Oklahoma Debt Relief Program

Reduce Your Credit Card Debt By Up To Half

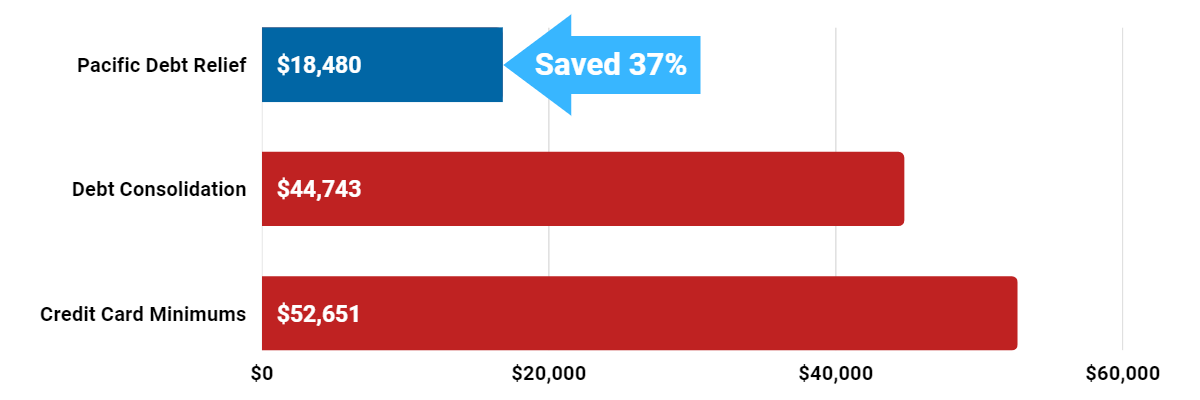

Pacific Debt Relief offers the only solution that significantly reduces your debt to less than you currently owe. That means you get debt-free in a fraction of the time it would take with other options.

Save thousands by lowering your debt balance and wiping away years of future interest and payments. Call today for a FREE consultation!

Our Debt Relief Reviews

Better Business Bureau of Oklahoma

Pacific Debt Relief is an A+ rated Business with the BBB (Better Business Bureau) for debt negotiation services . We have been accredited since 2010 and in business since 2002.

We have helped countless residents in the state of Oklahoma living with financial hardship and struggling to pay credit card balances. Luckily, Pacific Debt helps Oklahoman's get needed information to decide the best course of action.

Our debt specialists can help you with a FREE consultation today.

Oklahoma Debt Relief Testimonials

Common Questions for Debt Solutions

Reasons to Get Debt Relief in Oklahoma

There are many reasons why you might want relief from debt in Oklahoma. Perhaps you lost your job or were hit hard by the recent recession. Maybe you have medical bills or are struggling to keep up with credit card payments.

If you are looking for an Oklahoma debt settlement program, you could benefit from the free consultation we offer. Our experts explain all the available Oklahoma relief programs. We'll go over your debts including payday loans and look at the current interest rate.

Achieving relief isn't easy, but it's not impossible! Our staff is standing by with a free consultation and no upfront fees.

Common Types of Debt Relief Options

Each debt solutions below comes with pros and cons. Everyone's financial situation is unique so speak to a specialist who can help you understand your options .

- Debt Consolidation Loan

- Debt Settlement Services

- Credit Counseling

- Debt Management Program

- Bankruptcy

Debt Consolidation Loans

Debt consolidation loans roll debt into one loan. These low interest rate loans are used to consolidate debt and then pay the total unsecured debt. The loan is then paid with the borrower making one monthly payment. This can make debt repayment more manageable.

Debt consolidation depends on your total debt and finding someone to lend money to you.

Debt Settlement Services

Debt settlement can be helpful in resolving unsecured debt. An Oklahoma debt settlement company negotiates a lower payment amount. While negotiations are underway, you save sufficient funds to pay off the negotiated debt. The company may get creditors to forgive some debt.

You make a monthly payment into an insured savings account. The payments are used to pay down debt according to your payment plan.

