New York Debt Relief

Reduce Your Credit Card Debt By Up To Half

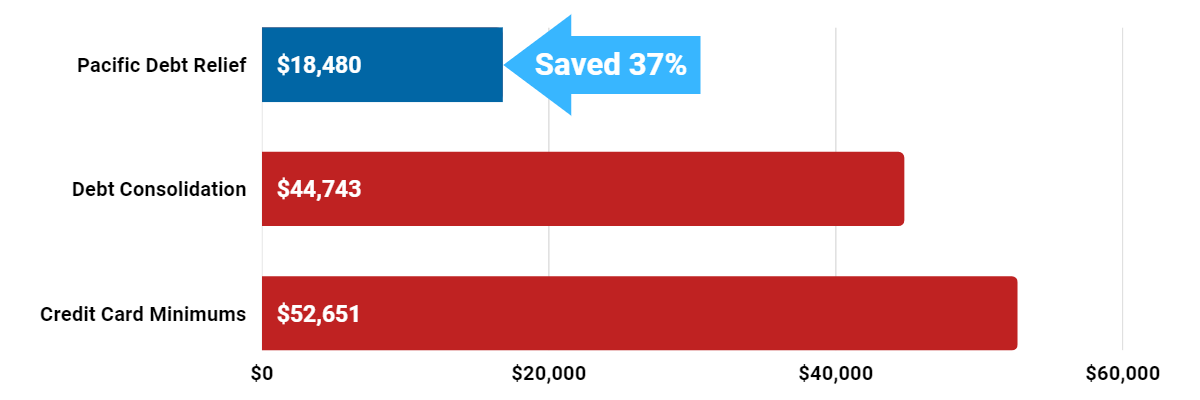

Pacific Debt Relief offers the only solution that significantly reduces your debt to less than you currently owe. That means you get debt-free in a fraction of the time it would take with other options.

Save thousands by lowering your debt balance and wiping away years of future interest and payments. Call us today for a FREE consultation!

National Debt Relief Works!

Reputable debt relief companies, especially Pacific Debt, can help you to live debt-free. Contact us today for a FREE consultation with no obligation. We will help you understand all your debt relief options and choose the best one for you.

New York Debt Relief Reviews

We Provide National Debt Relief

We are one of the leading debt settlement companies in the US. Since we provide national debt relief using our debt settlement programs, Pacific Debt has helped thousands of people reduce their debt, including credit card debt and personal loans.

Pacific Debt Relief Accreditation

Pacific Debt is accredited by:

- Consumer Debt Relief Initiative

- International Association of Professional Debt Arbitrators

In addition, the Federal Trade Commission, a government program, oversees debt relief companies and debt settlement programs.

Always check the accreditation of debt relief companies!

To be eligible for the Pacific Debt program, you must

- A total debt enrolled of at least $10,000 in unsecured debt (credit card companies, payday loans, personal loans, medical bills, collections and repossessions, business debts, and some student loans). If you have federal student loans, we can advise you on the Public Service Loan Forgiveness program.

- You are having difficulties making minimum payments

If you owe back taxes, we will advise you on available federal government programs from the IRS. Back child support payments can often be negotiated with the state DHS.

What New York Residents can expect from our Debt Relief Program

- One monthly payment is based on your budget

- Resolve your debt in 2-4 years

- No upfront fees - our fees vary from 15-25% of enrolled debt based on debt amount and state of registration-- and low monthly fees as well!

- Personal attention from our Client Success team

- Develop a plan to pay off debt at a lower negotiated rate and possibly decreased interest rates.

- Excellent Customer Service & Support

While bankruptcy may seem easier than our debt settlement program, the after-effects of bankruptcy will last at least seven years and can result in poor credit ratings and credit scores.

An alternative debt relief option is free credit counseling, but this option does not settle debts.

What is New York Debt Relief

Debt relief is the act of reducing the amount of debt you owe your creditors so that you can receive the financial relief you need in order to go about your everyday life. Debt settlement is one form of debt relief as is a nonprofit credit counseling agency. We are a national debt relief company and have worked with creditors across the US.

We work to decrease the amount of debt you owe including a decreased interest rate from credit card companies. As you put money into a savings account in a monthly payment, we pay your settled debt. You must make enough money to be able to put some in savings. You also stop paying creditors for a time, which can result in a decreased credit score.

How does New York debt relief work?

Pacific Debt provides debt relief in the form of debt settlement to residents living in New York, as well as national debt relief. If you have unsecured debt like credit card debt, we can help. Your debt relief requires you to set up and fund a savings account. Check out our debt relief program.

Take time to understand how the program works and all your debt relief options. Forgiven debt or settle debt can result in tax consequences. Credit scores do take a temporary hit.

Is New York debt relief legit?

Pacific Debt has helped hundreds of New Yorker's reduce the amount of debt they owe since 2002 and was rated the "Best Debt Settlement Company of 2020". If you are living in the state of New York, give us a call right away for a free consultation so we can help you understand all your debt relief options.

NY Debt Relief Testimonials

NY Debt Relief Case Studies

I recently went through a divorce, We sold our home and I would like to use the funds to get my debts resolved once and for all.

Location: New York, New York

I was diagnosed with cancer and I will be going be going through treatment and I will be going on disability therefore my income will decrease. I will not be able to continue to make these payments so I reached out for help to pay off my debt once and for all.

