Indiana Debt Relief

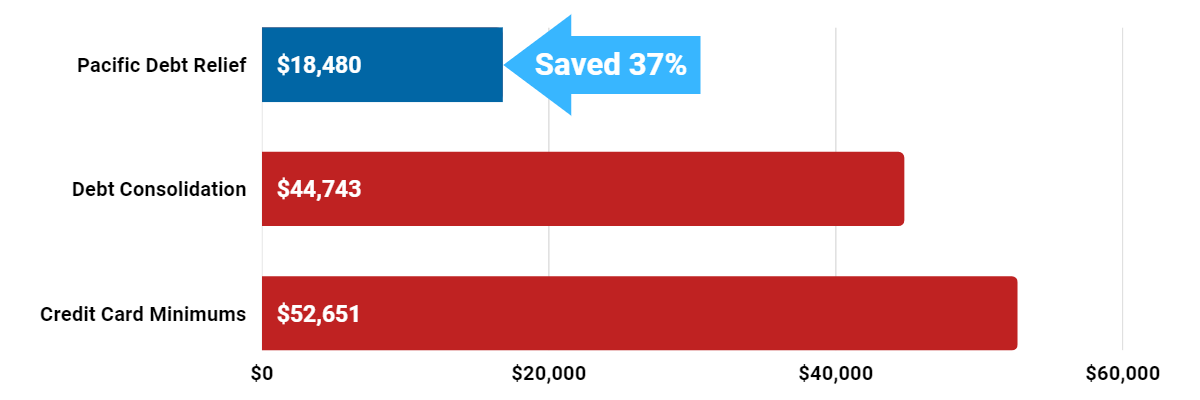

Reduce Your Credit Card Debt By Up To Half

Pacific Debt Relief offers the only solution that significantly reduces your debt to less than you currently owe. That means you get debt-free in a fraction of the time it would take with other options.

Save thousands by lowering your debt balance and wiping away years of future interest and payments. Call today for a FREE consultation!

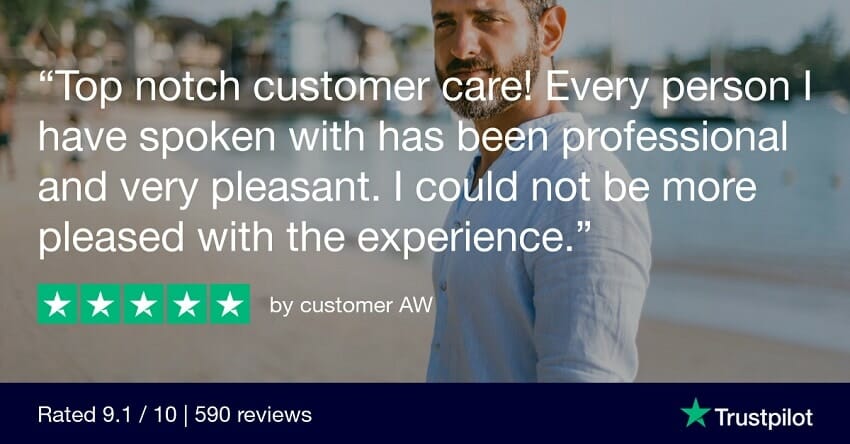

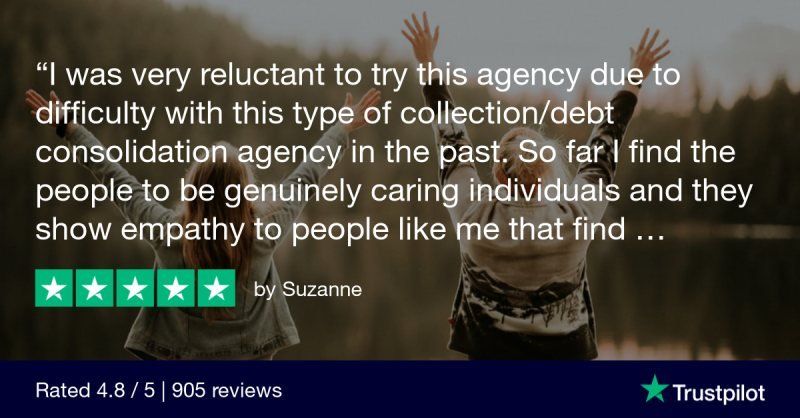

Indiana Debt Relief Reviews

What Is Indiana Debt Elimination?

