Colorado Debt Relief

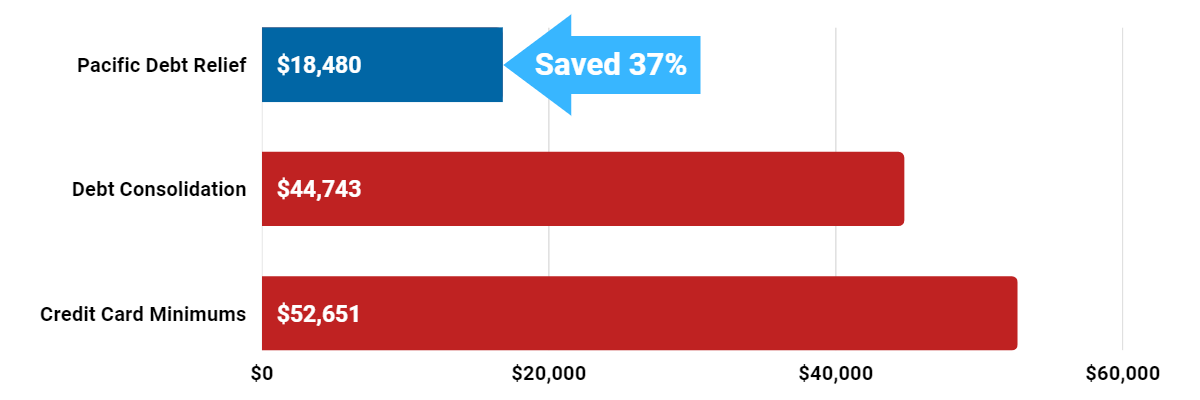

Reduce Your Credit Card Debt By Up To Half

Pacific Debt Relief offers the only solution that significantly reduces your debt to less than you currently owe. That means you get debt-free in a fraction of the time it would take with other options.

Save thousands by lowering your debt balance and wiping away years of future interest and payments. Call today for a FREE consultation!

Colorado Debt Relief Reviews

What is Colorado Debt Relief?

Debt relief involves paying off credit card debts and other debt. Pacific Debt, Inc is a leading debt settlement company located in San Diego, California with an excellent track record and reputation.

Our debt settlement program can help Coloradans settle debt for substantially less than what they currently owe. This relief program usually takes anywhere between 2-4 years to complete. Pacific Debt deals directly with your creditors while guiding you throughout the entire process.

Call one of our certified debt specialist who can help you understand all your relief options and your best course of action. Our FREE savings estimate will show you much money we can help save you each month. Our free debt analysis helps you make an informed decision.

Pacific Debt has one of the best-rated settlement programs available for Colorado residents who are eligible for our relief program. Debt settlement is a great option when you face pressure from bill collectors and creditors. We know what it's like to have high-interest rates for unsecured loans and medical bills.

The secret to settlement is to stop paying your bills to make creditors willing to negotiate. This action can come with late fees and collector phone calls.

This debt settlement may cause some credit score damage. Your settlement can stay on your credit report for up to seven years. Therefore, you should consider settlement for bills that are very delinquent or already in collections.

Most people considering debt relief so not have a high credit score. Most people who successfully complete our debt settlement services plan can see rapid improvements to their credit scores.

If you live in Colorado and want your best option to reduce what you owe, call us today. Our experts will help guide and explain all your options.

We understand what it is like to be unable to pay your creditor bills because of high interest rates or being unable to make the monthly payment for unsecured loans. Whether is credit card debt, student loan debt, or payday loan debt, we are here to help!

If you're a Colorado resident, speak to one of our debt management experts -- you'll understand all your options regarding debt and how we can help you reduce your unsecured debts.

Does National Debt Settlement Work?

Yes! Reputable debt settlement companies like Pacific Debt can help you to live without debt.

We do not require a balance transfer card, Colorado debt consolidation loans, or home equity loan. Our services can lower interest rates, offer helpful resources, and require a low monthly payment to help you eliminate debt faster and improve your personal finances. We offer upfront fees disclosure so you know what you pay before you sign up.

Pacific Debt is one of the leading relief companies in the US. We have helped thousands of people reduce outstanding balances on consumer debt like credit card debt and other loans. Since 2002, we've settled a national average of over $300 million in debt for our clients.

Contact us today to see how we can help you settle your accounts.

