Nebraska Debt Relief

Reduce Your Credit Card Debt By Up To Half

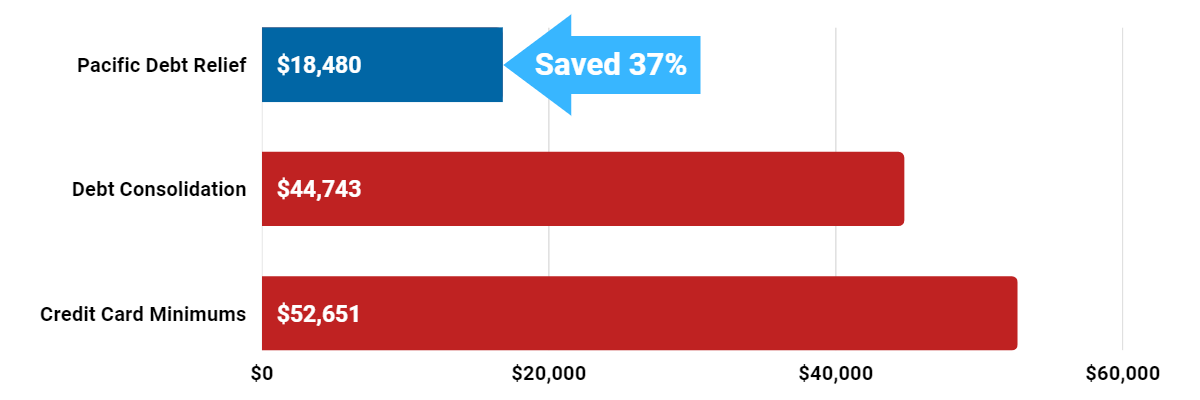

Pacific Debt Relief offers the only solution that significantly reduces your debt to less than you currently owe. That means you get debt-free in a fraction of the time it would take with other options.

Save thousands by lowering your debt balance and wiping away years of future interest and payments. Call today for a FREE consultation!

Nebraska Debt Relief Company

What are Nebraska Debt Relief Programs?

Nebraska debt relief involves debt reduction through debt settlement or consolidation.

Pacific Debt Relief specializes in debt settlement. We work to reduce your debt for less than you owe to your creditors. Most unsecured debts qualify for the Pacific Debt relief option, including credit card debts.

Pacific Debt debt settlement company works by dealing directly with your creditors including credit card companies while guiding you throughout the entire process.

Our best-rated debt settlement programs are available for Nebraskans. Call our certified specialists who will explain all your relief options.

Our free analysis will help you make an informed decision about your unsecured debt and your financial health.

Call to get your free consultation.

How Do Debt Relief Options Work?

Debt relief reduces the amount you owe your creditors so that you can receive relief for your financial future. Debt settlement is one option. Pacific Debt provides relief in the form of debt settlement to Nebraskans, as well as nationally.

The first step for Nebraska residents in finding relief is a FREE phone call with one of our specialists who can lay out all your options, so you understand your position and what steps need to be taken in order to reduce the full amount owed.

Is Debt Relief Legit?

Pacific Debt is a debt relief agency that has helped countless Nebraskans reduce their outstanding full amount and live a better future. Since 2002, we've settled over $300 million in credit card debt for our clients.

Contact us today to see how our debt relief option can help.

Nebraska residents searching a debt consolidation plan or for debt management may benefit from a free conversation with our debt specialists.

We may be able to help lower your monthly payments. If you are looking for consolidation loans but have bad credit, our debt settlement program might be perfect for you!

We are experts at debt negotiation so call for your financial situation.

We do not require a debt consolidation loan. Instead we negotiate to reduce interest rates, offer helpful resources, and a low total monthly payment with no upfront fees.

Get Free Consultation from our award winning debt settlement company

During Pacific Debt's program, you deposit an agreed single monthly payment amount in your own escrow bank account. As you build up sufficient funds, we pay your settled accounts.

Take time to understand how debt settlement programs work and all your relief options.

What New Clients can expect from our Debt Settlement Work

- Affordable monthly payments based on your budget

- Resolve your situation in 2-4 years

- No upfront fees with low monthly fees that vary from 15-25% of the total enrolled amount and state of registration

- Personal attention from your assigned Account Manager

- Repayment plan and possibly lower interest rates.

