goes delinquent.

For debts taken out in Texas, the following are the statutes of limitations for different types of debt.

- Oral agreements: 4 years

- Written contracts: 4 years

- Promissory notes: 4 years

- Credit cards and other revolving loans: 4 years

Texas Debt Consolidation & Debt Relief Program

If you have more debt than you can pay off, Pacific Debt can help you with debt settlement and learn to live debt-free. Since 2002, we've settled over $200 million in debt for thousands of clients.

We are a nationally top-ranked company specializing in debt settlement and we have helped countless Texas residents with our national debt relief. Contact us today so we can help you too! Remember we offer free debt analysis and can recommend a good credit counseling agency.

We will help you work through our proven and comprehensive debt negotiation program that involves monthly payments into a savings account. We may encourage you to enroll in a debt management plan. Your certified debt settlement counselor will review all your debt options.

If debt settlement is right for you, we move forward with our debt consolidation program and work to save you money. Pacific Debt can help with most unsecured debt like credit cards, medical bills, and repossessions.

It is not an easy process and it won't happen overnight, but you can do it. Pacific Debt will be there every step of the way to help. Call us and inquire about our TX debt settlement program and how it can help you reduce debt faster.

Since we are a national debt relief program, we may be able to help your relatives as well. If we can not, we will refer you to other debt relief companies including debt consolidation programs, that we trust. We are one of the best debt settlement companies and we want you to be able to trust our recommendations.

How Pacific Debt Relief Can Help You

We are a Texas debt settlement company that has a reputable track record of helping people with our negotiation program. If you are currently searching the internet for services like debt consolidation, debt consolidation loans, auto loan debt, debt settlement, credit counseling programs, and debt management plans then you should benefit from our FREE consultation.

Our free consultation is basically a free debt analysis that goes over everything, including your income, interest rate, existing debts and their debt amount, income taxes, and credit score to try to see how we can lower your debt and how much money you can save from our debt negotiation program.

If you have overwhelming debt and are finding it difficult to pay even the monthly minimum payments on time each month, give us a call and have a Texas debt specialist help explain all your options and the debt solutions that are available. We work directly with the credit card companies on your behalf to resolve debt.

Disclaimer: In some states, PDR may not be able to offer our services directly due to state regulations related to debt settlement. In those instances, PDR will refer you to a reputable debt relief provider or attorney firm for assistance with your debt. We are not lawyers and are not giving legal advice. Before filing bankruptcy, talk to a lawyer in your state. The information included on this site is for educational purposes only.

Do Not Sell My Personal Information

Do Not Sell My Personal Information