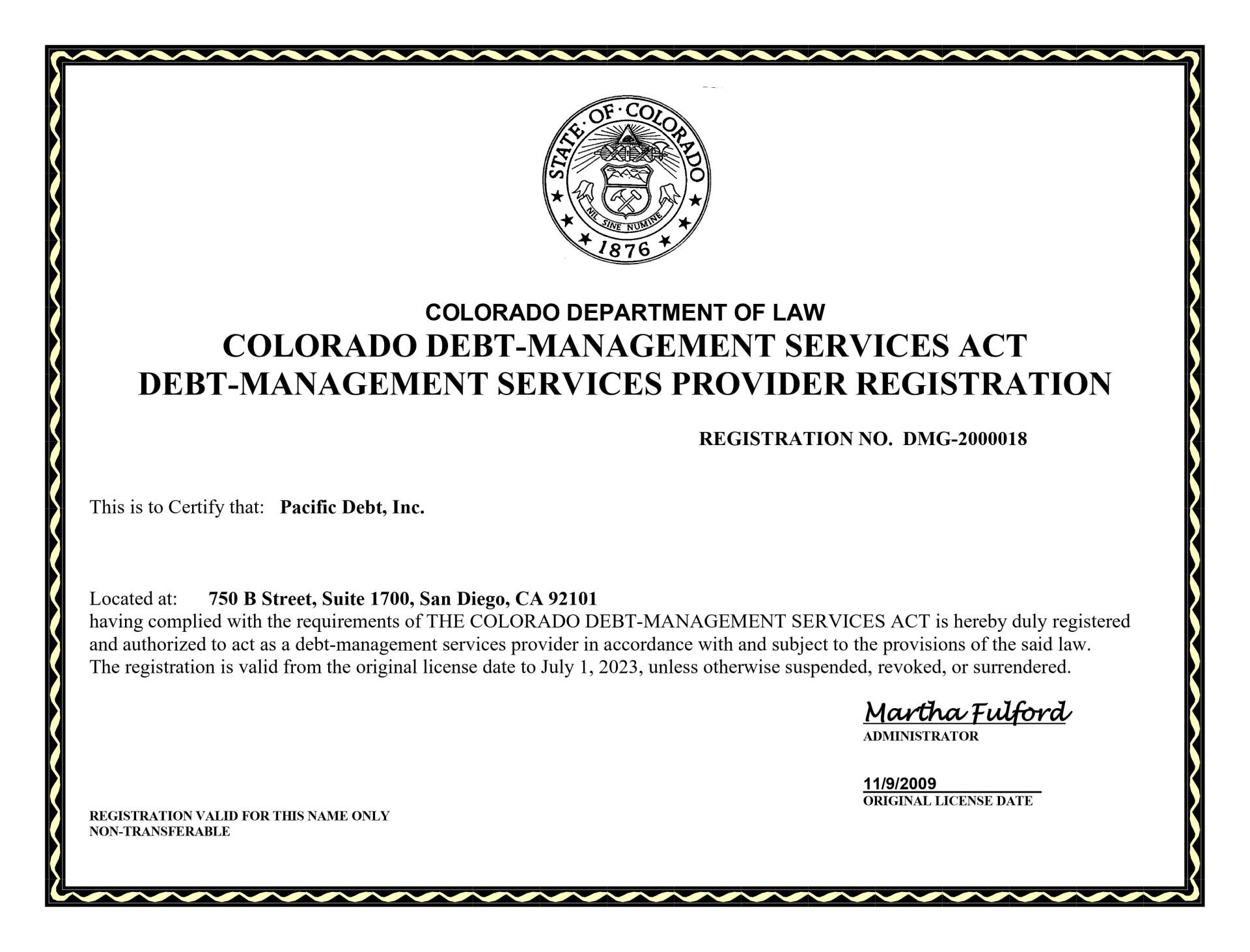

Pacific Debt Accreditation

Pacific Debt is accredited by:

- The Consumer Debt Relief Initiative

- International Association of Professional Debt Arbitrators

- Better Business Bureau

Always check the accreditation as there are debt relief scams.

Frequently Asked Questions

Colorado Better Business Bureau

Pacific Debt is an A+ rated business with the BBB . We have been accredited since 2010. We have received4.87 out of five stars based on 40 customer reviews with the BBB. We have helped countless debt relief residents in Colorado struggling to pay their credit card balances. Luckily, Pacific Debt is available to help Colorado residents get the information they need in order to figure out the right course of action. Our debt specialists can help you with a FREE consultation.

