Virginia Debt Relief Company

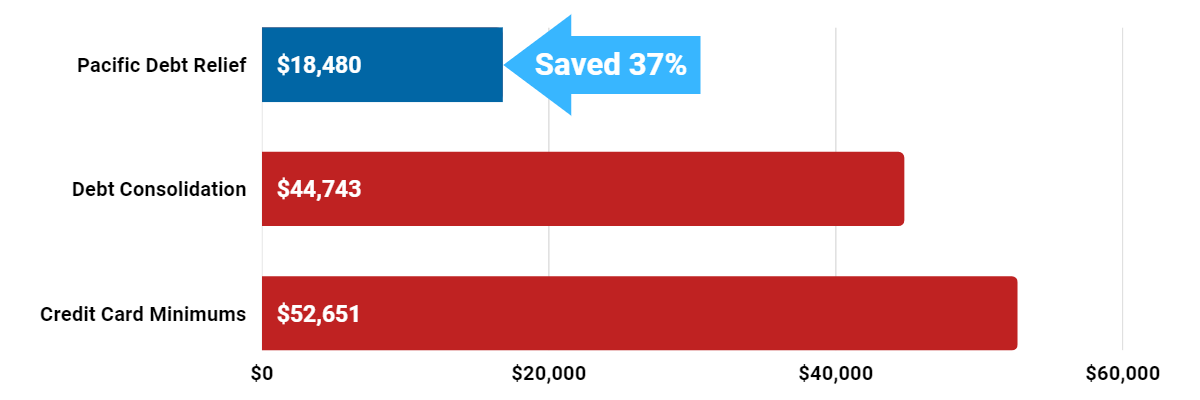

Reduce Your Credit Card Debt By Up To Half

Pacific Debt Relief offers the only solution that significantly reduces your debt to less than you currently owe. That means you get debt-free in a fraction of the time it would take with other options.

Save thousands by lowering your debt balance and wiping away years of future interest and payments.

Call us today for a FREE consultation!

What is Virginia Debt Relief?

Debt relief is the relief of unsecured debt, like consumer debt and some student loan debt.

Pacific Deb Relief is a leading debt settlement company located in San Diego, California with an excellent track record and reputation. We negotiate with your creditors to lower the amount you owe.

Get a FREE consultation today with no obligation. We will help explain all your options so you can understand them.

The program is aimed at getting Virginia residents to settle debt for substantially less than what they currently owe. This relief program usually takes anywhere between 2-4 years to complete and Pacific Debt will be dealing directly with your creditors while guiding you throughout the entire process.

The secret to settlement is that you have to stop paying your bills in order to make creditors willing to negotiate. This action can come with late fees and collector phone calls.

Debt settlement is a great option to have when you are facing pressure from bill collectors and creditors. We know what it's like to have high-interest rates for unsecured loans and medical bills.

Debt settlement does come with some credit score damage. Your settlement may stay on your credit report for up to seven years. You should consider settlement for bills that are very delinquent or already in collections as the damage is already done to your score. Most people considering debt relief so not have a high credit score.

Most people who successfully complete our debt settlement plan can see rapid improvements to their credit scores.

If you live in the state of Virginia and are looking for your best option for reducing what you owe, call us today. Our experts will help guide and explain all your options so you understand them well. Our settlement program can be custom tailored to fit your budget.

We understand what it is like to be unable to pay your creditor bills because of high-interest rates or just being unable to make the monthly payment for your unsecured loans. Whether it be credit card debt, student loan debt, or payday loan debt, we want you to know we are here to help!

If you're a Virginia resident and want to speak to one of our VA debt management experts to help you understand all your options regarding debt and how we can help you reduce your unsecured debts. We will provide a free debt analysis to help you make an informed decision.

Understanding the Virginia Debt Relief Program

In Virginia, like many states, debt can often become overwhelming for many residents. Recognizing this, the Virginia Debt Relief Program was established from Pacific Debt Relief to provide much-needed assistance.

