Pennsylvania Debt Relief

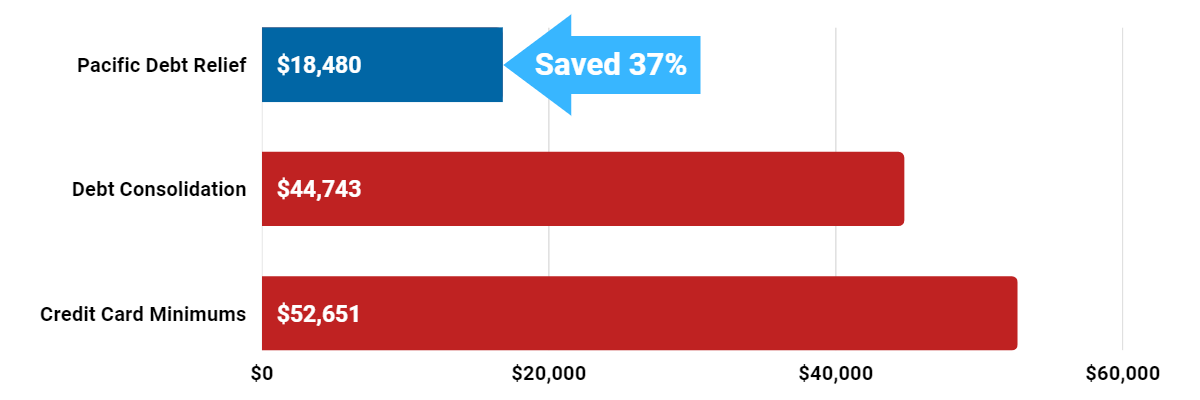

Reduce Your Credit Card Debt By Up To Half

Pacific Debt Relief offers the only solution that significantly reduces your debt to less than you currently owe. That means you get debt-free in a fraction of the time it would take with other options.

Save thousands by lowering your debt balance and wiping away years of future interest and payments. Call us today for a FREE consultation!

Pennsylvania Debt Relief Reviews

We’re not a law firm, we are a debt settlement company that specializes in debt negotiation. We can help Pennsylvania residents with personal loan debt and unsecured debt. Talk to an experienced and IAPDA certified debt specialists for free!

Pennsylvania Debt Relief Testimonials

Recent Pennsylvania Debt Relief Settlements

Now with changes in our income and having a lot of things change in our household we want to get out of debt a soon a possible with a payment that will be more affordable.

Location: Pittsburgh, Pennsylvania

I am on a fixed income, and I need a more affordable monthly payment to resolve my debt. I want to have more funds leftover for myself at the end of the month.

Location: Allentown, Pennsylvania

Pacific Debt offers a FREE Consultation to anyone looking at debt settlement options. Our Pennsylvania Debt Relief Program is designed to try to get you out of debt in two to four years.

Pennsylvania Debt Relief Common Questions

Better Business Bureau of Pennsylvania

Pacific Debt Relief is an A+ rated Business with the BBB for debt negotiation services to individuals and families struggling with unsecured debt. We have been accredited since 2010 and in business since 2002.

View our NMLS Consumer Access Verification Details

Pennsylvania Debt Relief Help

Click here to get your FREE Consultation & Savings Estimate We can help you and your family with relief from debt in the state of Pennsylvania, or even nationwide.

Pennsylvania Debt Settlement Services Act

The Debt Settlement Services Act is the providing for the licensure of persons providing debt settlement services, for the powers and duties of the Department of Banking and Securities and for enforcement.

View the Debt Settlement Services Act here

State of Pennsylvania

As of 2018, almost 13 million people called Pennsylvania home. Philadelphia is the largest city in Pennsylvania and the 5th largest city in the US. Pennsylvania is the heart of American independence. With an old history, good farmland, beautiful mountains, Pennsylvania was an industrial state that attracted many workers. As a result, Pennsylvania is ranked #6 for population and #11 for population density.

Pennsylvania Income Levels

The median state income is $52,005. As of 2018, the minimum wage is $7.25 per hour. Unfortunately, 18% of Pennsylvanian children under 18 live in poverty. For residents overall, 12.9% of all people in Pennsylvania live under the poverty level.

- Median state income: $52,005

- Minimum wage: $7.25/hour

- Children in poverty: 18%

- People in poverty: 12.9%

Homeowners in Pennsylvania

More than half (68.6%) of Pennsylvanians hold a home mortgage. The median home price in Pennsylvania is $169,000 (2018). Of course, that median price depends on the location with some areas being much higher.

- Homeowner rate: 68.6%

- Median home price: $169,000

Employment in PA

Pennsylvania’s current employment rate is 4.8%. However, the underemployment rate is 10.6%. Underemployment is the percentage of civilian workers who are unemployed, employed part-time or are not seeking employment.

If this is you, we can help. Pacific Debt offers Pennsylvania debt relief solutions tailored to your unique situation and budget. Our certified counselors help you work up a budget and explain your options.

- Unemployment: 4.8% (2018)

- Underemployment: 10.6% (2017)

Pennsylvania Debt Statistics

Pennsylvanians carry a lot of debt. The average credit card debt is $6,065 (2018). The average student loan debt is the highest in the US at $35,185. When you add all that debt on top of the cost of homes (rental or owned), versus the median income, it is very easy for Pennsylvanians to get into debt.

- Average credit card debt: $6,065 (2018)

- Average mortgage debt: $157,643 (2017)

- Average student loan debt: $35,185 (2017)

Pennsylvania Statute of Limitations

Pennsylvania’s statute of limitations lays out maximum time periods that debt collectors can take action against a delinquent debt. These statutes of limitations begin on the date that your debt goes delinquent.

For debts taken out in Pennsylvania, the following are the statutes of limitations for different types of debt.

- Oral agreements: 4 years

- Written contracts: 4 years

- Promissory notes: 4 years

- Credit cards and other revolving loans: 4 years

Pennsylvania Debt Relief & Consolidation

If you have more debt than you can pay off, Pacific Debt can help you consolidate your debt and learn to live debt-free. Since 2002, we’ve settled over $200 million in debt for thousands of clients. We are a nationally top-ranked debt relief company and we have helped countless people in the state of Pennsylvania with debt relief. Contact us today so we can help you too!

We will help you work through our proven and comprehensive debt relief program. Your certified debt relief counselor will review all your options. If debt settlement is right for you, we move forward with our debt consolidation program and work to save you money. Pacific Debt can help with most unsecured debt like credit cards, personal loans, medical bills, and repossessions.

It is not an easy process and it won’t happen overnight, but you can do it. Pacific Debt will be there every step of the way to help. Call us and inquire about our PA debt relief program and how it can help you.

Disclaimer: In some states, PDR may not be able to offer our services directly due to state regulations related to debt settlement. In those instances, PDR will refer you to a reputable debt relief provider or attorney firm for assistance with your debt. We are not lawyers and are not giving legal advice. Before filing bankruptcy, talk to a lawyer in your state. The information included on this site is for educational purposes only.

Do Not Sell My Personal Information

Do Not Sell My Personal Information