Location: Buffalo, New York

I was in over my head with monthly payments on my credit cards and I began to fall behind. I reached out for assistance with my debt to pay off my credit cards and avoid bankruptcy.

Location: Rochester, New York

New York Better Business Bureau

Pacific Debt is an A+ rated Business with the Better Business Bureau for debt negotiation services to individuals and families struggling with unsecured debt. We have been accredited since 2010 and in business since 2002. We specialize in debt settlement of unsecured debts.

We have helped thousands of people in New York with accredited debt relief. Call us today, we can help you too! We can help you understand all your financial options and create a debt management plan with our debt settlement specialists. If you do not live in New York, we are a national debt relief company.

Read more New York debt relief reviews and case studies to see how Pacific Debt helped people eliminate their debt.

Pacific Debt has a staff of dedicated debt settlement negotiators who are ready to help you negotiate your debt. Be aware that your credit report and credit scores may take a hit during a debt settlement program as you will be stopping payments, but should recover with time.

New York Debt Relief Help

Click here to get your FREE Consultation & Savings Estimate, or call us at 800-909-9893

We can help you and your family with relief from debt in the state of New York. We are also a national debt relief company and have contacts all over the US.

Remember, we offer a free consultation.

The State of New York

New York seems to be the center of the universe. Everyone knows New York City. Many of our ancestors passed through Ellis Island and New York City on their way to America. The rest of the state offers beautiful scenery, rich farming, and lovely mountains. Between New York City and the rest of the state, New York is ranked #3 for population and #7 for population density.

As of 2018, almost 20 million people called New York home. New York City is the largest city in the US and is the 24th largest city in the world.

Income in New York

The median state income is $62,909. As of 2018, the minimum wage is $11.00 per hour. Compared to other states, the minimum wage seems high, but when compared to the cost of living, it is very easy to get into debt. Unfortunately, 20.4% of New Yorker children under 18 live in poverty. For residents overall, 14.7% of all people in New York live under the poverty level.

- Median state income: $62,909

- Minimum wage: $11.00/hour

- Children in poverty: 20.4%

- People in poverty: 14.7%

Is New York a Community Property State?

Unfortunately, New York is not a community property state. Therefore your assets are not seen as 50/50 owned by you and your spouse. There are 10 states that are community property states, or a marital property state. In the state of New York, the judge will decide which assets are shared by you and your spouse, and what the equity is.

There are 10 community property states in which the state sees your assets as community property are Louisiana, Arizona, California, Texas, Washington, Idaho, Nevada,

New Mexico, and Wisconsin.

New York Homeowners

More than half (51.1%) of New Yorkers hold a mortgage. The median home price in New York State is $282,100 (2018). Of course, that median price depends on the location with some areas being much higher. In NYC, the median home price is $674,500.

- Homeowner rate: 51.1%

- Median home price: $282,100

Employment in NY

New York has a current unemployment rate of 4.6%. However, the underemployment rate is 9.4%. Underemployment is the percentage of civilian workers who are unemployed, employed part-time, or are not seeking employment.

If this is you, we can help. Pacific Debt offers New York debt relief solutions tailored to your unique situation and budget. Our certified counselors help you work up a budget and explain your options.

- Unemployment: 4.6% (2018)

- Underemployment: 9.4% (2017)

New York Debt Statistics

New Yorkers carry a lot of debt. The average credit card debt is $6,388 (2018). The average student loan debt is lower than the US average but is $24,461. When you add all that debt on top of the cost of homes (rental or owned), versus the median income, it is very easy for New Yorkers to get into debt.

- Average credit card debt: $3,710 (2017)

- Average mortgage debt: $243,244 (2017)

- Average student loan debt: 32,200 (2017)

New York Statute of Limitations New York

New York’s statute of limitations lays out maximum time periods that debt collectors can take action against a delinquent debt. These statutes of limitations begin on the date that your debt goes delinquent.

For debts taken out in New York, the following are the statutes of limitations for different types of debt.

- Oral agreements: 6 years

- Written contracts: 6 years

- Promissory notes: 6 years

- Credit cards and other revolving loans: 4-6 years

New York New York Debt Consolidation

If you have more debt than you can pay off, Pacific Debt can help you with debt settlement and learn to live debt-free. Since 2002, we've settled over $200 million in debt for thousands of clients. We are a nationally top-ranked debt settlement company and we have helped countless New York residents with our national debt relief. Contact us today so we can help you too!

We will help you work through our proven and comprehensive national debt relief program. Your certified debt relief counselor will review all your options including setting up a savings account. If debt settlement programs are right for you, we move forward with our debt consolidation program and work to save you money. Pacific Debt can help with most unsecured debt like credit cards, personal loans, medical bills, and repossessions. We work with both original debt and collection companies.

It is not an easy process and it won't happen overnight, but you can do it. Be aware that your credit report may take a small hit, but should recover and improve in the future. Pacific Debt will be there every step of the way to help. Call us and inquire about our NY accredited debt relief program and how it can help you.

Since we are a national debt relief program, we may be able to help your relatives as well. If we can not, we will refer you to other debt relief companies including debt consolidation programs, that we trust.

Disclaimer: In some states, PDR may not be able to offer our services directly due to state regulations related to debt settlement. In those instances, PDR will refer you to a reputable debt relief provider or attorney firm for assistance with your debt. We are not lawyers and are not giving legal advice. Before filing bankruptcy, talk to a lawyer in your state. The information included on this site is for educational purposes only.

Do Not Sell My Personal Information

Do Not Sell My Personal Information