Massachusetts Debt Relief

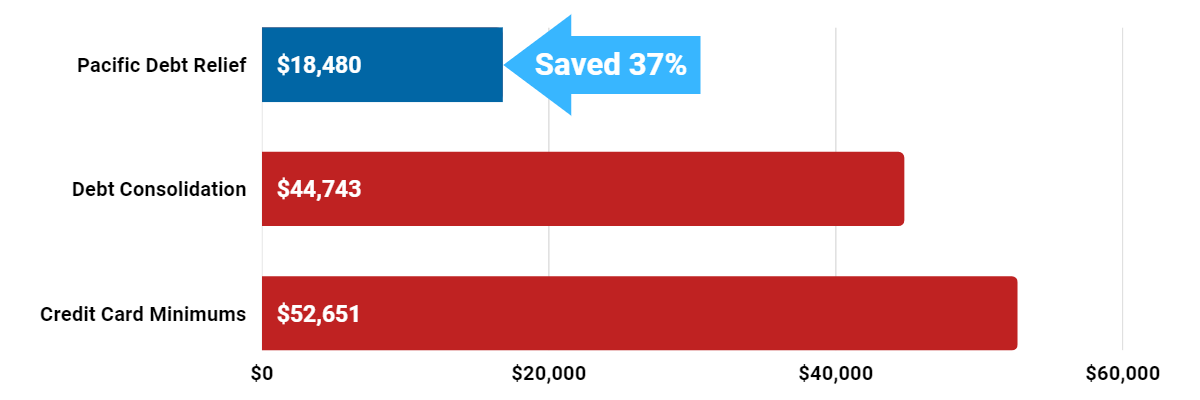

Reduce Your Credit Card Debt By Up To Half

Pacific Debt Relief offers the only solution that significantly reduces your debt to less than you currently owe. That means you get debt-free in a fraction of the time it would take with other options.

Save thousands by lowering your debt balance and wiping away years of future interest and payments. Call today for a FREE consultation!

Massachusetts Debt Relief Reviews

What are Massachusetts Debt Relief Programs?

Massachusetts debt relief involves the reduction of debt through debt settlement or debt consolidation.

Pacific Debt Relief specializes in debt settlement. We work to reduce your debt for less than you owe. Most unsecured debt qualify for the Pacific Debt relief program, including credit card debt.

Pacific Debt deals directly with your creditors while guiding you throughout the entire process.

Contact us today for a FREE consultation with no obligation. We will help you understand your debt relief options.

Our best-rated settlement programs are available for Massachusetts residents. Call our certified specialists who will explain all your relief options.

Our free debt analysis will help you make an informed decision. Call to get your free quote for our services.

How Does Debt Relief Work?

Debt relief reduces the amount you owe your creditors so that you can receive relief for your personal finance situation. Debt settlement is one option. Pacific Debt provides relief in the form of debt settlement to Massachusetts residents, as well as nationally.

The first step for Massachusetts residents in finding relief is a FREE phone call with one of our debt specialists who can lay out all your options, so you understand your position and what steps need to be taken in order to reduce your debt.

Is Massachusetts Debt Relief Legit?

Pacific Debt has helped countless Massachusetts residents reduce their debt and live debt free. Since 2002, we've settled over $300 million in credit card debt for our clients.

Contact us today to see how we can help.

Massachusetts residents searching for information on debt consolidation, or a debt management plan may benefit from a free conversation with our debt specialists. We may be able to help lower your monthly payments or even become debt-free. If you are looking for consolidation loans but have bad credit, our debt settlement program might be perfect for you!

We are experts at debt negotiation so call for your financial situation.

We do not require you to find a personal loan - we negotiate to reduce interest rates, offer helpful resources, and a low total monthly payment with no upfront fees. We can help you eliminate debt faster and improve your personal finances.

During Pacific Debt's program, you deposit an agreed single monthly payment amount in your own escrow bank account. As you build up sufficient funds, we pay your settled accounts.

The program usually takes between 2-4 years to complete because everyone's financial situation is different. Take time to understand how debt settlement programs work and all your Massachusetts relief options.

What to expect from our Massachusetts Debt Settlement Program

- Affordable monthly payment based on your budget

- Resolve your situation in 2-4 years

- No upfront fees with low monthly fees that vary from 15-25% of the total enrolled amount and state of registration

- Personal attention from our Client Success team

- Repayment plan and possibly lower interest rates.