The Virginia Debt Relief Program is a initiative designed to help Virginians who are struggling with overwhelming debt. This program provides resources, guidance, and support to help residents navigate their financial challenges and work towards becoming debt-free.

The program works by partnering with certified debt relief companies, like Pacific Debt, to provide services such as debt consolidation, debt management, and debt settlement. These services aim to lower your monthly payments, reduce interest rates, and often even reduce the total debt owed.

To be eligible for the Virginia Debt Relief Program, residents must be experiencing financial hardship, typically demonstrated by having unmanageable debt or being unable to meet minimum monthly debt payments. The program is particularly beneficial for those dealing with credit card debt, medical bills, personal loans, and other forms of unsecured debt.

Getting started with the Virginia Debt Relief Program involves reaching out to a participating debt relief company like Pacific Debt Relief. They will provide a free consultation to assess your financial situation and discuss the best options for your specific needs. If you're eligible and choose to enroll, the company will then work with your creditors on your behalf to negotiate lower payments and settle your debts.

It's important to note that while the program can provide significant debt relief, it's not a quick fix and requires commitment and discipline. Participants must be prepared to adjust their spending habits and follow the plan laid out by their debt relief provider.

Pacific Debt is proud to be providing a Virginia Debt Relief Program. We've helped many Virginians reduce their debt and look forward to helping even more. Contact us today for your free consultation and to learn more about how we can help you on your path to becoming debt-free

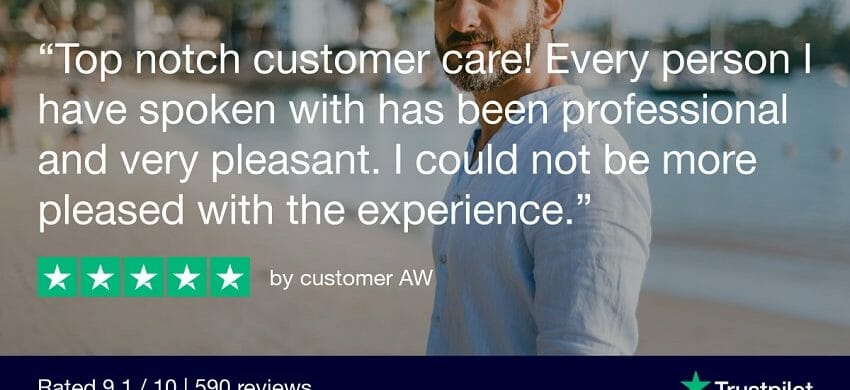

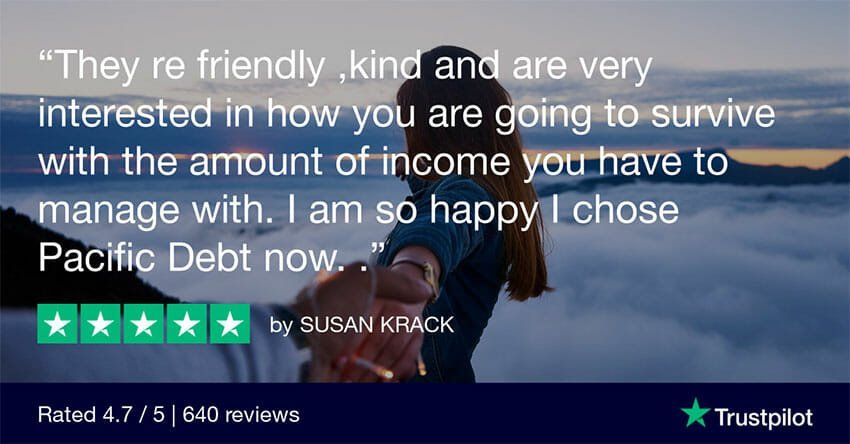

Virginia Debt Relief Reviews

We are one of the leading relief companies in the US. Pacific Debt has helped thousands of people reduce their outstanding balances, including consumer debt like credit card debt and other loans. Since 2002, we've settled a national average of over $300 million in debt for our clients. Contact us today to see how we can help you settle your accounts.