Pacific Debt, Inc is a leading debt settlement company located in San Diego, California with an excellent track record and reputation. We negotiate with your creditors to lower the amount you owe.

A certified debt relief specialist can help you understand all your debt relief options and what your best route of action would be. Pacific Debt has one of the best-rated settlement programs available for Indiana residents who are eligible for our debt relief program.

We can also give you a FREE Consultation to see how much money we can help save you each month.

The secret to settlement is that you have to stop paying your bills in order to make creditors willing to negotiate. This action can come with late fees and debt collector phone calls.

Debt settlement is a great option to have when you are facing pressure from bill collectors and creditors. We know what it's like to have high-interest rates for unsecured loans, medical bills, or credit card debt.

Debt settlement does come with some credit score and credit report damage. Your settlement may stay on your credit report for up to seven years. You should consider settlement for bills that are very delinquent or already in collections. That way the damage is already done to your credit score.

Most people who successfully complete our debt settlement plan can see rapid improvements to their credit scores.

If you live in the state of Indiana and are looking for your best option for reducing what you owe, call us today. Our experts will help guide and explain all your options so you understand them well. Our settlement program can be custom tailored to fit your budget.

Does National Debt Settlement Work?

Yes! Reputable debt settlement companies, especially Pacific Debt, can help you to live debt-free. We have great reviews so check them out.

No balance transfer card, no consolidation loan, no personal loans, no home equity loan - just lower interest rates, helpful resources, and low total monthly payments and upfront fee disclosures to help you eliminate debt faster and improve your personal finances.

Pacific Debt Accreditations

Pacific Debt Relief is proud to be accredited by the following organizations.

- The International Association of Professional Debt Arbitrators

- The Consumer Debt Relief Initiative

- Better Business Bureau

The Federal Trade Commission, a government program, also oversees debt relief companies. Always check the accreditation as there are debt relief scams.

What Indiana Consumers can expect from our Debt Settlement Services

- Monthly payments based on your budget

- Resolve your situation in 2-4 years, based on national average

- No fees upfront and low monthly fees- fees vary from 15-25% of the total enrolled amount and state of registration

- Personal attention from your assigned Account Manager and Certified Debt Counselor

- Develop a management plan and lower negotiated rates and possibly decreased interest rates.

- Excellent Customer Service & Support

- We negotiate decreased balances and lowered interest rate with individual creditors

- We don't lend money and your financial data is safe with us!

- No low interest loan needed

While bankruptcy may seem easier than our debt settlement program, the after-effects of bankruptcy will last at least ten years and can result in poor credit ratings and less than a good credit score.

Indiana Debt Relief Reviews

Indiana Better Business Bureau

Pacific Debt is an A+ rated Business with the Better Business Bureau for debt negotiation services to individuals and families struggling with unsecured debt. We have been accredited since 2010 and in business since 2002. We specialize in settlement of unsecured debts like loans, medical debt, and credit card debt.

We have helped thousands of people in Indiana with accredited debt relief. Call us today, we can help you too! We can help you understand all your financial options and create a debt management plan with our debt settlement specialists.

Read debt relief reviews and case studies to see how Pacific Debt helped people eliminate their total enrolled debt. We have a staff of dedicated negotiators who are ready to help you with debt settlement negotiations with your creditors and debt collectors.

Be aware that your average credit score may take a hit during our program as you will be stopping minimum payments, but should recover with time.

Take a look at our debt relief reviews from verified customers to see debt settlement work.

Help for Indiana Residents

Click here to get your FREE Consultation & Savings Estimate, or call us at 800-909-9893

We can help you and your family with debt relief in the state of Indiana. We are also a national company and have contacts all over the US.

Remember, we offer a free consultation and analysis. You may also want to enroll in a complete credit counseling program.