- Excellent Customer Service & Support

- We negotiate decreased balances and lower interest rates

Who qualifies for debt settlement?

You must meet the following:

- Outstanding balances of at least $10,000 in unsecured debts (credit card bills, payday loans, personal loans, doctor bills, collections and repossessions, business debts, and some student loans). We do not handle secured debt like mortgage payments.

- Difficulty making minimum payments

We are not a full balance debt resolution option. There are some tax consequences to debt settlement. Before pursuing debt settlement, discuss potential tax consequences with a tax professional.

* We are also not a law firm and are not giving legal advice.

Pacific Debt Accreditations

Pacific Debt Relief is proud to be accredited by the following organizations.

- The International Association of Professional Debt Arbitrators

- The Consumer Debt Relief Initiative

- Better Business Bureau

Massachusetts Debt Relief Testimonials

Massachusetts Better Business Bureau

Pacific Debt Is an A+ rated Business with the BBB for debt negotiation services to individuals and families struggling with unsecured debt. We have been accredited since 2010 and in business since 2002. We have received 4.87 out of five stars based on 40 customer reviews with the BBB.

Our debt specialists can help you with a FREE consultation.

Massachusetts

Massachusetts is central to American history and is home to the Cape Cod shore as well as the Berkshire Mountains. Massachusetts has twelve Fortune 500 companies, and a diverse economy based on higher education, biotechnology, and information technology. Massachusetts is ranked #15 for population and #3 for population density.

As of 2018, over 6.8 million people called Massachusetts home. Boston is the largest city in Massachusetts.

Income

The median state income is $75,297. As of 2018, the minimum wage is $11.00 per hour. Unfortunately, 13.3% of Massachusettsian children under 18 live in poverty. For residents overall, 10.4% of all people in Massachusetts live under the poverty level.

- Median state income: $75,297

- Minimum wage: $11.00/hour

- Children in poverty: 13.3%

- People in poverty: 10.4%

Is Massachusetts a Community Property State?

Massachusetts is not a community property state. Therefore your assets are not seen as equally owned by you and your spouse. In the state of Massachusetts, the judge will decide which assets are shared by you and your spouse, and what the equity is for each.

Currently, there are only 9 states (Louisiana, Arizona, California, Texas, Washington, Idaho, Nevada, New Mexico, and Wisconsin) that are community property states.

Homeowners

More than half (60%) of Massachusettsians hold a mortgage. The median home price in Massachusetts is $398,300 (2018). Of course, that median price depends on the location with some areas being much higher.

- Homeowner rate: 60%

- Median home price: $398,300

Employment

Massachusetts has a current unemployment rate of 3.5%. However, the underemployment rate is 8.1%. Underemployment is the percentage of civilian workers who are unemployed, employed part-time or are not seeking employment.

If this is you, we can help. Pacific Debt offers Massachusetts debt relief solutions tailored to your unique situation and budget. Our certified counselors help you work up a budget and explain your options.

- Unemployment: 3.5% (2018)

- Underemployment: 8.1% (2017)

Massachusetts Debt

Massachusettsians carry a lot of debt. The average credit card debt is $6,277 (2018). The average student loan debt is $30,584. In addition, Massachusetts is in the top 10 states with the highest average mortgage debt. When you add all that debt on top of the cost of homes (rental or owned), versus the median income, it is very easy for Massachusettsians to get into debt.

- Avg credit card debt: $6,277 (2018)

- Avg mortgage debt: $252,624 (2017)

- Avg student loan debt: $30,584 (2017)

Massachusetts Statute of Limitations

Massachusetts’ statute of limitations lays out maximum time periods that debt collectors can take action against a delinquent debt. These statutes of limitations begin on the date that your debt goes delinquent.

For debts taken out in Massachusetts, the following are the statutes of limitations for different types of debt.

- Oral agreements: 6 years

- Written contracts: 6 years

- Promissory notes: 6 years

- Credit cards and other revolving loans: 6 years

Massachusetts Debt Relief

If you have more debt than you can pay off, Pacific Debt can help you consolidate your debt and learn to live debt free. Since 2002, we’ve settled over $200 million in debt for thousands of clients. We are a nationally top ranked debt relief company located in San Diego.

