Michigan Debt Relief

Reduce Your Credit Card Debt By Up To Half

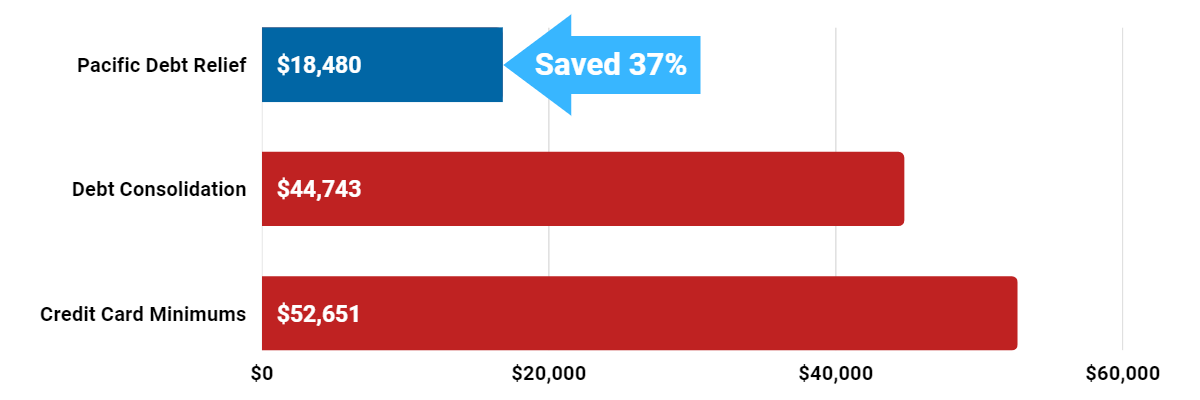

Pacific Debt Relief offers the only solution that significantly reduces your debt to less than you currently owe. That means you get debt-free in a fraction of the time it would take with other options.

Save thousands by lowering your debt balance and wiping away years of future interest and payments.

Call today for a FREE consultation!

Michigan Debt Relief Reviews

What is Michigan Debt Relief?

Pacific Debt Relief is a leading debt settlement company located in San Diego, California with an excellent track record and reputation. We negotiate with your creditors to lower the amount you owe.

Get a FREE consultation today with no obligation. Let us help you understand your options so you can choose the best one for your situation.

A certified debt specialist can help you understand all your debt relief options and what your best route of action would be. We can also give you a savings estimate to see how much money we can help save you each month. Pacific Debt has one of the best-rated debt settlement programs available for Michigan residents who are eligible for our program.

The secret to debt settlement is that you have to stop paying your bills in order to make creditors willing to negotiate. This action can come with late fees and creditor phone calls.

Debt settlement is a great option to have when you are facing pressure from bill collectors and creditors. We know what it's like to have high-interest rates for unsecured loans, doctor or hospital bills, or credit card debts.

Debt settlement does come with some credit score and credit report damage. Your debt settlement may stay on your credit report for up to seven years and keep you from a high credit score during that time. You should consider debt settlement for debts that are very delinquent or already in collections.

Most people who successfully complete Pacific Debt, Inc's debt relief option can see rapid improvements to their credit scores.

If you live in the state of Michigan and are looking for your best debt relief option for reducing your debt, call us today. Our debt negotiation experts will help guide and explain all your options so you understand them well. Our MI debt relief option can be custom tailored to fit your budget.

Does Michigan Debt Relief Work?

Yes! Reputable debt settlement organizations, especially Pacific Debt Relief, can help you to live debt-free. We have great reviews on our debt settlement process, so check them out.

No debt consolidation loans, no low interest loan, no home equity loans - just lower interest rates, helpful resources, and low total monthly payments and upfront fee disclosures to help you eliminate debt faster and improve your personal finances.

Pacific Debt Relief Accreditation

Pacific Debt Relief is proud to be accredited by the following organizations.

