South Carolina Debt Relief

Reduce Your Credit Card Debt By Up To Half

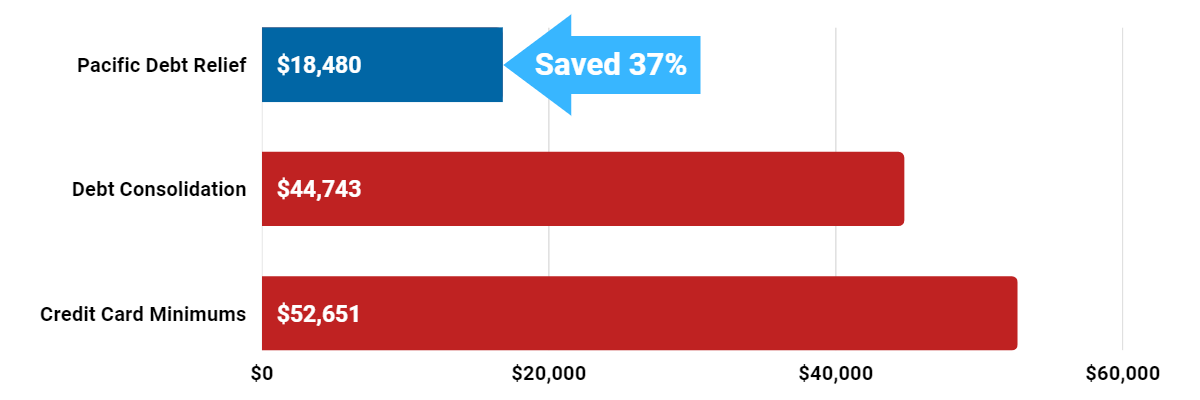

Pacific Debt Relief offers the only solution that significantly reduces your debt to less than you currently owe. That means you get debt-free in a fraction of the time it would take with other options.

Save thousands by lowering your debt balance and wiping away years of future interest and payments. Call today for a FREE consultation!

For over 20 years our debt relief program has helped clients change the trajectory of their financial lives. Our work has impacted families and future generations. We are a debt relief company that provides exceptional customer service and works diligently to maintain your trust throughout our entire process.

Don't just take our word for it, read our video testimonial reviews. We're rated A+ and fully accredited by the Better Business Bureau (BBB). We have thousands of reviews and testimonials highlighting we are trustworthy, we keep our word, we have a friendly dedicated customer care team, we offer tailored programs to suit your unique needs, and offer ongoing encouragement throughout the process of becoming debt free.

During your free debt relief consultation we will listen closely to your financial situation and create a tailored program to get you debt-free faster than you thought possible. We have helped hundreds of thousands of clients resolve millions in consumer debt. We are ready to help you get out of debt!

South Carolina Debt Relief Reviews & Ratings

What is South Carolina Debt Relief?

Pacific Debt Relief is a top-rated debt settlement company that works directly with your creditors to negotiate lower balances on your behalf.

If you are struggling with high-interest debt in South Carolina, you are not alone. Many residents face financial challenges due to rising living costs and mounting bills. Our experienced debt specialists will evaluate your situation and guide you through your debt relief options, including customized debt settlement programs.

- No upfront fees – you only pay after we successfully negotiate your debt

- Personalized debt reduction plans based on your financial situation

- One affordable monthly payment

Debt Relief Programs in South Carolina

Pacific Debt Relief offers one of the top-rated debt relief programs for eligible South Carolina residents.

How It Works

- We negotiate with your creditors to reduce your debt balance

- You make one affordable monthly payment into a settlement savings account

- Once enough funds accumulate, we pay off negotiated debts one by one

While debt settlement may impact your credit score in the short term, most clients see significant improvements once their debts are resolved.

South Carolina Debt Statistics

In the fiscal year 2024, South Carolina's state debt totaled approximately $14.44 billion, while local government debt was notably higher at about $28.68 billion. This marks a significant increase from the 2000 fiscal year, when state debt was around $7.06 billion and local government debt was $11.61 billion, reflecting substantial growth in both areas over the past two decades.

Carrying high-interest debt can feel overwhelming. Call Pacific Debt Relief today to take the first step toward financial freedom.

Does Debt Settlement Work?

Yes. Debt settlement is a proven strategy for lowering total debt balances and creating manageable repayment plans.

Rather than relying on balance transfer credit cards, personal loans, or debt consolidation loans, our program works directly with creditors to lower the total amount owed.

- No new loans required

- Lower overall debt balances

- Faster debt repayment than traditional methods

Since 2002, Pacific Debt Relief has successfully settled over $300 million in debt for clients nationwide.

Find out how much you could save by scheduling a

free consultation today.

Pacific Debt Relief Accreditation

Pacific Debt Relief is accredited by:

- Consumer Debt Relief Initiative

- International Association of Professional Debt Arbitrators

- Better Business Bureau

The Federal Trade Commission, a government program, also oversees debt relief companies. Always check the accreditation of debt relief companies as there are debt relief scams.

What South Carolina Residents Can Expect from Our Debt Settlement Services

- Personalized debt relief plans based on your financial situation

- No upfront fees – program fees range from 15-25% of enrolled debt

- Debt resolution in 2-4 years (on average)

- Dedicated account managers and certified debt specialists

- Ongoing customer support throughout the process

- No new personal loans required

We negotiate directly with creditors to reduce balances and lower interest rates—helping you save thousands in unnecessary payments.

Call today at

(833) 865-2028 to start your debt relief journey.

Types of Debt We Help Settle in South Carolina

We specialize in negotiating unsecured debts, including:

- Credit card debt

- Medical bills

- Personal loans

- Payday loans

- Utility bills

Debt settlement can help significantly reduce balances and get you out of debt faster than traditional debt management plans or consolidation loans.

Debt settlement is best suited for those facing serious financial hardship and looking for an alternative to bankruptcy.

Debt Collection Laws

Washington residents are protected against predatory debt collection practices under the federal Fair Debt Collection Practices Act (FDCPA).

Debt collectors in South Carolina CANNOT:

- Charge more than 6% interest on unpaid debts unless specified in a contract

- Garnish more than 25% of wages

- Use or threaten physical force, harassment, or abusive language

- Make false legal claims or threats of arrest

- Reveal debt information to employers, except in limited legal circumstances

- Publicly disclose your debt information

Debt collectors MUST:

- Identify themselves and their purpose when contacting you

- Provide written notice if they intend to sue

- Contact family members only to locate you—not to discuss your debt

Call us at (833) 865-2028 to discuss your situation and learn about your consumer rights and protections. Our knowledgeable debt specialists can provide guidance and advice.

Other Debt Relief Options

While debt settlement is a great option for many, we want you to understand all your choices, including:

- Debt consolidation

- Credit counseling

- Bankruptcy

We’ll guide you through the best debt relief strategy for your financial situation. Get in touch today for a free debt analysis!

Frequently Asked Questions

DISCLAIMER: In some states, PDR may not be able to offer our services directly due to state regulations related to debt settlement. In those instances, PDR will refer you to a reputable debt relief provider or attorney firm for assistance with your debt. We are not lawyers and are not giving legal advice. Before filing bankruptcy, talk to a lawyer in your state. The information included on this site is for educational purposes only. Your state may not qualify for the Pacific Debt, Inc debt relief program. If it does not qualify, we can refer you to a Trusted Partner or assist in connecting you with a provider who offers servicing in your state of residence.

Do Not Sell My Personal Information

Do Not Sell My Personal Information