Pacific Debt is an A+ rated Business with the Better Business Bureau for debt negotiation services to individuals and families struggling with unsecured debt. Our customer reviews speak for themselves - 4.87 out of five stars based on 40 customer reviews with the BBB. We have been accredited since 2010 and in business since 2002.

We specialize in the settlement of debts like loans, medical and utility bills, and credit card debt and have helped thousands of people in Colorado with accredited debt solutions. we can help you understand all your financial options and create a debt management program with our debt settlement specialists.

Be aware that your average credit score may take a hit during our program as you will be stopping minimum payments, but should recover with time

Click here to chat with a credit counselor for FREE!, or call us at 800-909-9893 We can help you and your family with relief from debt in the state of Colorado.

Colorado Residents

Colorado is home to the Fourteeners – a series of mountain peaks all over 14,000 feet high, the Denver Broncos, ski resorts, Dinosaur National Park, and some glorious vistas. No matter if you want a quiet country town, outdoor sports, theater, shopping, or a booming city, Colorado has it all. As a result, Colorado is ranked #21 for the population. Since the state is large, Colorado only ranks #31 for population density. As of 2018, over 5 million people called Colorado home. Denver is the largest city in Colorado and ranks as the 21st largest city in the US.

Income in the State of Colorado

The median state income is $69,117. As of 2019, the minimum wage is $11.10 per hour. Unfortunately, 11.7% of Coloradan children under 18 live in poverty. For residents, 10.3% of all people in Colorado live below the poverty level.

- Median state income: $69,117

- Minimum wage: $11.10/hour

- Children in poverty: 11.7%

- People in poverty: 10.3%

Is Colorado a Community Property State?

Unfortunately, Colorado is not a community property state. Therefore your assets are not seen as equally owned by you and your spouse. Currently, only 10 states (Louisiana,

Arizona,

California,

Texas, Washington,

Idaho,

Nevada,

New Mexico, and

Wisconsin) are community property states. In the state of

Colorado, the judge will decide which assets are shared by you and your spouse, and what the equity is for each.

Homeowners in CO

More than half (64.7%) for Coloradans hold a mortgage. The median home price in Colorado is $367,440 (2018). Of course, that median price depends on the location with some areas being much higher.

- Homeowner rate: 64.7%

- Median home price: $367,440

Click here to speak to a credit counselor for FREE!

Colorado Employment Numbers

Colorado has recovered from the depression, and the current unemployment rate is 2.9%. However, the underemployment rate is 6.3%. Underemployment is the percentage of unemployed civilian workers, employed part-time or not seeking employment.

If this is you, we can help. Pacific Debt offers Colorado solutions tailored to your unique situation and budget. Our certified counselors help you work up a budget and explain your options.

- Unemployment: 2.9% (2018)

- Underemployment: 6.3% (2017)

Colorado Debt Stats

Coloradans carry a lot of debt. The median credit card debt is $2,985 (2019). The average student loan debt is lower than the US average but is $26,530. When you add all that debt on top of the cost of homes (rental or owned), versus the median income, it is very easy for Coloradans to get into debt.

- Avg credit card debt: $2,985 (2018)

- Avg mortgage debt: $258,026 (2017)

- Avg student loan debt: $26,530 (2017)

Statute of Limitations Colorado Debt

The Colorado debt statute of limitations lays out maximum time periods that debt collectors can take action against a delinquent debt. These statutes of limitations begin on the date that your debt goes delinquent.

For debts taken out in Colorado, the following are the statutes of limitations for different types of debt.

- Oral agreements: 6 years

- Written contracts: 6 years

- Promissory notes: 6 years

- Credit cards and other revolving loans: 6 years

Colorado Debt Collection Laws

Colorado residents are protected against unscrupulous debt collectors. The Federal Fair Debt Collection Practices Act (FDCPA) prohibits debt collectors from using abusive or harassing bill collection practices. In addition, the Colorado Fair Debt Collection Practices Act (CFDCPA) adds protections against more types of collectors and actions. If you are a victim of any of these actions, you may take legal action against them.

Overall, debt collectors can NOT:

- Charges more than 10% interest

- Garnish more than 25% of wages

- U se/threaten physical force or criminal tactics to harm you, your property, or your reputation

- Accusing you of committing a crime for not paying the debt

- Make/threaten to make defamatory statements to someone else

- Threaten arrest, to seize assets, or garnish wages unless actually planning to take such action

- Use obscene or profane language

- Cause you to spend money you wouldn’t otherwise have spent (ie long-distance telephone calls)

- Call you repeatedly or let your phone ring repeatedly

- Call frequently

- Contact your employer, except to verify employment or health insurance status, garnish wages or locate you

- Reveal information about debt to anyone except your spouse or your parents if a minor.