- The International Association of Professional Debt Arbitrators

- The Consumer Debt Relief Initiative

- Better Business Bureau

What Michigan Residents can expect from our Michigan Debt Settlement Services

- An affordable monthly payment based on your budget

- Resolve your situation in 2-4 years, based on national average

- No fees upfront and low monthly fees- fees vary from 15-25% of the total enrolled amount and state of registration

- Personal attention from your assigned Account Manager and Certified Debt Specialist

- Develop a debt management plan and lower negotiated rate and possibly a decreased interest rate. This is not full balance debt resolution.

- Excellent Customer Service & Support

- We negotiate decreased balances and lowered interest rate with individual creditors holding unsecured debt

- We don't lend money and your financial data is safe with us!

- No loans needed

While bankruptcy may seem easier than our debt settlement program, the after-effects of bankruptcy will last at least ten years and can result in poor credit ratings and less than a good credit score.

Michigan Debt Settlement Common Questions

Michigan Debt Relief Reviews / Case Studies

I am on fixed income and I can no longer afford my minimum payments. I want to avoid bankruptcy at all costs. I am looking for a program with a clear end in sight.

Location: Detroit, Michigan

I went through a divorce and had to use the credit to get myself back on my feet. I am making payments on everything but can only afford the minimums. I am, now looking to set a plan in place that will resolve the debts much faster.

Location: Warren, Michigan

Michigan Better Business Bureau

Pacific Debt Relief is an A+ rated business with the BBB. We have been accredited since 2010 and in business since 2002. We have received 4.87 out of five stars based on 40 customer reviews with the BBB.

We have helped thousands of people in Michigan as an accredited debt settlement company. Call us today, we can help you too! We can help you understand all your financial options and create a debt management plan with our debt settlement specialists.

Read our reviews and case studies to see how Pacific Debt helped people eliminate their total enrolled debt. We have a staff of dedicated debt settlement negotiators who are ready to help you.

Be aware that your credit score may take a hit during debt settlement as you will be stopping minimum payments, but should recover with time.

View our NMLS Consumer Access Verification Details

Visit our Google page and review our debt relief reviews from verified customers

Call Us for Immediate Debt Relief Service at 1-800-909-9893

You may also want to enroll in a complete debt counseling program. Get Free Consultation

The State of Michigan

Michigan is central to American automotive history and is home to the Mackinac Island and whose shape is carved from four of the five Great Lakes. Michigan has seventeen Fortune 500 companies, and a diverse economy based on automotive, biotechnology, and information technology. Michigan is ranked #10 for population and #24 for population density.

As of 2018, over 10.7 million people called Michigan home. Detroit is the largest city in Michigan.

Income in Michigan

The median state income is $75,297. As of 2018, the minimum wage is $11.00 per hour. Unfortunately, 13.3% of Michigander children under 18 live in poverty. For residents overall, 10.4% of all people in Michigan live under the poverty level.

- Median state income: $75,297

- Minimum wage: $11.00/hour

- Children in poverty: 13.3%

- People in poverty: 10.4%

Is Michigan a Community Property State?

Michigan is not a community property state. Therefore your assets are not seen as equally owned by you and your spouse. In the state of Michigan, the judge will decide which assets are shared by you and your spouse, and what the equity is for each.

There are 10 community property states in which the state sees your assets as community property are: Louisiana, Arizona, California, Texas, Washington, Idaho, Nevada, New Mexico, and Wisconsin.

Michigan Homeowners

More than half (72.9%) of Michiganders hold a mortgage. The median home price in Michigan is $149,900 (2018). Of course, that median price depends on the location with some areas being much higher.

- Homeowner rate: 72.9%

- Median home price: $149,900

Michigan Employment

Michigan residents have a current unemployment rate of 4.8%. However, the underemployment rate is 10.3%. Underemployment is the percentage of civilian workers who are unemployed, employed part-time or are not seeking employment.

If this is you, we can help. Pacific Debt offers Michigan debt relief solutions tailored to your unique situation and budget. Our certified counselors help you work up a budget and explain your options.