Indiana

Indiana has been settled since 8000 BC when paleo-Indians first arrived. The rich soil and river systems contributed to its settlement after Europeans arrived. Motor vehicles, pharmaceutical products, optical and medical equipment, and electric machinery form much of the state's economy. Indiana ranks #16 for population and #16 for population density.

As of 2018, over 6.6 million people called Indiana home. Indianapolis is the largest city in Indiana.

Income

The median state income is $51,807. As of 2018, the minimum wage is $7.25 per hour. Unfortunately, 17.2% of Indiana children under 18 live in poverty. For Indiana residents overall, 14.4% of all people in Indiana live under the poverty level.

- Median state income: $51,807

- Minimum wage: $7.25/hour

- Children in poverty: 17.2%

- People in poverty: 14.4%

Is Indiana a Community Property State?

Indiana is not a community property state or marital property state. Therefore your assets are not seen as equally owned by you and your spouse. In the state of Indiana, the judge will decide which assets are shared by you and your spouse, and what the equity is for each.

There are 10 community property states in which the state sees your assets as community property are Louisiana, Arizona, California, Texas, Washington, Idaho, Nevada, New Mexico, and Wisconsin.

Homeowners

More than half (70%) of Indianans hold a mortgage. The median home price in Indiana is $133,500 (2018). Of course, that median price depends on the location with some areas being much higher.

- Homeowner rate: 70%

- Median home price: $133,500

Employment

Indiana has a current unemployment rate of 3.2%. However, the underemployment rate is 8.3%. Underemployment is the percentage of civilian workers who are unemployed, employed part-time or are not seeking employment.

If this is you, we can help. Pacific Debt offers solutions tailored to your unique situation and budget. Our certified counselors help you work up a budget and explain your options.

- Unemployment: 3.2% (2018)

- Underemployment: 8.3% (2017)

Indiana Debt Statistics

Indiana debt statistics are a bit bleak as Indianans carry a lot of debt. The average credit card debt is $6,958 (2018). The average student loan debt is $29,307. When you add all that debt on top of the cost of homes (rental or owned), versus the median income, it is very easy for Indianans to get into debt.

- Avg credit card debt: $6,958 (2018)

- Avg mortgage debt: $122,791 (2017)

- Avg student loan debt: $29,307 (2017)

Indiana Statute of Limitations

Indiana's statute of limitations lays out maximum time periods that debt collectors can take action. These statutes of limitations begin on the date that your debt goes delinquent.

The following are the statutes of limitations for different types of debt.

- Oral agreements: 6 years

- Written contracts: 6 years

- Promissory notes: 6 years

- Credit cards and other revolving loans: 6 years

Indiana Debt Settlement Programs

If you owe more than you can pay off, Pacific Debt can help you consolidate your debt and learn to live debt free. Since 2002, we've settled over $200 million in debt for thousands of clients.

We are a nationally top-ranked company specializing in debt settlement and we have helped countless Indiana residents with our services. Contact us today so we can help you too! Remember we offer free debt analysis and can recommend a good credit counseling agency.

We will help you work through our proven and comprehensive program. Your certified debt relief counselor will review all your options. If settlement is right for you, we move forward with our program and work to save you money. Pacific Debt can help with most unsecured debt like credit cards, personal loans, and repossessions.

It is not an easy process and it won't happen overnight, but you can do it. We will be there every step of the way to help.

Call us and ask our award winning specialists about our Indiana debt settlement program and how it can help you end your financial difficulties faster.

Since we are a national company, we may be able to help your relatives as well. If we can not, we will refer you to other Indiana debt relief programs including debt consolidation programs that we trust. We are leaders in the field and we want you to be able to trust our recommendations.

Other Debt Relief Programs

We are a debt settlement company and have discussed debt settlement is detail. The quick version is: you (or a company) negotiates with creditors to lower the debt amount of unsecured loans, like credit cards and helps you to save money in order to settle debts. Click here to learn more about debt settlement.

However, we do want you to understand your other options. These include debt consolidation, credit counseling, and bankruptcy.

Debt Consolidation

This option rolls all debt into a single, lower interest payment. You apply for a lower interest loan to complete your payment plan or make a lump sum payment, or work with a debt consolidation company. Click here to learn more about debt consolidation.