- Excellent Customer Service & Support

- We negotiate a decreased lump sum payment and lower interest rates

Who qualifies for debt settlement?

You must meet the following:

- Outstanding debt amount of at least $10,000 in unsecured debts (credit card bills, payday loans, personal loans, medical bills, collections and repossessions, and some student loans).

- Difficulty making minimum payments

There are some tax consequences to debt settlement as forgiven amounts are considered income. Before pursuing debt settlement, discuss potential tax consequences with a tax professional.

We are also not a law firm and are not giving legal advice.

Pacific Debt Accreditation

We are accredited by:

- The Consumer Debt Relief Initiative

- International Association of Professional Debt Arbitrators

- Better Business Bureau

Debt Relief Testimonials from Real Clients

Better Business Bureau of Nebraska

Pacific Debt

is an A+ rated business with the BBB. We have been accredited since 2010. We have received 4.87 out of five stars based on 40 client customer reviews with the BBB.

The State of Nebraska

Nebraska is part of the breadbasket of America. The wide-open plains offer many opportunities for agriculture while the largest cities are home to universities specializing in dentistry, research, and, of course, football! Nebraska’s economy is based on agriculture. Nebraska is ranked #37 for population and #43 for population density.

As of 2018, over 1.9 million people called Nebraska home. Omaha is the largest city in Nebraska.

Income in Nebraska

The median state income is $56,927. As of 2018, the minimum wage is $9.00 per hour. Unfortunately, 13.9% of Nebraskan children under 18 live in low income families. For residents overall, 11.4% of all people in Nebraska are considered low income individuals and live under the poverty level.

- Median state income: $56,927

- Minimum wage: $9.00/hour

- Children in poverty: 13.9%

- People in poverty: 11.4%

Is Nebraska a Community Property State?

Nebraska is not a community property state. Therefore your assets are not seen as equally owned by you and your spouse. Currently, only Louisiana, Arizona, California, Texas, Washington, Idaho, Nevada, New Mexico, and Wisconsin are community property states.

In the state of Nebraska, the judge will decide which assets are shared by you and your spouse, and what the equity is for each.

Nebraska Homeowners

More than half (66.1%) of Nebraskans hold a mortgage. The median home price in Nebraska is $175,500 (2018). Of course, that median price depends on the location with some areas being much higher.

- Homeowner rate: 66.1%

- Median home price: $175,500

Employment in Nebraska

Nebraska has a current unemployment rate of 2.8%. However, the underemployment rate is 6.2%. Underemployment is the percentage of civilian workers who are unemployed, employed part-time or are not seeking employment.

If this is you, we can help. Pacific Debt offers Nebraska debt relief solutions tailored to your unique situation and budget. Our certified counselors help you work up a budget and explain your options.

- Unemployment: 2.8% (2018)

- Underemployment: 6.2% (2017)

Nebraska Debt Statistics

Nebraskans carry a lot of debt. The average credit card debt is $6,180 (2018). The average student loan debt is $$26,082. When you add all that debt on top of the cost of homes (rental or owned), versus the median income, it is very easy for Nebraskans to get into debt.

- Avg credit card debt: $6,180 (2018)

- Avg mortgage debt: $136,882 (2017)

- Avg student loan debt: $26,082 (2017)

Nebraska Statute of Limitations

Nebraska’s statute of limitations lays out maximum time periods that debt collectors can take action against a delinquent debt. These statutes of limitations begin on the date that your debt goes delinquent.

For debts taken out in Nebraska, the following are the statutes of limitations for different types of debt.

- Oral agreements: 4 years

- Written contracts: 5 years

- Promissory notes: 5 years

- Credit cards and other revolving loans: 5 years

We are not a law firm and are not offering advice. Contact a law office.

Nebraska Debt Relief & Debt Consolidation

If you have more debt than you can pay off, Pacific Debt can help you consolidate your debt and learn to live debt free. Since 2002, we’ve settled over $200 million in debt for thousands of clients. We are a nationally top ranked debt relief company located in San Diego.

We will help you work through our proven and comprehensive debt relief program. Your certified debt relief counselor will review all your options. If debt settlement is right for you, we move forward with our debt consolidation program and work to save you money. Pacific Debt can help with most unsecured debt like credit cards, personal loans, medical bills, and repossessions.