Do research before choosing a debt settlement company. Look for a licensed and accredited one, and read reviews.

Pacific Debt is rated one of the best debt settlement companies because of our exceptional customer service. We have relationships and reputations with most credit card companies and lenders throughout the United States.

If you have debt, our debt settlement program can help. The program is geared towards people with heavy financial hardship.

If you live in Oklahoma and want out of debt, then debt settlement company could be your best solution for immediate relief.

Credit Counseling

Credit counseling involves working closely with a credit counselor at a credit counseling agency to develop a debt repayment plan. A credit counseling agency can help you negotiate with creditors and develop a budget to pay off your debts.

Credit counseling may help you get lower interest rates or waive certain fees. through a full balance debt resolution program. Look for an accredited, not-for-profit debt counseling agency and a professional credit counselor.

Debt Management Program

Debt Management Programs are formal agreements between debtors and creditors to repay a monitary percentage over a fixed period of time. DMPs can help consumers struggling to make minimum payments on credit cards or other debts.

Under a DMP, the creditor stops all collection activity against the debtor. The creditor may reduce or eliminate interest charges and late fees. The DMP goal is to help the debtor get back on track financially so they can pay off their entire debt balance.

Bankruptcy

Bankruptcy is a legal action by a person who cannot repay debts owed to creditors.

When a person declares bankruptcy, they declare they are unable to pay back debts. This can be due to financial difficulties, such as high levels of debt or unemployment. Often, bankruptcy results in liquidation, meaning all assets are sold off to repay their debts.

Bankruptcy is the most damaging to your credit score. Bankruptcy is very expensive.

More about Bankruptcy.

Bankruptcy Court Information

Bankruptcy erases most debt as well as your credit history. It is not an action to take lightly. Oklahoma residents must follow the following Oklahoma Bankruptcy law.

Persons filing for bankruptcy must:

- Complete credit counseling within six months before filing for bankruptcy.

- Complete a financial management instructional course after filing bankruptcy.

- Complete a Bankruptcy Act Means Test

- Itemize current income sources; major financial transactions; monthly living expenses; debts (secured and unsecured); and property (all assets and possessions, not just real estate).

- Collect the last 2 years of tax returns, deeds to real estate you own, car titles, and loan documents

- File for bankruptcy

- Chapter 7 fee is $306

- Chapter 13 fee is $281

- Meet with court assigned bankruptcy trustee

- Attend a Meeting of Creditors

- Confirm plan if filing for Chapter 13 bankruptcy

DISCLAIMER: We are not lawyers and are not giving legal advice. Before filing bankruptcy, talk to a lawyer in your state.

The information included on this site is for educational purposes only. Your state may not qualify for the Pacific Debt, Inc debt relief program. If it does not qualify, we can refer you to a Trusted Partner or assist in connecting you with a provider who offers services in your state of residence.

The Pros of Our Debt Relief Program

We have no upfront fees and provide a free debt analysis consultation to see how we can help. If you want a reputable debt relief company to help you reduce debt, we are your company.

We may help you settle your debt for less than what you owe with the possibility of becoming debt-free in 24-48 months.

There are other Oklahoma debt reduction programs and debt solutions but we are leaders in the debt relief industry and have a successful track record with Oklahoma debt negotiation.

Potential Tax Consequences

There are potential consequences with debt settlement. If you settle a debt for less than the full amount, the IRS may consider the difference between the two amounts to be taxable income.

Additionally, forgiven debt is considered taxable income. It's important to discuss potential consequences with a tax professional before entering into a debt settlement agreement. Creditors will provide tax documentation.

For more about tax implications from debt settlement read What Are The Tax Consequences Of Debt Settlement?

Credit Scores

Debt settlement may have a negative impact on your credit score. You will be marked as delinquent on your payments, and your credit report will show that you have unpaid debt. The amount of settled debt may be reported as a negative item on your credit report.

After settling your debt, your credit score should improve quickly from making timely payments and keeping a low balance on your credit cards.