- Publicly publish your name for failing to pay

- Send a postcard or letter with revealing information on the envelope

- Claim to be someone other than a debt collector, including a governmental official

- Use stationery that appears to be from a law firm

- Charge you collection or attorney’s fees unless legally allowable

- Threaten to report you to a credit reporting agency if they have no intention of doing so

- Send a letter claiming to come from a claim, credit, audit, or legal department unless it actually is

Debt collectors must:

- Disclose caller identification

- May contact your family to locate you

- Must serve you with notice of a lawsuit if suing you

Colorado Bankruptcy Court Information

Bankruptcy is a legal action that can erase most of your debt as well as your credit history. It is not an action to take lightly. If you do, you must follow the following steps in Arkansas Bankruptcy law.

Persons filing for bankruptcy must:

- Complete credit counseling within six months before filing for bankruptcy.

- Complete a financial management instructional course after filing bankruptcy.

- Complete a Bankruptcy Act Means Test to determine if you are eligible for a Chapter 7 or 13 bankruptcy

- Itemize current income sources; major financial transactions; monthly living expenses; debts (secured and unsecured); and property (all assets and possessions, not just real estate).

- Collect last 2 years of tax returns, deeds to real estate you own, car titles, and loan documents

- File for bankruptcy

- Chapter 7 bankruptcy fee is $306

- Chapter 13 bankruptcy fee is $281

- Meet with court assigned bankruptcy trustee

- Attend a Meeting of Creditors

- Confirm plan if filing for Chapter 13 bankruptcy

Other Debt Relief Options

We are a debt settlement company and have discussed the debt settlement process in detail. The quick version is that you (or a company) negotiate with creditors to lower the debt amount and helps you to save money in order to settle debts. Click here to learn more about debt settlement.

We want you to understand your other options. These include debt consolidation, credit counseling, and bankruptcy.

Debt Consolidation Program

To consolidate debt, you roll all debt into a single, lower interest rate payment. You apply for a lower-interest debt consolidation loan to complete your payment plan, make a lump sum payment, or work with a debt consolidation company. Click here to learn more about debt consolidation.

Credit Counseling

Credit counseling helps you learn money management, including developing a budget, helping you understand your credit report, and setting up a debt management plan. A certified credit counselor will guide you through the credit counseling steps. Click here to learn more about Credit Counseling.

Bankruptcy Filings

This is a last resort option – this legal action wipes out most of your debt, severely damages your credit for up to ten years, and is expensive and time-consuming. Click here to learn more about bankruptcy and bankruptcy filings.

Other services

Avoid credit repair services as there is nothing they can do that you can not do for yourself to improve your credit reports.