Credit Counseling

Credit counseling helps you learn money management including developing a budget, helping you understand your credit report, and set up a debt management plan. Click here to learn more about Credit Counseling.

Bankruptcy Filings

This is a last resort option – this legal action wipes out most of your debt, severely damages your credit for up to ten years, and is expensive and time-consuming. Click here to learn more about bankruptcy and bankruptcy filings.

Debt Collection Laws

Indianans are protected against unscrupulous debt collectors. The federal Fair Debt Collection Practices Act (FDCPA) prohibits debt collectors from using abusive or harassing bill collection practices. In addition, the Indiana Fair Debt Collection Practices Act (IFDCPA) adds protections against more types of collectors and actions. If you are a victim of any of these actions, you may take legal action against them.

Overall, debt collectors can NOT:

- Charges more than 10% interest

- Garnish more than 25% of wages

- U se/threaten physical force or criminal tactics to harm you, your property, or your reputation

- Accusing you of committing a crime for not paying the debt

- Make/threaten to make defamatory statements to someone else

- Threaten arrest, to seize assets, or garnish wages unless actually planning to take such action

- Use obscene or profane language

- Cause you to spend money you wouldn’t otherwise have spent (ie long-distance telephone calls)

- Call you repeatedly or let your phone ring repeatedly

- Call frequently

- Contact your employer, except to verify employment or health insurance status, garnish wages or locate you

- Reveal information about debt to anyone except your spouse or your parents if a minor.

- Publicly publish your name for failing to pay

- Send a postcard or letter with revealing information on the envelope

- Claim to be someone other than a debt collector, including a governmental official

- Use stationery that appears to be from a law firm

- Charge you collection or attorney’s fees unless legally allowable

- Threaten to report you to a credit reporting agency if they have no intention of doing so

- Send a letter claiming to come from a claim, credit, audit, or legal department unless it actually is

Debt collectors must:

- Disclose caller identification

- May contact your family to locate you

- Must serve you with notice of a lawsuit if suing you

Bankruptcy Court Information

Bankruptcy is a legal action that can erase most of your debt as well as your credit history. It is not an action to take lightly. If you do, you must follow the following steps in Indiana.

Persons filing for bankruptcy must:

- Complete credit counseling within six months before filing for bankruptcy.

- Complete a financial management instructional course after filing bankruptcy.

- Complete a Bankruptcy Act Means Test to determine if you are eligible for a Chapter 7 or 13 bankruptcy

- Itemize current income sources; major financial transactions; monthly living expenses; debts (secured and unsecured); and property (all assets and possessions, not just real estate).

- Collect last 2 years of tax returns, deeds to real estate you own, car titles, and loan documents

- File for bankruptcy

- Chapter 7 bankruptcy fee is $306

- Chapter 13 bankruptcy fee is $281

- Meet with court assigned bankruptcy trustee

- Attend a Meeting of Creditors

- Confirm plan if filing for Chapter 13 bankruptcy

Indiana Debt Questions

Indiana Cities Served by Pacific Debt

* Since not all states are included, not all clients can enroll in our company. People in other states can be connected to one of our trusted partners

Keep in mind that there are some tax consequences as well as temporarily decreased credit scores. Before deciding to pursue debt settlement, always discuss potential tax consequences with a tax professional who can provide you with tax advice.

Advance

Albion

Altona

Anderson

Argos

Auburn

Avon

Batesville

Berne

Birdseye

Blountsville

Boston

Bremen

Brooklyn

Brownsburg

Buffalo

Burnettsville

Cambridge City

Cannelton

Carthage

Center Point

Charlestown

Churubusco

Clay City

Clermont

Coatesville

Columbus

Corydon

Crane

Crown Point

Cynthiana

Danville

Decatur

Denver

Dune Acres

Dupont

East Germantown

Edinburgh

Elizabethtown

Elwood

Fairland

Farmland

Flora

Fountain City

Francisco

Fredericksburg

Galena

Gas City

Georgetown

Goshen

Granger

Greensboro

Greenville

Grissom AFB

Hamlet

Harmony

Hazleton

Highland

Holland

Hudson

Hymera

Ingalls

Jeffersonville

Kendallville

Kingman

Knightstown

Koontz Lake

Ladoga

Lagro

Lake Village

Lapel

Lawrence

Leesburg

Ligonier

Livonia

Loogootee

Lynnville

Macy

Markle

Matthews

Medora

Mentone

Mexico

Middlebury

Milford town (Kosciusko County)