- Unemployment: 4.8% (2018)

- Underemployment: 10.3% (2017)

Michigan Debt

Michiganders carry a lot of debt. The average credit card debt is $6,082 (2018). The average student loan debt is $29,450. Michigan is in the top 10 states with the lowest average mortgage debt. When you add all that debt on top of the cost of homes (rental or owned), versus the median income, it is very easy for Michiganders to get into debt.

- Avg credit card debt: $6,082 (2018)

- Avg mortgage debt: $135,240 (2017)

- Avg student loan debt: $29,450 (2017)

Michigan Statute of Limitations

Michigan's statute of limitations lays out maximum time periods that debt collectors can take action against a delinquent debt. These statutes of limitations begin on the date that your debt goes delinquent.

For debts taken out in Michigan, the following are the statutes of limitations for different types of debt.

- Oral agreements: 6 years

- Written contracts: 6 years

- Promissory notes: 6 years

- Credit cards and other revolving loans: 6 years

Michigan Debt Relief & Debt Consolidation

If you have more debt than you can pay off, Pacific Debt can help you consolidate your debt and learn to live debt free. Since 2002, we've settled over $200 million in debt for thousands of clients. We are a nationally top ranked debt relief company located in San Diego.

We will help you work through our proven and comprehensive debt relief program that involves one monthly payment into a savings account. We may encourage you to enroll in a debt management plan. Your certified debt settlement counselor will review all your debt options. If Michigan debt settlement is right for you, we move forward with our debt settlement plan and work to save money on your enrolled debt. Enrolled debt can include unsecured debt like credit card debt, medical bills, loans, and other unsecured debt.

It is not an easy process and it won't happen overnight, but you can do it. Pacific Debt will be there every step of the way to help.

We are a nationally top-ranked company specializing in debt settlement and we have helped countless Michigan residents with our national debt relief. Contact us today so we can help you too! Remember we offer free debt analysis and can recommend a good credit counseling agency.

Call us and ask our award winning debt specialists about our Michigan debt settlement program and how it can help you reduce debt faster.

Since we are a national debt relief company, we may be able to help your relatives as well. If we can not, we will refer you to other Michigan debt relief programs including debt consolidation programs that we trust. We are leading debt relief company and we want you to be able to trust our recommendations.

Other Debt Relief

We are a debt settlement company and have discussed debt settlement in detail. The quick version is: you (or a company) negotiates with creditors to lower the debt amount of unsecured loans, like credit cards and helps you to save money in order to settle debts. Click here to learn more about debt settlement.

However, we do want you to understand your other options. These include debt consolidation, credit counseling, and bankruptcy.

Michigan Debt Consolidation

This option rolls all debt into a single payment. You apply for a lower interest debt consolidation loan to pay off the debt or work with a debt consolidation program. Click here to learn more about debt consolidation.

Credit Counseling

Credit counseling helps you learn money management including developing a budget, helping you understand your credit score, and set up a debt management plan. Click here to learn more about Credit Counseling.

File Bankruptcy

Filing bankruptcy is a last resort option – this legal action wipes out most of your total debt, severely damages your credit for up to ten years, and is expensive and time-consuming. Click here to learn more about bankruptcy.

Contact Pacific Debt today so we can help you with your creditors.

Debt Collection Laws

Michiganders are protected against unscrupulous debt collectors. The federal Fair Debt Collection Practices Act (FDCPA) prohibits debt collectors from using abusive or harassing bill collection practices. In addition, the Michigan Fair Debt Collection Practices Act (MFDCPA) adds protections against more types of collectors and actions. If you are a victim of any of these actions, you may take legal action against them.

Overall, debt collectors can NOT:

- Charges more than 10% interest

- Garnish more than 25% of wages

- U se/threaten physical force or criminal tactics to harm you, your property, or your reputation

- Accusing you of committing a crime for not paying the debt

- Make/threaten to make defamatory statements to someone else

- Threaten arrest, to seize assets, or garnish wages unless actually planning to take such action

- Use obscene or profane language

- Cause you to spend money you wouldn’t otherwise have spent (ie long-distance telephone calls)

- Call you repeatedly or let your phone ring repeatedly

- Call frequently

- Contact your employer, except to verify employment or health insurance status, garnish wages or locate you

- Reveal information about debt to anyone except your spouse or your parents if a minor.