It is not an easy process and it won’t happen overnight, but you can do it. Pacific Debt will be there every step of the way to help.

Debt Collection Laws of Nebraska

Nebraskans are protected against unscrupulous debt collectors by federal law. The federal Fair Debt Collection Practices Act (FDCPA) prohibits debt collectors from using abusive or harassing bill collection practices. In addition, the Nebraska Fair Debt Collection Practices Act (NFDCPA) adds protections against more types of collectors and actions. If you are a victim of any of these actions, speak with a law firm.

Overall, debt collectors can NOT:

- Charges more than 10% interest

- Garnish more than 25% of wages

- U se/threaten physical force or criminal tactics to harm you, your property, or your reputation

- Accusing you of committing a crime for not paying the debt

- Make/threaten to make defamatory statements to someone else

- Threaten arrest, to seize assets, or garnish wages unless actually planning to take such action

- Use obscene or profane language

- Cause you to spend money you wouldn’t otherwise have spent (ie long-distance telephone calls)

- Call you repeatedly or let your phone ring repeatedly

- Call frequently

- Contact your employer, except to verify employment or health insurance status, garnish wages or locate you

- Reveal information about debt to anyone except your spouse or your parents if a minor.

- Publicly publish your name for failing to pay

- Send a postcard or letter with revealing information on the envelope

- Claim to be someone other than a debt collector, including a governmental official

- Use stationery that appears to be from a law firm

- Charge you collection or attorney’s fees unless legally allowable

- Threaten to report you to a credit reporting agency if they have no intention of doing so

- Send a letter claiming to come from a claim, credit, audit, or legal department unless it actually is

Debt collectors must:

- Disclose caller identification

- May contact your family to locate you

- Must serve you with notice of a lawsuit if suing you

Nebraska Bankruptcy Court Information

Bankruptcy is a legal action that can erase most of your debt as well as your credit history. It is not an action to take lightly.

Persons filing for bankruptcy must:

- Complete credit counseling within six months before filing for bankruptcy.

- Complete a financial management instructional course after filing bankruptcy.

- Complete a Bankruptcy Act Means Test to determine if you are eligible for a Chapter 7 or 13 bankruptcy

- Itemize current income sources; major financial transactions; monthly living expenses; debts (secured and unsecured); and property (all assets and possessions, not just real estate).

- Collect last 2 years of tax returns, deeds to real estate you own, car titles, and loan documents

- File for bankruptcy

- Chapter 7 bankruptcy fee is $306

- Chapter 13 bankruptcy fee is $281

- Meet with court assigned bankruptcy trustee

- Attend a Meeting of Creditors

- Confirm plan if filing for Chapter 13 bankruptcy

Pacific Debt, Inc

We are one of the nationally top-ranked debt settlement companies and we have helped countless Nebraska residents with our national program.

Call us and ask our award-winning debt specialists about our settlement program and how debt settlement works.

Remember we offer a free consultation.

Nebraska Relief Programs

We are a debt settlement company and have discussed debt settlement in detail. Click here to learn more about debt settlement. Settled debt can temporarily harm your credit report and average credit score.

We want you to understand your options including debt consolidation, credit counseling, and bankruptcy.

Read all program materials prior to enrolling with any program.

Nebraska Debt Consolidation

This rolls all debt into a debt consolidation loan and then paying off the loan. Having good credit scores is a necessity.

Click here to learn more about debt consolidation and debt consolidation loans.

Credit Counseling Agency

Credit counseling uses a credit counselor to help you learn money management including developing a budget, helping you understand your credit scores, and set up a debt management plan.

Look for a non profit credit counselor with a nonprofit credit counseling agency.

Click here to learn more about Credit Counseling.

Nebraska Bankruptcy

Bankruptcy is a last resort option – this legal action wipes out most of your owed debt including credit cards, severely damages your credit for up to ten years, and bankruptcy code is expensive and time-consuming.

Click here to learn more about bankruptcy and always contact Nebraska attorneys for assistance.

Avoid credit repair services as there is nothing they can do that you cannot do for yourself to improve your credit report.