Milton

Monon

Monrovia

Monticello

Mooresville

Mount Auburn

Mount Summit

Munster

New Albany

New Carlisle

New Haven

New Paris

New Richmond

New Whiteland

North Liberty

North Vernon

Oak Park

Oldenburg

Orland

Ossian

Palmyra

Patoka

Perrysville

Pine Village

Plymouth

Portland

Princeton

Reynolds

Rising Sun

Roanoke

Rocky Ripple

Roselawn

Russellville

St. Leon

Saltillo

Saratoga

Seelyville

Shadeland

Shelbyville

Shoals

Somerville

South Whitley

Spring Grove

Spurgeon

Stilesville

Sulphur Springs

Sweetser

Tell City

Tipton

Trail Creek

Union City

Utica

Vera Cruz

Vincennes

Wallace

Warren Park

Waveland

Westfield

Westport

Wheatland

Whiting

Winamac

Wingate

Wolcottville

Wynnedale

Zionsville

Akron

Alexandria

Ambia

Andrews

Ashley

Aurora

Bainbridge

Battle Ground

Bethany

Bloomfield

Bluffton

Boswell

Bright

Brooksburg

Brownstown

Bunker Hill

Burns Harbor

Camden

Carbon

Cayuga

Centerville

Chesterfield

Cicero

Claypool

Clifford

Colfax

Connersville

Country Club Heights

Crawfordsville

Crows Nest

Dale

Darlington

Decker

Dillsboro

Dunkirk

Dyer

Eaton

Edwardsport

Elkhart

English

Fairmount

Ferdinand

Fort Branch

Fowler

Frankfort

Fremont

Galveston

Gaston

Georgetown

Gosport

Greencastle

Greensburg

Greenwood

Gulivoire Park

Hammond

Hartford City

Hebron

Highland

Holton

Huntertown

Indianapolis city (balance)