- Publicly publish your name for failing to pay

- Send a postcard or letter with revealing information on the envelope

- Claim to be someone other than a debt collector, including a governmental official

- Use stationery that appears to be from a law firm

- Charge you collection or attorney’s fees unless legally allowable

- Threaten to report you to a credit reporting agency if they have no intention of doing so

- Send a letter claiming to come from a claim, credit, audit, or legal department unless it actually is

Debt collectors must:

- Disclose caller identification

- May contact your family to locate you

- Must serve you with notice of a lawsuit if suing you

Bankruptcy Court Information

Bankruptcy is a legal action that can erase most of your debt as well as your credit history. It is not an action to take lightly. If you do, you must follow the following steps in Michigan.

Persons filing for bankruptcy must:

- Complete credit counseling within six months before filing for bankruptcy.

- Complete a financial management instructional course after filing bankruptcy.

- Complete a Bankruptcy Act Means Test to determine if you are eligible for a Chapter 7 or 13 bankruptcy

- Itemize current income sources; major financial transactions; monthly living expenses; debts (secured and unsecured); and property (all assets and possessions, not just real estate).

- Collect last 2 years of tax returns, deeds to real estate you own, car titles, and loan documents

- File for bankruptcy

- Chapter 7 bankruptcy fee is $306

- Chapter 13 bankruptcy fee is $281

- Meet with court assigned bankruptcy trustee

- Attend a Meeting of Creditors

- Confirm plan if filing for Chapter 13 bankruptcy

Pacific Debt Provides Debt Relief Michigan Cities

Addison village

Alanson village

Allen village

Almont village

Applegate village

Athens village

Au Gres

Baldwin village

Barnes Lake-Millers Lake

Battle Creek

Beaverton

Bellaire village

Benton Heights

Bessemer

Big Rapids

Blissfield village

Boyne City

Bridgeport

Bronson

Buchanan

Burr Oak village

Byron Center

Camden village

Capac village

Carrollton

Casnovia village

Cedar Springs

Centreville village

Cheboygan

Clarksville village

Climax village

Coldwater

Columbiaville village

Constantine village

Corunna

Cutlerville

Dearborn

Deerfield village

De Witt

Dowagiac

Eagle village

East Lansing

Eaton Rapids

Edmore village

Elkton village

Empire village

Evart

Farmington Hills

Ferndale

Flint

Fountain village

Frankfort

Freeport village

Gaastra

Galien village

Gibraltar

Goodrich village

Grand Ledge

Grass Lake village

Greilickville

Grosse Pointe Park

Hamtramck

Harbor Springs

Harrison

Harvey

Hemlock

Hillman village

Holt

Houghton

Hubbard Lake

Hudsonville

Inkster

Ironwood

Jenison

Kalkaska village

Kinde village

K. I. Sawyer AFB

Lake City

Lake Odessa village

Lambertville

Lathrup Village

Lennon village

Level Park-Oak Park

Lincoln Park

Lost Lake Woods

Luther village

Mackinac Island

Manchester village

Manton

Marion village

Martin village

Maybee village

Melvindale

Merrill village

Michigamme

Midland

Millington village

Monroe

Morenci

Mount Morris

Munising

Nashville village

Newberry village

New Lothrop village

North Muskegon

Norton Shores

Oak Park

Onaway

Orchard Lake Village

Otisville village

Owendale village

Parchment

Pearl Beach

Perrinton village

Pewamo village

Pinconning

Plymouth Township

Port Hope village

Posen village

Prudenville

Reading

Republic

Riverview

Rockford

Romulus

Rose City

Saginaw

St. Clair

St. Johns

Sand Lake village

Saugatuck

Sebewaing village

Sheridan village

Shorewood-Tower Hills-Harbert

South Gull Lake

South Range village

Springfield

Standish

Sterling village

Stony Point