Pacific Debt Relief Accreditation

Pacific Debt is accredited by:

- The Consumer Debt Relief Initiative

- International Association of Professional Debt Arbitrators

- Better Business Bureau

Always check the accreditation as there are debt relief scams.

What Virginia Residents can expect from our Debt Settlement Services

- Monthly payments based on your budget

- Resolve your situation in 2-4 years, based on national average

- No upfront fees and low monthly fees- fees vary from 15-25% of the total enrolled amount and state of registration

- Personal attention from your assigned Account Manager and Certified Debt Counselor

- Develop a management plan and lower negotiated rates and possibly decreased interest rates.

- Excellent Customer Service & Support

- We negotiate decreased balances and lowered interest rate with individual creditors

- We don't lend money and your financial data is safe with us!

- No low interest loan needed

While bankruptcy may seem easier than our debt settlement program, the after-effects of bankruptcy will last at least ten years and can result in poor credit ratings.

Virginia Debt Relief Programs

What are debt relief programs?

Debt relief is the act of reducing the amount you owe your creditors so that you can receive the financial relief you need in order to go about your everyday life. Debt settlement is one form as are services provided by a nonprofit credit counseling agency. We are a national settlement company and have worked with creditors across the US.

We work to decrease the amount you owe including a decreased interest rate from credit card companies. As you save sufficient funds through a single monthly payment, we pay off your settled accounts. You must have funds to be able to put some in savings. You also stop paying creditors for a time, which can result in a low scores.

Avoid credit repair services as there is nothing they can do that you can not do for yourself to improve your credit score.

How do Virginia debt relief programs work?

Pacific Debt provides relief in the form of debt settlement to Virginia residents, as well as national debt relief. If you have unsecured consumer debt like credit card debt, we can help.

Your debt management program requires you to set up and make a monthly payment into a savings account. Check out our debt relief program.

Take time to understand how debt settlement programs work and all your Virginia options.

Is Virginia debt relief a real thing?

Yes, relief is a real thing. It's available through a number of different programs.

The main thing to remember is that you should always research any company or program before you sign up. Make sure you understand the terms and conditions and be aware of any potential scams.

Pacific Debt has helped hundreds of Virginia residents reduce the amount they owe since 2002. If you are living in the state of Virginia, give us a call right away for a consultation so we can help you understand all your debt relief options.

Who qualifies for our program?

You must meet the following:

- You have a total debt of at least $10,000 in unsecured debts (charge cards, payday loans, collections and repossessions, and some student loans).

- You are having difficulties making minimum monthly payments (you'll put what you can afford into a single monthly payment) or making on time payments.

- Live in a state where we can do business. We provide debt settlement in the following states: Alabama, Alaska, Arizona, Arkansas, California, Colorado, District of Columbia, Florida, Idaho, Indiana, Kentucky, Louisiana, Massachusetts, Maryland, Michigan, Minnesota, Missouri, Mississippi, Montana, North Carolina, Nebraska, New Mexico, New York, Oklahoma, Pennsylvania, South Dakota, Texas, Utah, Virginia, Wisconsin

* Since not all states are included, not all applicants can enroll in our company. People in other states can be connected to one of our trusted partners

Call us today for a free savings estimate. Keep in mind that there are some tax consequences as well as temporarily decreased credit scores. Before deciding to pursue debt settlement, always discuss potential tax consequences with a tax professional who can provide you with tax advice.

Virginia Debt Relief Program

Pacific Debt has helped hundreds of people living in Virginia reduce their credit card debt. If you find yourself struggling with your credit card monthly payments or high-interest rates, we can help with our debt relief program! If you live in Virginia and are in serious financial hardship, we can help! We provide debt relief in the form of debt settlement.

We have a lot of customers who find us by searching for "debt consolidation Virginia" but their credit is not at the point where they can obtain a loan. Usually, in this case, the customer will then choose debt settlement over bankruptcy.