Jamestown

Jonesboro

Kennard

Kingsbury

Knightsville

Kouts

Lafayette

Lake Dalecarlia

Lakeville

La Porte

Lawrenceburg

Leo-Cedarville

Linden

Lizton

Losantville

Lyons

Madison

Markleville

Mauckport

Mellott

Meridian Hills

Michiana Shores

Middletown

Millersburg

Mishawaka

Monroe

Monterey

Montpelier

Morgantown

Mount Ayr

Mount Vernon

Napoleon

New Amsterdam

New Castle

New Market

New Pekin

New Ross

Noblesville

North Manchester

North Webster

Oaktown

Onward

Orleans

Otterbein

Paoli

Patriot

Peru

Pittsboro

Poneto

Poseyville

Redkey

Richmond

River Forest

Rochester

Rome City

Rossville

Russiaville

St. Paul

Sandborn

Schererville

Sellersburg

Shamrock Lakes

Sheridan

Sidney

South Bend

Speedway

Spring Hill

Star City

Stinesville

Summitville

Switz City

Tennyson

Topeka

Tri-Lakes

Uniondale

Valparaiso

Vernon

Wabash

Walton

Warsaw

Waynetown

West Harrison

West Terre Haute

Whiteland

Wilkinson

Winchester

Winona Lake

Woodburn

Yeoman

Alamo

Alfordsville

Amboy

Angola

Atlanta

Austin

Bargersville

Bedford

Beverly Shores

Bloomingdale

Boonville

Bourbon

Bristol

Brookston

Bruceville

Burket

Butler

Campbellsburg

Carlisle

Cedar Grove

Chalmers

Chesterton

Clarks Hill

Clayton

Clinton

Collegeville

Converse

Covington

Cromwell

Culver

Daleville

Darmstadt

Delphi

Dublin

Dunlap

Earl Park

Economy

Elberfeld

Ellettsville

Etna Green

Fairview Park

Fillmore

Fortville

Fowlerton

Franklin

French Lick

Garrett

Geneva

Glenwood

Grabill

Greendale

Greens Fork

Griffin

Hagerstown

Hanover

Hartsville

Henryville

Hillsboro

Homecroft

Huntingburg

Indian Heights

Jasonville

Jonesville

Kentland

Kingsford Heights

Knox

Laconia

La Fontaine

Lakes of the Four Seasons

Lanesville

Larwill

Leavenworth

Lewisville

Linton

Logansport

Lowell

McCordsville

Marengo

Marshall

Mecca

Melody Hill

Merom

Michigan City

Milan

Millhousen

Mitchell

Monroe City

Montezuma

Mooreland

Morocco

Mount Carmel

Mulberry

Nappanee

Newberry

New Chicago

New Middletown

Newpoint

Newtown

North Crows Nest

North Salem

Norway

Odon

Oolitic

Osceola

Owensville

Paragon

Pendleton

Petersburg

Plainfield

Portage

Pottawattamie Park

Remington

Ridgeville

Roachdale

Rockport

Rosedale

Royal Center

St. Joe

Salamonia

San Pierre

Schneider

Selma

Sharpsville

Shipshewana

Silver Lake

South Haven

Spencer

Spring Lake

State Line City

Straughn

Sunman

Syracuse

Terre Haute

Town of Pines

Troy

Universal

Van Buren

Versailles

Wakarusa

Wanatah

Washington

West Baden Springs

West Lafayette

Westville

Whitestown

Williams Creek

Windfall City

Winslow

Woodlawn Heights

Yorktown

Albany

Alton

Amo

Arcadia

Attica

Avilla

Bass Lake

Beech Grove

Bicknell

Bloomington

Borden

Brazil

Brook

Brookville

Bryant

Burlington

Cadiz

Cannelburg

Carmel

Cedar Lake

Chandler

Chrisney

Clarksville

Clear Lake

Cloverdale

Columbia City

Corunna

Crandall

Crothersville

Cumberland

Dana

Dayton

De Motte

Dugger

Dunreith

East Chicago

Edgewood

Elizabeth

Elnora

Evansville

Farmersburg

Fishers

Fort Wayne

Francesville

Frankton

Fulton

Gary

Gentryville

Goodland

Grandview

Greenfield

Greentown

Griffith

Hamilton

Hardinsburg

Haubstadt

Hidden Valley

Hobart

Hope

Huntington

Indian Village

Jasper

Kempton

Kewanna

Kirklin

Kokomo

La Crosse

Lagrange

Lake Station

La Paz

Laurel

Lebanon

Liberty

Little York

Long Beach

Lynn

Mackey

Marion

Martinsville

Medaryville

Memphis

Merrillville

Michigantown

Milford town (Decatur County)

Milltown

Modoc

Monroeville

Montgomery

Moores Hill

Morristown

Mount Etna

Muncie

Nashville

Newburgh

New Harmony

New Palestine

Newport

New Washington

North Judson

North Terre Haute

Oakland City

Ogden Dunes

Orestes

Osgood

Oxford

Parker City

Pennville

Pierceton

Plainville

Porter

Princes Lakes

Rensselaer

Riley

Roann

Rockville

Roseland

Rushville

St. John

Salem

Santa Claus

Scottsburg

Seymour

Shelburn

Shirley

Simonton Lake

Southport

Spiceland

Springport

Staunton

Sullivan

Swayzee

Taylorsville

Thorntown

Trafalgar

Ulen

Upland

Veedersburg

Vevay

Walkerton

Warren

Waterloo

West College Corner

West Lebanon

Wheatfield

Whitewater

Williamsport

Winfield

Wolcott

Worthington

Zanesville

Disclaimer: In some states, PDR may not be able to offer our services directly due to state regulations related to debt settlement. In those instances, PDR will refer you to a reputable debt relief provider or attorney firm for assistance with your debt. We are not lawyers and are not giving legal advice. Before filing bankruptcy, talk to a lawyer in your state. The information included on this site is for educational purposes only.

Do Not Sell My Personal Information

Do Not Sell My Personal Information