Swartz Creek

Tecumseh

Three Oaks village

Trowbridge Park

Twining village

Unionville village

Vandercook Lake

Vicksburg village

Waldron village

Warren

Wayland

West Bloomfield Township

West Monroe

Whitehall

Williamston

Wolverine Lake village

Wyandotte

Zeeland

Adrian

Albion

Allendale

Alpena

Argentine

Atlanta

Augusta village

Bancroft village

Baroda village

Bay City

Beecher

Belleville

Benzonia village

Beulah village

Bingham Farms village

Bloomfield Hills

Boyne Falls village

Bridgman

Brooklyn village

Buckley village

Burt

Cadillac

Canada Creek Ranch

Carleton village

Carson City

Caspian

Cement City village

Charlevoix

Chelsea village

Clawson

Clinton village

Coleman

Comstock Northwest

Coopersville

Croswell

Daggett village

Dearborn Heights

De Tour Village village

Dexter village

Dryden village

East Grand Rapids

Eastpointe

Eau Claire village

Edwardsburg village

Ellsworth village

Escanaba

Fairgrove village

Farwell village

Ferrysburg

Flushing

Fowler village

Franklin village

Free Soil village

Gagetown village

Garden village

Gladstone

Grand Beach village

Grand Rapids

Grayling

Grosse Ile

Grosse Pointe Shores village

Hancock

Harper Woods

Harrisville

Haslett

Hersey village

Hillsdale

Homer village

Houghton Lake

Hubbardston village

Huntington Woods

Ionia

Ishpeming

Jonesville village

Keego Harbor

Kingsford

Laingsburg

Lake Fenton

Lake Orion village

L'Anse village

Laurium village

Leonard village

Lewiston

Linden

Lowell

Lyons village

Mackinaw City village

Manistee

Maple Rapids village

Marlette

Marysville

Mayville village

Memphis

Mesick village

Michigan Center

Milan

Minden City village

Montague

Morley village

Mount Pleasant

Muskegon

Negaunee

New Buffalo

Niles

Northport village

Norway

Okemos

Onekama village

Ortonville village

Otsego

Owosso

Parma village

Peck village

Perry

Pierson village

Plainwell

Pontiac

Port Huron

Potterville

Quincy village

Redford

Richland village

Robin Glen-Indiantown

Rockwood

Roosevelt Park

Roseville

Saginaw Township North

St. Clair Shores

St. Joseph

Sandusky

Sault Ste. Marie

Shelby

Sherwood village

Skidway Lake

South Haven

South Rockwood village

Spring Lake village

Stanton

Sterling Heights

Sturgis

Sylvan Lake

Tekonsha village

Three Rivers

Troy

Twin Lake

Utica

Vassar

Village of Clarkston

Walker

Waterford

Wayne

West Branch

Westphalia village

White Pigeon village

Wixom

Woodhaven

Wyoming

Zilwaukee

Ahmeek village

Algonac

Allen Park

Alpha village

Armada village

Auburn

Au Sable

Bangor

Barryton village

Beal City

Beechwood

Bellevue village

Berkley

Beverly Hills village

Birch Run village

Bloomfield Township

Breckenridge village

Brighton

Brown City

Buena Vista

Burton

Caledonia village

Canadian Lakes

Carney village

Carsonville village

Cass City village

Center Line

Charlotte

Chesaning village

Clayton village

Clinton

Coloma

Comstock Park

Copemish village

Crystal Falls

Dansville village

Decatur village

Detroit

Dimondale village

Dundee village

East Jordan

East Tawas

Ecorse

Elberta village

Elsie village

Essexville

Fair Plain

Fennville

Fife Lake village

Forest Hills

Fowlerville village

Fraser

Fremont

Gaines village

Garden City

Gladwin

Grand Blanc

Grandville

Greater Galesburg

Grosse Pointe

Grosse Pointe Woods

Hanover village

Harrietta village

Hart

Hastings

Hesperia village

Holland

Honor village

Howard City village

Hubbell

Imlay City

Iron Mountain

Ithaca

Kalamazoo

Kent City village

Kingsley village

Lake Angelus

Lake Linden village

Lakeview village

Lansing

Lawrence village

Le Roy village

Lexington village

Litchfield

Ludington

McBain

Madison Heights

Manistique

Marcellus village

Marquette

Mason