Call us for FREE and talk to a debt specialist today to find out all your debt solutions. Our customer service agents are standing by ready to help you.

We now help those residents living in the state of Virginia, including those in northern Virginia. We help eliminate your credit card debt with our debt relief program in the form of debt settlement. If you live anywhere in Virginia, please do not hesitate to call us right away. See how much money we can save you each month. Talk to our debt management experts for free.

Feel free to read more information on debt settlement. If you are looking for a debt consolidation alternative or bankruptcy alternative, contact us right away for immediate help.

Pacific Debt has helped thousands of people reduce their debt. Since 2002, we've settled over $300 million in debt for our clients. Contact us today to see how we can help.

Virginia Debt Relief Testimonials

Our debt relief program can help residents through out Virginia. including Virginia Beach, Norfolk, and Chesapeake.

Virginia Debt Relief Case Studies

I'm going through a divorce and I have fallen behind on payments. I have reached out for assistance through debt settlement to pay off my accounts listed and avoid bankruptcy.

Location: Norfolk, Virginia

I went through a divorce in November of 2015. This caused things to spiral out of control. I had no debt and good credit, now I have debts and bad credit. I want to set a plan in place to resolve my debts once and for all.

Location: Richmond, Virginia

Virginia Better Business Bureau

Pacific Debt is an A+ rated Business with theBetter Business Bureau for debt negotiation services to individuals and families struggling with unsecured debt. We have been accredited since 2010 and in business since 2002. We specialize in settlement of unsecured debts like loans, medical and utility bills, and credit card debt.

We have helped thousands of people in Virginia with accredited debt solutions. Call us today, we can help you too! We can help you understand all your financial options and create a debt management program with our debt settlement specialists.

Read our reviews and case studies to see how Pacific Debt helped people eliminate their total enrolled debt. We have a staff of dedicated negotiators who are ready to help you with debt settlement negotiations with your creditors.

Be aware that your average credit score may take a hit during our program as you will be stopping minimum payments, but should recover with time.

Take a look at our reviews from verified customers to see debt settlement work.

Help for Virginia Residents

Click here to get your FREE Consultation & Savings Estimate, or call us at 800-909-9893

We can help you and your family in the state of Virginia. We are also a national company and have contacts all over the US.

Remember, we offer a free consultation and analysis. You may also want to enroll in a complete credit counseling program.

Pacific Debt is an A+ rated Business with the BBB for debt negotiation services to individuals and families struggling with unsecured debt. We have been accredited since 2010 and in business since 2002.

Pacific Debt offers a FREE Consultation to anyone looking at debt settlement options . Our Virginia Relief Program is designed to try to get you out of debt in 2-4 years.

Click here to get your FREE Debt Consultation & Savings Estimate, or call us immediately for debt relief at 800-909-9893

State of Virginia

Virginia offers an incredible history, notable people, and scenery from the ocean to the Appalachians to the Cumberland Plateau. Virginia has a diverse economy based on the federal government, military, agriculture, and business. Virginia is ranked #12 for population and #14 for population density.

As of 2018, over 8.5 million people called Virginia home. Virginia Beach is the largest city in Virginia.

Pacific Debt offers a FREE Virginia Debt Relief Consultation to anyone looking at debt settlement options . Our Program is designed to try to get you out of debt in two to four years .

Is Virginia a Community Property State?

Virginia is not a community property state or a spousal state. Therefore your assets are not seen as equally owned by you and your spouse. Currently, there are only 10 states (Louisiana, Arizona, California, Texas, Washington, Idaho, Nevada, New Mexico, and Wisconsin) that are community property states. In the state of Virginia, the judge will decide which assets are shared by you and your spouse, and what the equity is for each.

Income in Virginia

The median state income is $68,114. As of 2018, the minimum wage is $7.25 per hour. Unfortunately, 13.9% of Virginian children under 18 live in poverty. For residents overall, 11% of all people in Virginia live under the poverty level.