Contact Pacific Debt for a free initial consultation

Pacific Debt Offers Debt Relief for Nebraska Cities

Abie village

Alda village

Alma

Anselmo village

Arlington village

Ashton village

Aurora

Bancroft village

Bartley village

Bazile Mills village

Bee village

Bellevue

Benkelman

Berwyn village

Bloomfield

Boys Town village

Brewster village

Brock village

Bruning village

Burr village

Butte village

Cambridge

Cedar Bluffs village

Central City

Chambers village

Cisco

Clay Center

Coleridge village

Concord village

Cortland village

Crab Orchard village

Creston village

Culbertson village

Dalton village

Davey village

Decatur village

De Witt village

Dodge village

Du Bois village

Dwight village

Edison village

Elkhorn

Elwood village

Endicott village

Exeter village

Falls City

Firth village

Franklin

Funk village

Geneva

Gilead village

Gordon

Grant

Gretna

Hadar village

Hamlet village

Harrisburg

Hastings

Heartwell village

Hendley village

Hickman

Holstein village

Hoskins village

Hubbell village

Hyannis village

Inman village

Johnson village

Kearney

Kimball

Lawrence village

Lewellen village

Lincoln

Lodgepole village

Louisville village

Lynch village

McGrew village

Madrid village

Manley village

Mason City village

Meadow Grove village

Merriman village

Minatare

Monroe village

Mullen village

Naponee village

Nelson

Newman Grove

Nora village

North Loup village

Oakland

Odell village

Omaha

Ord

Osmond

Page village

Panama village

Pender village

Pickrell village

Plainview

Pleasanton village

Potter village

Prosser village

Ravenna

Reynolds village

Riverton village

Rosalie village

Rushville

St. Paul

Saronville village

Scribner

Shelton village

Sidney

South Bend village

Sprague village

Stanton

Steinauer village

Stockville village

Stuart village

Sutherland village

Table Rock village

Tecumseh

Thedford village

Trenton village

Unadilla village

Valentine

Verdel village

Waco village

Walthill village

Wauneta village

Weeping Water

West Point

Wilsonville village

Winslow village

Wood River

Yutan

Adams village

Alexandria village

Alvo village

Ansley village

Arnold village

Atkinson

Avoca village

Barada village

Bassett

Beatrice

Beemer village

Bellwood village

Bennet village

Big Springs village

Bloomington village

Bradshaw village

Bridgeport

Broken Bow

Bruno village

Burton village

Byron village

Campbell village

Cedar Creek village

Ceresco village

Chapman village

Clarks village

Clearwater village

Colon village

Cook village

Cotesfield village

Craig village

Crete

Curtis

Danbury village

David City

Denton village

Diller village

Doniphan village

Dunbar village

Eagle village

Elba village

Elm Creek village

Elyria village

Ericson village

Fairbury

Farnam village

Fordyce village

Fremont

Gandy village

Genoa

Giltner village

Gothenburg

Greeley Center village

Gross village

Haigler village

Hampton village

Harrison village

Hayes Center village

Hebron

Henry village

Hildreth village

Homer village

Howard City village

Humboldt

Imperial

Ithaca village

Johnstown village

Kenesaw village

Lamar village

Lebanon village

Lewiston village

Lindsay village

Long Pine

Loup City

Lyons

McLean village

Magnet village

Marquette village

Maxwell village

Melbeta village

Milford

Minden

Moorefield village

Murdock village

Nebraska City

Nemaha village

Newport village

Norfolk

North Platte

Obert village

Offutt AFB

O'Neill

Orleans village

Otoe village

Palisade village

Papillion

Peru

Pierce

Platte Center village

Plymouth village

Prague village

Ragan village

Raymond village

Richland village

Roca village

Roseland village

Ruskin village

Salem village

Schuyler

Seneca village

Shickley village

Silver Creek village

South Sioux City

Springfield

Staplehurst village

Stella village

Strang village

Sumner village

Sutton

Talmage village

Tekamah

Thurston village

Trumbull village

Union village

Valley

Verdigre village

Wahoo

Washington village

Wausa village

Wellfleet village

Whitney village

Winnebago village

Wisner

Wymore

Ainsworth

Allen village

Amherst village

Arapahoe

Arthur village

Atlanta village

Axtell village

Barneston village

Battle Creek

Beaver City

Belden village

Belvidere village

Bennington

Bladen village

Blue Hill