Mecosta village

Mendon village

Metamora village

Middletown

Milford village

Mineral Hills village

Montgomery village

Morrice village

Muir village

Muskegon Heights

Newaygo

New Era village

North Adams village

Northview

Novi

Olivet

Onsted village

Oscoda

Otter Lake village

Oxford village

Paw Paw village

Pellston village

Petersburg

Pigeon village

Pleasant Ridge

Portage

Portland

Powers village

Quinnesec

Reed City

Richmond

Rochester

Rogers City

Roscommon village

Rothbury village

Saginaw Township South

St. Helen

St. Louis

Sanford village

Schoolcraft village

Shelby village

Shields

Southfield

South Lyon

Sparta village

Springport village

Stanwood village

Stevensville village

Sunfield village

Tawas City

Temperance

Traverse City

Turner village

Ubly village

Vandalia village

Vermontville village

Village of Lake Isabella village

Walkerville village

Watervliet

Webberville village

West Ishpeming

Westwood

Whitmore Lake

Wolf Lake

Woodland village

Yale

Akron village

Allegan

Alma

Ann Arbor

Ashley village

Auburn Hills

Bad Axe

Baraga village

Barton Hills village

Bear Lake village

Belding

Benton Harbor

Berrien Springs village

Big Bay

Birmingham

Bloomingdale village

Breedsville village

Britton village

Brownlee Park

Burlington village

Byron village

Calumet village

Canton

Caro village

Caseville village

Cassopolis village

Central Lake village

Chatham village

Clare

Clifford village

Clio

Colon village

Concord village

Copper City village

Custer village

Davison

Deckerville village

Detroit Beach

Douglas village

Durand

Eastlake village

Eastwood

Edgemont Park

Elk Rapids village

Emmett village

Estral Beach village

Farmington

Fenton

Flat Rock

Forestville village

Frankenmuth

Freeland

Fruitport village

Galesburg

Gaylord

Gobles

Grand Haven

Grant

Greenville

Grosse Pointe Farms

Gwinn

Harbor Beach

Harrison

Hartford

Hazel Park

Highland Park

Holly village

Hopkins village

Howell

Hudson

Indian River

Iron River

Jackson

Kaleva village

Kentwood

Kingston village

Lake Ann village

Lake Michigan Beach

Lakewood Club village

Lapeer

Lawton village

Leslie

Lincoln village

Livonia

Luna Pier

McBride village

Mancelona village

Manitou Beach-Devils Lake

Marine City

Marshall

Mattawan village

Melvin village

Menominee

Michiana village

Middleville village

Millersburg village

Mio

Montrose

Mount Clemens

Mulliken village

Napoleon

New Baltimore

New Haven village

North Branch village

Northville

Oakley village

Omer

Ontonagon village

Ossineke

Ovid village

Palmer

Paw Paw Lake

Pentwater village

Petoskey

Pinckney village

Plymouth

Port Austin village

Port Sanilac village

Prescott village

Ravenna village

Reese village

River Rouge

Rochester Hills

Romeo village

Rosebush village

Royal Oak

St. Charles village

St. Ignace

Saline

Saranac village

Scottville

Shepherd village

Shoreham village

Southgate

South Monroe

Spring Arbor

Stambaugh

Stephenson

Stockbridge village

Suttons Bay village

Taylor

Thompsonville village

Trenton

Tustin village

Union City village

Vanderbilt village

Vernon village

Wakefield

Walled Lake

Waverly

Weidman

Westland

White Cloud

Whittemore

Wolverine village

Woodland Beach

Ypsilanti

Disclaimer: In some states, PDR may not be able to offer our services directly due to state regulations related to debt settlement. In those instances, PDR will refer you to a reputable debt relief provider or attorney firm for assistance with your debt. We are not lawyers and are not giving legal advice. Before filing bankruptcy, talk to a lawyer in your state. The information included on this site is for educational purposes only.

Do Not Sell My Personal Information

Do Not Sell My Personal Information