- Median state income: $68,114

- Minimum wage: $7.25/hour

- Children in poverty: 13.9%

- People in poverty: 11%

Homeowners in Virginia

More than half (67.5%) of Virginians hold a mortgage. The median home price in Virginia is $251,100 (2018). Of course, that median price depends on the location with some areas being much higher.

- Homeowner rate: 67.5%

- Median home price: $251,100

Employment in Virginia

Virginia has a current employment rate of 3.4%. However, the underemployment rate is 9.1%. Underemployment is the percentage of civilian workers who are unemployed, employed part-time or are not seeking employment.

- Unemployment: 3.4% (2018)

- Underemployment: 9.1% (2017)

If this is you, we can help. Pacific Debt offers Virginia debt relief solutions tailored to your unique situation and budget. Our certified counselors help you work up a budget and explain your options.

Virginia Debt Statistics

Virginians carry a lot of debt. The average credit card debt is $7,867 (2018). The average student loan debt is $28,751. In addition, Virginia is in the top 10 states with the highest average mortgage debt. When you add all that debt on top of the cost of homes (rental or owned), versus the median income, it is very easy for Virginians to get into debt.

- Average credit card debt: $7,867 (2018)

- Average mortgage debt: $246,379 (2017)

- Average student loan debt: $28,751 (2017)

Virginia Statute of Limitations

Virginia's statute of limitations lays out maximum time periods that debt collectors can take action against a delinquent account. These statutes of limitations begin on the date that your debt goes delinquent.

For debts taken out in Virginia, the following are the statutes of limitations for different types of debt.

- Oral agreements: 3 years

- Written contracts: 5 years

- Promissory notes: 6 years

- Credit cards and other revolving loans: 6 years

Virginia Debt Relief & Debt Consolidation

If you have more debt than you can pay off, Pacific Debt can help you consolidate your debt and learn to live debt-free. Since 2002, we've settled over $200 million in debt for thousands of clients. We are a nationally top-ranked debt relief company and we have helped countless people in the state of Virginia with debt relief. Contact us today so we can help you too!

We will help you work through our proven and comprehensive debt relief program. Your certified debt relief counselor will review all your options. If debt settlement is right for you, we move forward with our debt consolidation program and work to save you money. Pacific Debt can help with most unsecured debt like credit cards, personal loans, and repossessions.

It is not an easy process and it won't happen overnight, but you can do it. Pacific Debt will be there every step of the way to help. Call us and inquire about our VA debt relief program and how it can help you.

Other Debt Relief Programs

We are a debt settlement company and have discussed the debt settlement process in detail. The quick version is: you (or a company) negotiates with creditors to lower the debt amount of unsecured loans, like credit cards and helps you to save money in order to settle debts. Click here to learn more about debt settlement.

However, we do want you to understand your other options. These include debt consolidation, credit counseling, and bankruptcy.

Debt Consolidation

This option rolls all debt into a single, lower interest rate payment. You apply for a lower interest debt consolidation loan to complete your payment plan or make a lump sum payment, or work with a debt consolidation company. Click here to learn more about debt consolidation.

Credit Counseling

Credit counseling helps you learn money management including developing a budget, helping you understand your credit report, and set up a debt management plan. Click here to learn more about Credit Counseling.

Bankruptcy Filings

This is a last resort option – this legal action wipes out most of your debt, severely damages your credit for up to ten years, and is expensive and time-consuming. Click here to learn more about bankruptcy and bankruptcy filings.

Collection Agency Laws

Virginians are protected against unscrupulous collectors. The federal Fair Debt Collection Practices Act (FDCPA) prohibits collectors from using abusive or harassing bill collection practices.

Disclaimer: In some states, PDR may not be able to offer our services directly due to state regulations related to debt settlement. In those instances, PDR will refer you to a reputable debt relief provider or attorney firm for assistance with your debt. We are not lawyers and are not giving legal advice. Before filing bankruptcy, talk to a lawyer in your state. The information included on this site is for educational purposes only.

Do Not Sell My Personal Information

Do Not Sell My Personal Information