Colorado Debt Relief Coverage by Pacific Debt

Acres Green

Alamosa

Antonito

Arriba

Atwood

Avondale

Bennett

Beulah Valley

Blue River

Bow Mar

Brookside

Burlington

Campo

Cascade-Chipita Park

Cedaredge

Cherry Hills Village

Coal Creek

Colorado City

Commerce City

Crawford

Cripple Creek

De Beque

Denver

Dolores

Eads

Eaton

Eldora

Empire

Evans

Firestone

Fort Carson

Fort Morgan

Franktown

Fruita

Genoa

Gleneagle

Granada

Grand View Estates

Grover

Hartman

Heritage Hills

Holyoke

Hudson

Iliff

Julesburg

Keystone

Kittredge

La Junta

Lamar

Las Animas

Limon

Loghill Village

Louisville

Manassa

Marble

Merino

Monte Vista

Morrison

Naturita

Northglenn

Nunn

Ophir

Otis

Pagosa Springs

Paonia

Penrose

Platteville

Pueblo

Raymer

Rico

Rocky Ford

Saguache

Sanford

Sedalia

Sheridan

Silver Cliff

Simla

Springfield

Stonegate

Sugar City

Telluride

Todd Creek

Two Buttes

Vona

Ward

Westcreek

Wiggins

Winter Park

Yampa

Aguilar

Alamosa East

Applewood

Arvada

Ault

Basalt

Berkley

Black Forest

Bonanza

Branson

Broomfield

Byers

Canon City

Castle Pines

Center

Cheyenne Wells

Coal Creek

Colorado Springs

Cortez

Creede

Crook

Deer Trail

Derby

Dove Creek

Eagle

Eckley

Eldorado Springs

Englewood

Evergreen

Flagler

Fort Collins

Fountain

Fraser

Fruitvale

Georgetown

Glenwood Springs

Granby

Greeley

Gunbarrel

Haswell

Highlands Ranch

Hooper

Hugo

Indian Hills

Keenesburg

Kim

Kremmling

Lake City

Laporte

La Veta

Lincoln Park

Log Lane Village

Louviers

Mancos

Mead

Milliken

Montezuma

Mountain View

Nederland

North Washington

Oak Creek

Orchard City

Ouray

Palisade

Parachute

Perry Park

Poncha Springs

Pueblo West

Red Cliff

Ridgway

Romeo

St. Mary's

San Luis

Sedgwick

Sheridan Lake

Silver Plume

Snowmass Village

Starkville

Strasburg

Superior

The Pinery

Towaoc

Vail

Walden

Welby

Westminster

Wiley

Woodland Park

Yuma

Air Force Academy

Allenspark

Arboles

Aspen

Aurora

Battlement Mesa

Berthoud

Black Hawk

Boone

Breckenridge

Brush

Calhan

Carbondale

Castle Rock

Central City

Cimarron Hills

Cokedale

Columbine

Cottonwood

Crested Butte

Crowley

Del Norte

Dillon

Downieville-Lawson-Dumont

Eagle-Vail

Edgewater

Elizabeth

Erie

Fairplay

Fleming

Fort Garland

Fowler

Frederick

Garden City

Gilcrest

Golden

Grand Junction

Green Mountain Falls

Gunnison

Haxtun

Hillrose

Hotchkiss

Idaho Springs

Jamestown

Ken Caryl

Kiowa

Lafayette

Lakeside

Larkspur

Leadville

Littleton

Lone Tree

Loveland

Manitou Springs

Meeker

Minturn

Montrose

Mountain Village

New Castle

Norwood

Olathe

Orchard Mesa

Ovid

Palmer Lake

Parker

Pierce

Ponderosa Park

Ramah

Red Feather Lakes

Rifle

Roxborough Park

Salida

Sawpit

Seibert

Sherrelwood

Silverthorne

South Fork

Steamboat Springs

Stratmoor

Swink

Thornton

Trinidad

Victor

Walsenburg

Wellington

West Pleasant View

Williamsburg

Woodmoor

Akron

Alma

Aristocrat Ranchettes

Aspen Park

Avon

Bayfield

Bethune

Blanca

Boulder

Brighton

Buena Vista

Campion

Carriage Club

Castlewood

Cheraw

Clifton

Collbran

Columbine Valley

Craig

Crestone

Dacono

Delta

Dinosaur

Durango

East Pleasant View

Edwards

El Jebel

Estes Park

Federal Heights

Florence

Fort Lupton

Foxfield

Frisco

Genesee

Glendale

Gold Hill

Grand Lake

Greenwood Village

Gypsum

Hayden

Holly

Hot Sulphur Springs

Ignacio

Johnstown

Kersey

Kit Carson

La Jara

Lakewood

La Salle

Leadville North

Lochbuie

Longmont

Lyons

Manzanola

Meridian

Moffat

Monument

Mount Crested Butte

Niwot

Nucla

Olney Springs

Ordway

Padroni

Paoli

Peetz

Pitkin

Pritchett

Rangely

Redlands

Rockvale

Rye

Salt Creek

Security-Widefield

Severance

Silt

Silverton

Southglenn

Sterling

Stratton

Tabernash

Timnath

Twin Lakes

Vilas

Walsh

Westcliffe

Wheat Ridge

Windsor

Wray

Disclaimer: In some states, PDR may not be able to offer our services directly due to state regulations related to debt settlement. In those instances, PDR will refer you to a reputable debt relief provider or attorney firm for assistance with your debt. We are not lawyers and are not giving legal advice. Before filing bankruptcy, talk to a lawyer in your state. The information included on this site is for educational purposes only.

Hours of Operation

Mon-Thurs: 8am - 6pm PST

Friday: 8am - 4:30pm PST

Clients

Phone: (877) 722-3328

Fax: (619) 238-6709

Email: cs@pacificdebt.com

Non-Clients

Phone: (877) 959-6945

Fax: (619) 238-6709

Email: inquiries@pacificdebt.com

Do Not Sell My Personal Information

Do Not Sell My Personal Information