Before you contact credit repair services, be aware that you can fix your own credit fairly easily. We address these steps in other blogs.

Debt Relief Oklahoma

If you want a debt consolidation loan or Oklahoma debt settlement, Pacific Debt can help immediately with a FREE consultation! We are a debt settlement company and our debt reduction program was created to help people reduce their debt substantially.

Oklahoma

Oklahoma is a combination of southern and western states with trees on the eastern side and open prairies on the western. Energy, transportation equipment, agriculture, and telecommunications form much of the state's economy. The capital of Oklahoma is Oklahoma City. Oklahoma is ranked #28 for population and #35 for population density.

As of 2018, over 10 million people called Oklahoma home. Oklahoma City is the largest city in Oklahoma.

Income

The median state income is $49,176. As of 2018, the minimum wage is $7.25 per hour with many low income families. Unfortunately, 22.6% of Oklahoman children under 18 live in poverty. For residents overall, 16.3% of all people in Oklahoma live in poverty.

- Median state income: $49,176

- Minimum wage: $7.25/hour

- Children in poverty: 22.6%

- People in poverty: 16.3%

Is Oklahoma a Community Property State?

Oklahoma is not a community property state. Assets are not equally owned by you and your spouse. In the state of Oklahoma, the judge decides which assets are shared by you and your spouse and the equity for each.

The 10 community property states are Louisiana, Arizona, California, Texas, Washington, Idaho, Nevada, New Mexico, and Wisconsin.

Oklahoma Housing Market

Over half (68.9%) of Oklahomans hold a mortgage. The median home price in Oklahoma is $119,400 (2018).

- Homeowner rate: 68.9%

- Median home price: $119,400

Employment

Oklahoma has a current unemployment rate of 4.0%. The underemployment rate is 9.2%. Underemployment is the percentage of workers who are unemployed, employed part-time, or are not seeking employment.

If this is you, we can help. Pacific Debt offers Oklahoma debt relief solutions tailored to your unique situation and budget. Certified counselors help you create a budget and explain options.

- Unemployment: 4.0% (2018)

- Underemployment: 9.2% (2017)

Oklahoma Debt

Oklahomans carry a lot of debt. The average credit card debt is $8,059 (2018). This is well over the national average of $5,315. The average student loan debt is $26,068.

- Average credit card debt: $8,059 (2018)

- Average mortgage debt: $130,700 (2017)

- Average student loan debt: $26,068 (2017)

Oklahoma Statute of Limitations

Oklahoma's statute of limitations is the maximum time period that debt collectors can take action. These statutes of limitations begin on the date of delinquency.

For debts in Oklahoma, the following statutes of limitations apply.

- Oral agreements: 3 years

- Written contracts: 5 years

- Promissory notes: 5 years

- Credit cards and other revolving loans: 5 years

Oklahoma Debt Relief & Debt Consolidation

If you have more debt than you can pay off, Pacific Debt can help settle your debt. Since 2002, we've settled over $200 million in debt for thousands of clients. We are a nationally top-ranked debt relief company located in San Diego. We have helped people in Oklahoma with debt relief. Contact us today so we can help you too!

We help you work through our proven, comprehensive debt relief program.

Your certified debt relief counselor reviews all your options. If debt settlement is right for you, we move forward with our debt consolidation program. Pacific Debt can help with most unsecured debt like credit cards, personal loans, medical bills, and repossessions.

It is not an easy process and it won't happen overnight, but you can do it. Pacific Debt will be there every step of the way.

Call to inquire about our OK debt relief program and how it can help you.

Disclaimer: In some states, PDR may not be able to offer our services directly due to state regulations related to debt settlement. In those instances, PDR will refer you to a reputable debt relief provider or attorney firm for assistance with your debt. We are not lawyers and are not giving legal advice. Before filing bankruptcy, talk to a lawyer in your state. The information included on this site is for educational purposes only.

Do Not Sell My Personal Information

Do Not Sell My Personal Information