Brady village

Bristow village

Brownville village

Brunswick village

Burwell

Cairo village

Carleton village

Cedar Rapids village

Chadron

Chappell

Clarkson

Clinton village

Columbus

Cordova village

Cowles village

Crawford

Crofton

Cushing village

Dannebrog village

Dawson village

Deshler

Dix village

Dorchester village

Duncan village

Eddyville village

Elgin

Elmwood village

Emerson village

Eustis village

Fairfield

Farwell village

Fort Calhoun

Friend

Garland village

Gering

Glenvil village

Grafton village

Greenwood village

Guide Rock village

Hallam village

Harbine village

Hartington

Hay Springs village

Hemingford village

Herman village

Holbrook village

Hooper

Howells village

Humphrey

Indianola

Jackson village

Julian village

Kennard village

Laurel

Leigh village

Lexington

Linwood village

Loomis village

Lushton village

McCook

Macy

Malcolm village

Martinsburg village

Maywood village

Memphis village

Miller village

Mitchell

Morrill village

Murray village

Nehawka village

Nenzel village

Nickerson village

Norman village

Oak village

Oconto village

Ogallala

Ong village

Osceola

Overton village

Palmer village

Pawnee City

Petersburg village

Pilger village

Plattsmouth

Polk village

Preston village

Ralston

Red Cloud

Rising City village

Rockville village

Royal village

St. Edward

Santee village

Scotia village

Seward

Sholes village

Smithfield village

Spalding village

Springview village

Stapleton village

Sterling village

Stratton village

Superior

Swanton village

Tarnov village

Terrytown village

Tilden

Uehling village

Upland village

Valparaiso village

Verdon village

Wakefield

Waterbury village

Waverly

Western village

Wilber

Winnetoon village

Wolbach village

Wynot village

Albion

Alliance

Anoka village

Arcadia village

Ashland

Auburn

Ayr village

Bartlett village

Bayard

Beaver Crossing village

Belgrade village

Benedict village

Bertrand village

Blair

Blue Springs

Brainard village

Broadwater village

Brule village

Burchard village

Bushnell village

Callaway village

Carroll village

Center village

Chalco

Chester village

Clatonia village

Cody village

Comstock village

Cornlea village

Cozad

Creighton

Crookston village

Dakota City

Davenport village

Daykin village

Deweese village

Dixon village

Douglas village

Dunning village

Edgar

Elk Creek village

Elsie village

Emmet village

Ewing village

Fairmont village

Filley village

Foster village

Fullerton

Garrison village

Gibbon

Goehner village

Grand Island

Gresham village

Gurley village

Halsey village

Hardy village

Harvard

Hazard village

Henderson

Hershey village

Holdrege

Hordville village

Hubbard village

Huntley village

Inglewood village

Jansen village

Juniata village

Kilgore village

La Vista

Leshara village

Liberty village

Litchfield village

Lorton village

Lyman village

McCool Junction village

Madison

Malmo village

Maskell village

Mead village

Merna village

Milligan village

Monowi village

Morse Bluff village

Naper village

Neligh

Newcastle village

Niobrara village

North Bend

Oakdale village

Octavia village

Ohiowa village

Orchard village

Oshkosh

Oxford village

Palmyra village

Paxton village

Phillips village

Pine Ridge

Pleasant Dale village

Ponca

Primrose village

Randolph

Republican City village

Riverdale village

Rogers village

Rulo village

St. Helena village

Sargent

Scottsbluff

Shelby village

Shubert village

Snyder village

Spencer village

Stamford village

Steele City village

Stockham village

Stromsburg

Surprise village

Syracuse

Taylor village

Thayer village

Tobias village

Ulysses village

Utica village

Venango village

Virginia village

Wallace village

Waterloo village

Wayne

Weston village

Wilcox village

Winside village

Wood Lake village

York

Disclaimer: In some states, PDR may not be able to offer our services directly due to state regulations related to debt settlement. In those instances, PDR will refer you to a reputable debt relief provider or attorney firm for assistance with your debt. We are not lawyers and are not giving legal advice. Before filing bankruptcy, talk to a lawyer in your state. The information included on this site is for educational purposes only.

Do Not Sell My Personal Information

Do Not Sell My Personal Information