We will help you work through our proven and comprehensive debt relief program. Your certified debt relief counselor will review all your options. If debt settlement is right for you, we move forward with our debt consolidation program and work to save you money. Pacific Debt can help with most unsecured debt like credit cards, personal loans, medical bills, and repossessions.

It is not an easy process and it won’t happen overnight, but you can do it. Pacific Debt will be there every step of the way to help.

Pacific Debt, Inc

We are a nationally top-ranked company specializing in debt settlement and we have helped countless Massachusetts residents with our national program. Contact our professional debt negotiators today so we can help you too!

Call us and ask our award-winning debt specialists about our settlement program and how it can help you reduce debt faster.

Since we are a national debt relief company, we may be able to help your relatives as well. If we cannot, we will refer you to other programs that we trust.

Other Debt Relief Options

We are a debt settlement company and have discussed debt settlement in detail. Click here to learn more about debt settlement.

We want you to understand your options and reach financial stability. These include consolidation, credit counseling, and bankruptcy.

Read all program materials prior to enrolling with any program.

Debt Consolidation program

This rolls all debt into a low interest rate debt consolidation loan, often home equity loans, or work with a company to set up a consolidation plan. You may want to speak with someone about debt management programs.

Click here to learn more about debt consolidation and debt consolidation loans.

Credit Counseling

Credit counseling helps you learn money management including developing a budget, helping you understand your credit score, and set up a debt management program. This debt management program does not involve any settlement.

Look for professional credit counselors from a non-profit credit counseling organization.

Click here to learn more about Credit Counseling.

File Bankruptcy

Filing bankruptcy is a last resort option – this legal action wipes out most of your total debt, severely damages your credit with a credit reporting agency for up to ten years, and is expensive and time-consuming.

Click here to learn more about bankruptcy.

Avoid credit repair services as there is nothing they can do that you cannot do for yourself to improve your credit report.

Contact Pacific Debt for a free debt evaluation today so we can help you with your creditors.

Debt Collection Laws

Massachusettsians are protected against unscrupulous debt collectors. The federal Fair Debt Collection Practices Act (FDCPA) prohibits debt collectors from using abusive or harassing bill collection practices.In addition, the Massachusetts Fair Debt Collection Practices Act (MFDCPA) adds protections against more types of collectors and actions. If you are a victim of any of these actions, you may take legal action against them.

Overall, debt collectors can NOT:

- Charges more than 10% interest

- Garnish more than 25% of wages

- U se/threaten physical force or criminal tactics to harm you, your property, or your reputation

- Accusing you of committing a crime for not paying the debt

- Make/threaten to make defamatory statements to someone else

- Threaten arrest, to seize assets, or garnish wages unless actually planning to take such action

- Use obscene or profane language

- Cause you to spend money you wouldn’t otherwise have spent (ie long-distance telephone calls)

- Call you repeatedly or let your phone ring repeatedly

- Call frequently

- Contact your employer, except to verify employment or health insurance status, garnish wages or locate you

- Reveal information about debt to anyone except your spouse or your parents if a minor.

- Publicly publish your name for failing to pay

- Send a postcard or letter with revealing information on the envelope

- Claim to be someone other than a debt collector, including a governmental official

- Use stationery that appears to be from a law firm

- Charge you collection or attorney’s fees unless legally allowable

- Threaten to report you to a credit reporting agency if they have no intention of doing so

- Send a letter claiming to come from a claim, credit, audit, or legal department unless it actually is

Debt collectors must:

- Disclose caller identification

- May contact your family to locate you

- Must serve you with notice of a lawsuit if suing you

Bankruptcy Court Information

Bankruptcy is a legal action that can erase most of your debt as well as your credit history. It is not an action to take lightly. If you do, you must follow the following steps in Massachusetts.

Persons filing for bankruptcy must:

- Complete credit counseling within six months before filing for bankruptcy.

- Complete a financial management instructional course after filing bankruptcy.

- Complete a Bankruptcy Act Means Test to determine if you are eligible for a Chapter 7 or 13 bankruptcy

- Itemize current income sources; major financial transactions; monthly living expenses; debts (secured and unsecured); and property (all assets and possessions, not just real estate).

- Collect last 2 years of tax returns, deeds to real estate you own, car titles, and loan documents

- File for bankruptcy

- Chapter 7 bankruptcy fee is $306

- Chapter 13 bankruptcy fee is $281

- Meet with court assigned bankruptcy trustee

- Attend a Meeting of Creditors

- Confirm plan if filing for Chapter 13 bankruptcy

Pacific Debt Offers Debt Relief to Massachusetts Cities

Abington

Amesbury

Athol

Barnstable Town

Belmont

Boston

Brewster

Burlington

Chelsea

Cordaville

Dennis Port

East Dennis

East Harwich

Everett

Fitchburg

Framingham

Granby

Groton

Hatfield

Holland

Housatonic

Kingston

Leominster

Lowell

Malden

Marlborough

Mattapoisett Center

Melrose

Millers Falls

Monson Center

Needham

Newton

North Attleborough Center

North Falmouth

North Plymouth

North Westport

Ocean Grove

Oxford

Pinehurst

Popponesset

Randolph

Rockport

Salem

Scituate

Shelburne Falls

Somerville

South Deerfield

South Yarmouth

Sturbridge

Three Rivers

Upton-West Upton

Waltham

Watertown

West Brookfield

West Falmouth

West Yarmouth

Whitinsville

Winchendon

Woods Hole

Acushnet Center

Amherst Center

Attleboro

Barre

Beverly

Bourne

Bridgewater

Buzzards Bay

Chicopee

Danvers

Dover

East Douglas

East Pepperell

Fall River

Forestdale

Franklin

Great Barrington

Hanson

Haverhill

Holyoke

Hudson

Lawrence

Lexington

Lunenburg

Mansfield Center

Marshfield

Maynard

Methuen

Millis-Clicquot

Monument Beach

New Bedford

North Adams

Northborough

Northfield

North Scituate

Norton Center

Onset

Palmer

Pittsfield

Popponesset Island

Raynham Center

Rowley

Salisbury

Seabrook

Shirley

South Amherst

South Dennis

Spencer

Swampscott

Topsfield

Vineyard Haven

Ware

Webster

West Chatham

Westfield

Weweantic

Wilbraham

Winchester

Worcester

Adams

Andover

Ayer

Belchertown

Bliss Corner

Boxford

Brockton

Cambridge

Clinton

Dedham

Duxbury

East Falmouth

East Sandwich

Falmouth

Fort Devens

Gardner

Greenfield

Harwich Center

Hingham

Hopedale

Hull

Lee

Littleton Common

Lynn

Marblehead

Marshfield Hills

Medfield

Middleborough Center

Milton

Nahant

Newburyport

North Amherst

North Brookfield

North Lakeville

North Seekonk

Norwood

Orange

Peabody

Plymouth

Provincetown

Reading

Rutland

Sandwich

Seconsett Island

Smith Mills

South Ashburnham

South Duxbury

Springfield

Taunton

Townsend

Wakefield

Wareham Center

Wellesley

West Concord

West Springfield

Weymouth

Williamstown

Winthrop

Yarmouth Port

Agawam

Arlington

Baldwinville

Bellingham

Bondsville

Braintree

Brookline

Chatham

Cochituate

Dennis

East Brookfield

Easthampton

Essex

Fiskdale

Foxborough

Gloucester

Green Harbor-Cedar Crest

Harwich Port

Holbrook

Hopkinton

Ipswich

Lenox

Longmeadow

Lynnfield

Marion Center

Mashpee Neck

Medford

Milford

Monomoscoy Island

Nantucket

New Seabury

Northampton

North Eastham

North Pembroke

Northwest Harwich

Ocean Bluff-Brant Rock

Orleans

Pepperell

Pocasset

Quincy

Revere

Sagamore

Saugus

Sharon

Somerset

Southbridge

South Lancaster

Stoneham

Teaticket

Turners Falls

Walpole

Warren

Westborough

West Dennis

West Wareham

White Island Shores

Wilmington

Woburn

Disclaimer: In some states, PDR may not be able to offer our services directly due to state regulations related to debt settlement. In those instances, PDR will refer you to a reputable debt relief provider or attorney firm for assistance with your debt. We are not lawyers and are not giving legal advice. Before filing bankruptcy, talk to a lawyer in your state. The information included on this site is for educational purposes only.

Do Not Sell My Personal Information

Do Not Sell My Personal Information